AI: Meta's 49% 'Acqui-hire' of Scale.ai. RTZ #747

The M&A and ‘Aqui-hire’ trend this AI Tech Wave continues. This time with Meta forging ahead with a $15 billion, 49% investment in leading AI Data company Scale.ai, a possibility we discussed just a couple of days ago. It echoes the original Microsoft/OpenAI 49% partnership of a few years ago, which continues despite recent points of misalignment.

Including today’s separate announcement that OpenAI will also use Google Cloud to supplement its core dependence on Microsoft’s Azure cloud services, and its own Stargate AI Infrastructure partnership with Softbank.

And of course other recent multi billion dollar acquihires like Microsoft’s purchase of Inflection not so long ago, OpenAI’s moves with Jony Ive’s io Products/Lovefrom, and of course Google’s acquisition of Character.ai, bringing back AI uber-researcher Noam Shazeer back to Google DeepMind. And former OpenAI co-founder Ilya Sutskever’s founding of his own ‘AI super-intelligence’ company.

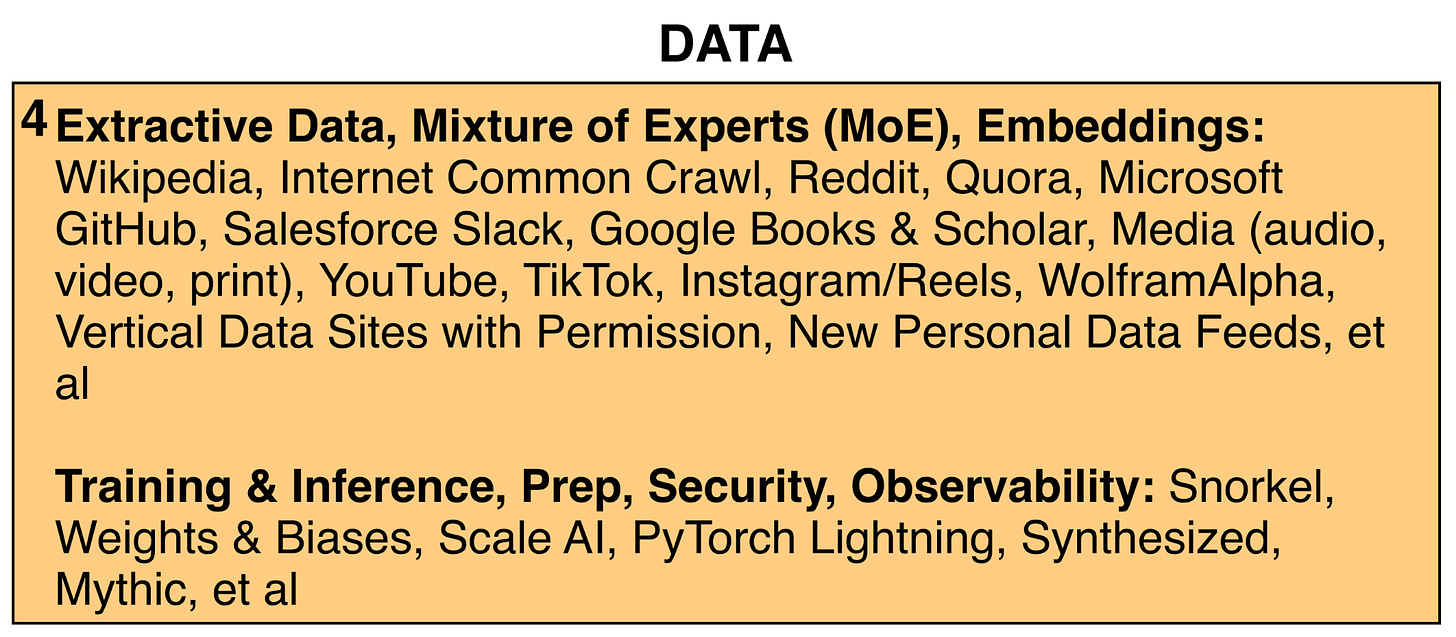

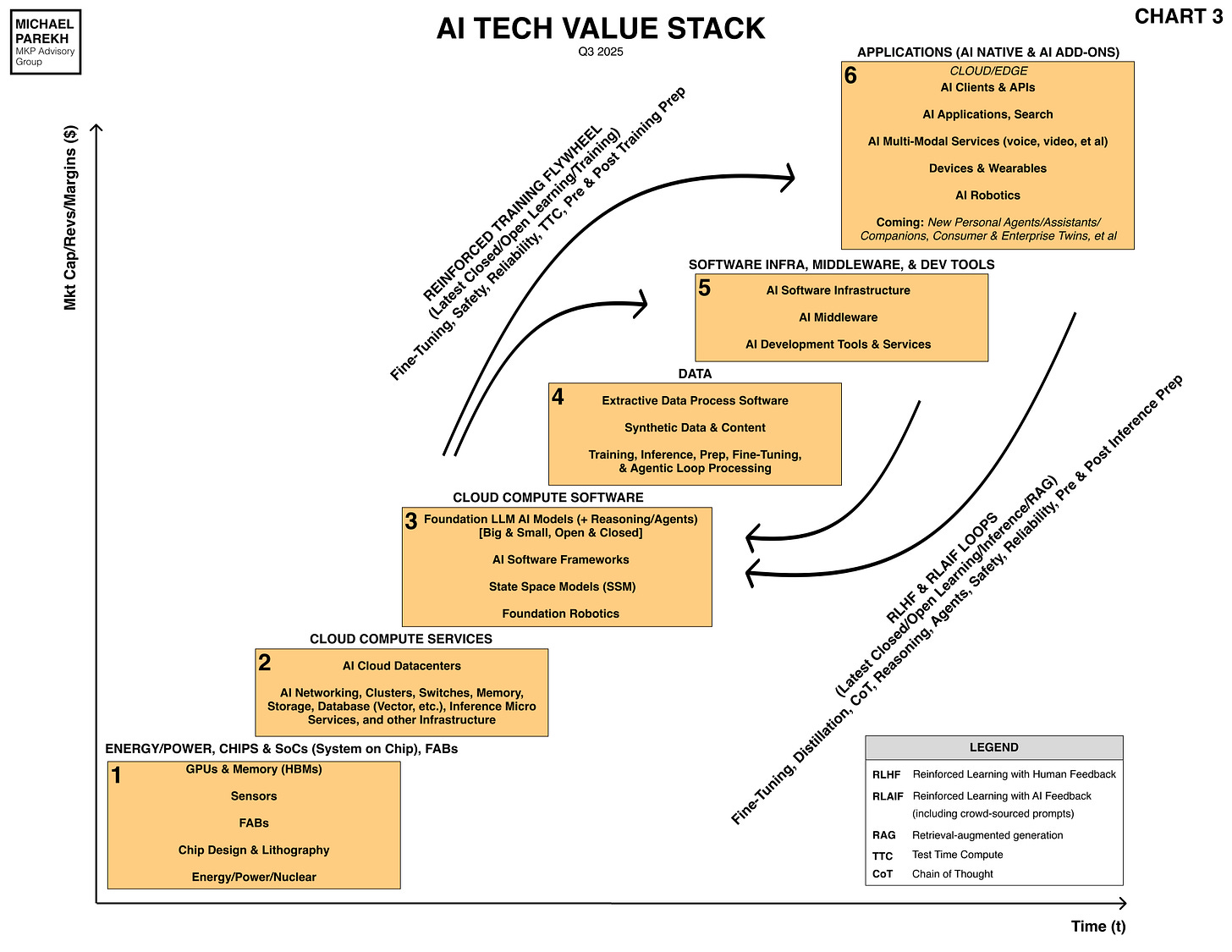

The Meta move is especially notable given founder/CEO Mark Zuckerberg’s laser focused ambition on super-scaling AI, and AI data centers. Currently open sourced with Llama, but potentially with more Amazon AWS type aspirations on the third party AI market that Scale.AI is already focused on in the Data Box 4 in the AI Tech Stack I regularly discuss.

The Information outlines the transaction well in “Meta to Pay Nearly $15 Billion for Scale AI Stake and Startup’s 28-Year-Old CEO”:

“Meta has agreed to take a 49% stake in data labeling firm Scale AI for $14.8 billion, two people familiar with the matter said. The unusual deal will be structured so Meta will send the cash to Scale’s existing shareholders and place the startup’s CEO, Alexandr Wang, in a top position inside Meta, the people said.

