AI: Negative Tariff impact on AI ahead. RTZ #681 (part 1/3)

The Bigger Picture, Sunday April 6, 2025

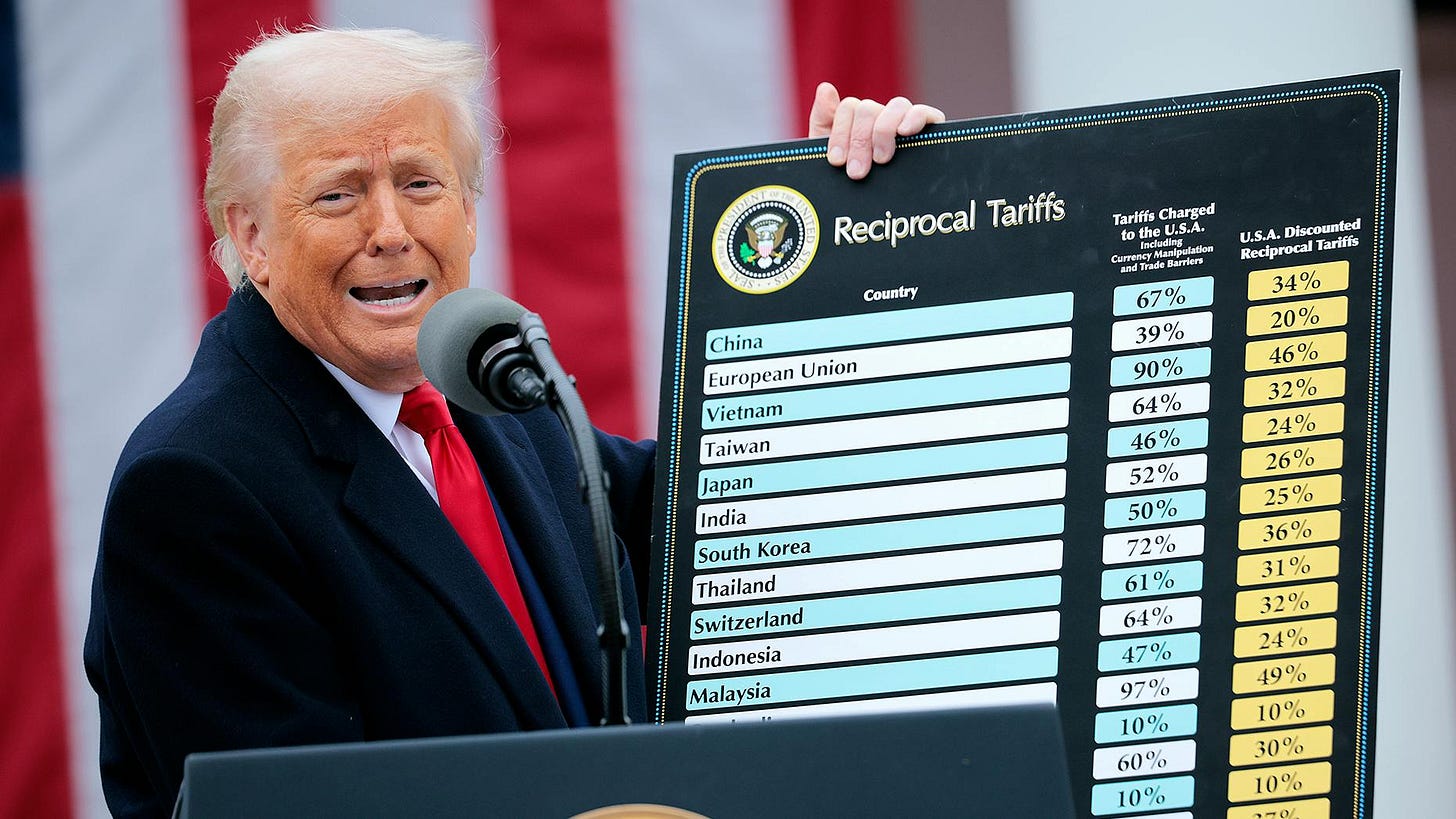

The big news this week of course was the larger than expected Trump Tariffs that shook the world economies and markets to their core. A globalized supply chain that’s driven much of the global prosperity for the last 75 plus years. With the US being the lead beneficiary to date. I wrote about it at length on Friday.

The moves will have wide and deep repercussions through every aspect of the US and global economy in the coming weeks and months. With lots of unintended consequences. And they will likely slow the US down in AI ‘space race’ relative to China. LLM AIs, AI robots, AI cars and far more. Despite the optimistic framing by some, the probabilities of US success are diminished by these moves.

So the specific implications for this AI Tech Wave may be worth zooming in on, as the ‘Bigger Picture’ conversation this Sunday.

Axios outlines it in how “Tariff threaten AI momentum”:

“President Trump’s new tariffs could increase AI costs, drive up data center construction prices and complicate supply chains.”