The deal, which hasn’t yet been finalized, appears to be a rich one for Scale’s shareholders, with big paydays for some of Scale’s biggest investors such as Accel, Index Ventures, Founders Fund and Greenoaks, as well as current and former employees. Scale shareholders also would maintain their existing holdings in Scale, which will now be valued at $28 billion, including the cash invested, up from $13.8 billion last year.”

The organizational arrangements post deal are also noteworthy:

“Meta would put Wang in charge of a new “superintelligence” lab, along with other top Scale technical employees, the New York Times and Bloomberg reported Tuesday morning. That will put Wang, 28, in competition with some of his customers and friends, including OpenAI CEO Sam Altman. The deal likely would further enrich Wang, who became the youngest self-made billionaire in the U.S. several years ago. (For more on Wang’s rise in Silicon Valley, read our feature from last year.)”

‘Zuck’ continues to be on an AI tear at Meta:

“Meta CEO Mark Zuckerberg has been actively recruiting top AI researchers in an effort to boost his company’s AI efforts. He was frustrated with the reaction to its latest AI offering, Llama 4 and aims to catch up to competitors such as Google and OpenAI. Meta is restructuring its AI operations after losing some top executives to rivals.”

There are some questions on what Scale.ai itself does post deal:

“Scale faces important questions following the deal. It removes Wang from the day to day of the company he founded in 2016 to provide human-labeling services to clean up data to be used by emerging AI companies focused on self-driving cars. Jason Droege, a former Uber Eats executive who became Scale’s chief strategy officer last fall, has been in discussions to become Scale’s new CEO, one of the people said.”

“What happens with Scale’s existing customer base is another question. One of Scale’s largest existing customers is Alphabet, one of the people said. The startup told investors early last year its customers also include Microsoft, Amazon, Nvidia and OpenAI. “Scale has been a long-term partner of OpenAI, and is at the forefront of building the largest-scale foundation models,” the company wrote in an investor presentation last spring.”

Lot to be determined, as it seems:

“Meta is also a significant customer and plans to increase their spending on Scale for data labeling services as part of the deal, one of the people said.”

Regulatory issues were also a part driver of the structure:

“Meta, with abundant cashflow, could have bought Scale. But the company is coming off a painful trial in which regulators sought to show the company’s acquisitions of Instagram and WhatsApp were anticompetitive. The unusual structure of the deal, and the fact Meta will own just 49% of Scale, could be an effort to avoid more regulatory scrutiny.”

Scale.ai has come far in a few years:

“The startup, last valued at $13.8 billion in a funding round last spring, has grown rapidly by harnessing a large number of contract workers who help teach AI models by writing their own ideal responses to questions submitted by users. Scale pioneered some of this work with OpenAI, called reinforcement learning through human feedback, which has become part of making chatbots generate humanlike responses. Scale’s customers have included Alphabet, Meta and OpenAI.”

“Scale generated about $870 million in revenue last year and expected more than $2 billion this year, The Information previously reported. It also lost about $150 million, before accounting for interest, taxes, depreciation and amortization.”

And some recent questions around its prospects of late:

“There have been some signs of the company struggling to meet expectations, however, including missing sales and profit goals it set with investors last year, The Information previously reported. Some big AI developers are starting to bring the type of work Scale does in house.”

“The company had more than $900 million of cash on its balance sheet at the end of last year, according to financial information shared with prospective investors. Since Scale’s founding in 2016, it has raised more than $1.5 billion from investors. Some of its earliest backers include Y Combinator, Accel and Outlander, and it’s also raised from firms such as Thrive Capital, Coatue Management, Dragoneer and Tiger Global.”

Founder/CEO Mark Zuckerberg is in a hurry to Scale.ai at Meta, as evidenced in these other concurrent accounts worth reading. His ability to monetize AI with advertisers more aggressively than other Mag 7s is also worthwhile noting.

As is his ambitions on the enterprise side of the AI market, and compete with peers. Especially against that other uber founder/CEO Elon Musk with his own AI Ambitions with Grok/xAI and beyond. Not to mention AI competitors from China.

This move with Scale.ai is a milestone for this AI Tech Wave worth noting. Especially in the quest for more Data, organic and synthetic, for LLM AI and ‘Physical AI’ companies going forward.

With or without Scale.ai as a leading provider of AI Data Services. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)