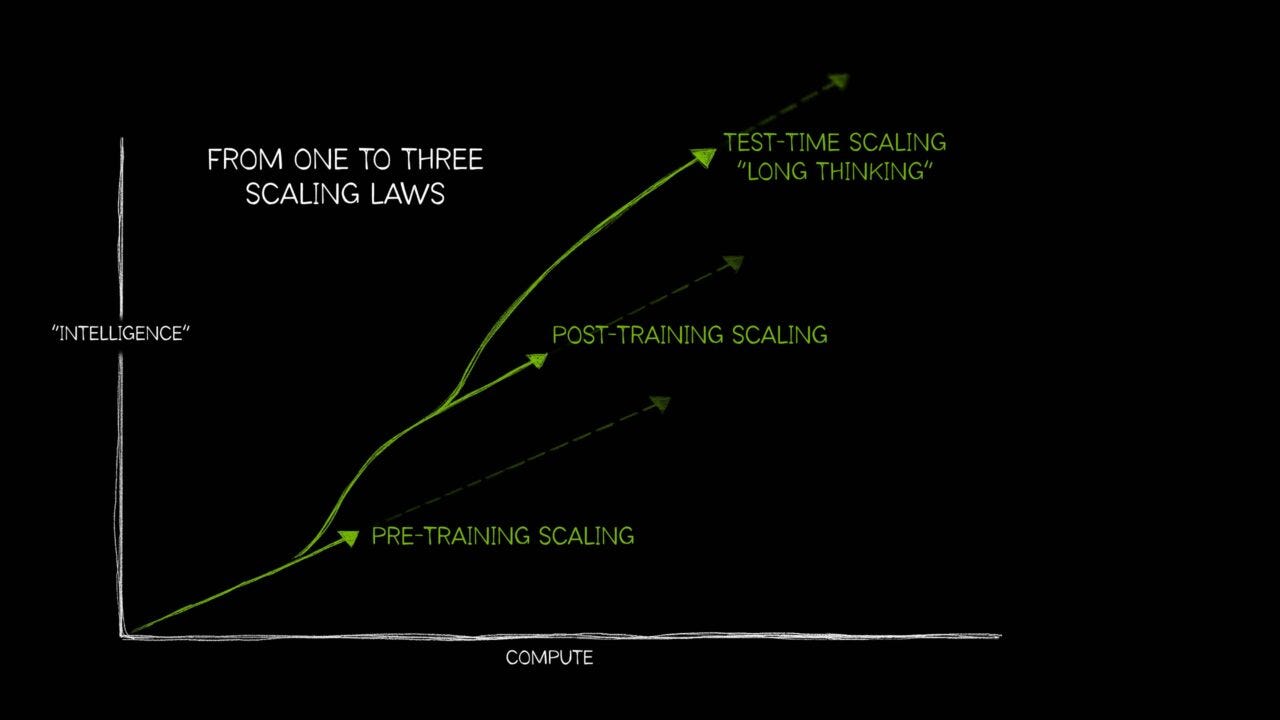

The first impact is of course going to be on the annual multi-hundred billion dollar AI data center builds we’ve discussed often in these pages. All driven by the relentless scaling of AI ahead.

“Why it matters: AI is driving the tech boom and integrating itself into other sectors. Slowing its growth could slow the broader economy.”

“Driving the news: Trump previously announced a 25% tariff on steel and aluminum imports, both important for construction.”

-

“On Wednesday, he added broad tariffs on major electronics equipment exporters, including China, Taiwan and South Korea.”

-

“The levies also targeted green sources of energy, which could create bottlenecks for energy-hungry AI data centers.”

-

“Yale’s Budget Lab has estimated that broad-based tariffs could raise the price of construction by 2.4%, electrical equipment by 9.2%, and metal products by 5.8%.”

-

“The administration did exempt copper, semiconductors and lumber but warned that they could be subject to future tariffs.”

The exemptions on semiconductor unfortunately does not cover the majority of semiconductors that are built into products being consumed by businesses and consumers.

And most of these products are sourced overseas of course.

“What they’re saying: “Much of the electrical infrastructure and data center equipment is manufactured outside of the U.S.,” global head of CBRE Data Center Solutions Pat Lynch wrote.”

“Zoom in: CoreWeave noted in its IPO filing that higher tariffs already had impacted the price and availability of GPUs.”

The coming weeks may see many adjustments in these tariffs as the administration negotiates with dozens of countries worldwide. But the core damage has already been done in terms of the fundamental uncertainties being a new, constant reality.

“Between the lines: Even if the tariffs roll back, the uncertainty is already discouraging investment, which likely means more delays in data center construction.”

-

“These hyperscalers have been engaged in this spending war to get to new heights,” says Anirban Basu, chief economist at Associated Builders and Contractors. “Some of them are going to be pulling back on some of those plans.”

And even though many companies both US and otherwise have pledged large investments in the US going forward, they too are likely to be dented by these tariffs.

“The bottom line: Trump has touted how he’s going to attract hundreds of billions of dollars in AI spending to the U.S.”

-

“Tariffs might mean less bang for the bucks.”

As I summarized it on Friday:

“For now, these ‘liberation’ moves are likely throwing away some odf the net economic gains of the AI era in the coming year”.

And then some.

Paritcularly in the upgrade cycle of computer and devices for local, ‘Small AI’ I’ve discussed to date.

The possibility of $2300 iPhones is not far-fetched. Impacting, Apple, Nvidia, Microsoft, and vast array of the US tech ecosystem.

That is the Bigger Picture to keep in mind, as we get ready to see these events unfold further this week. And far beyond in this AI Tech Wave. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)