AI: Nvidia in China, two steps back, one step forward. RTZ #783

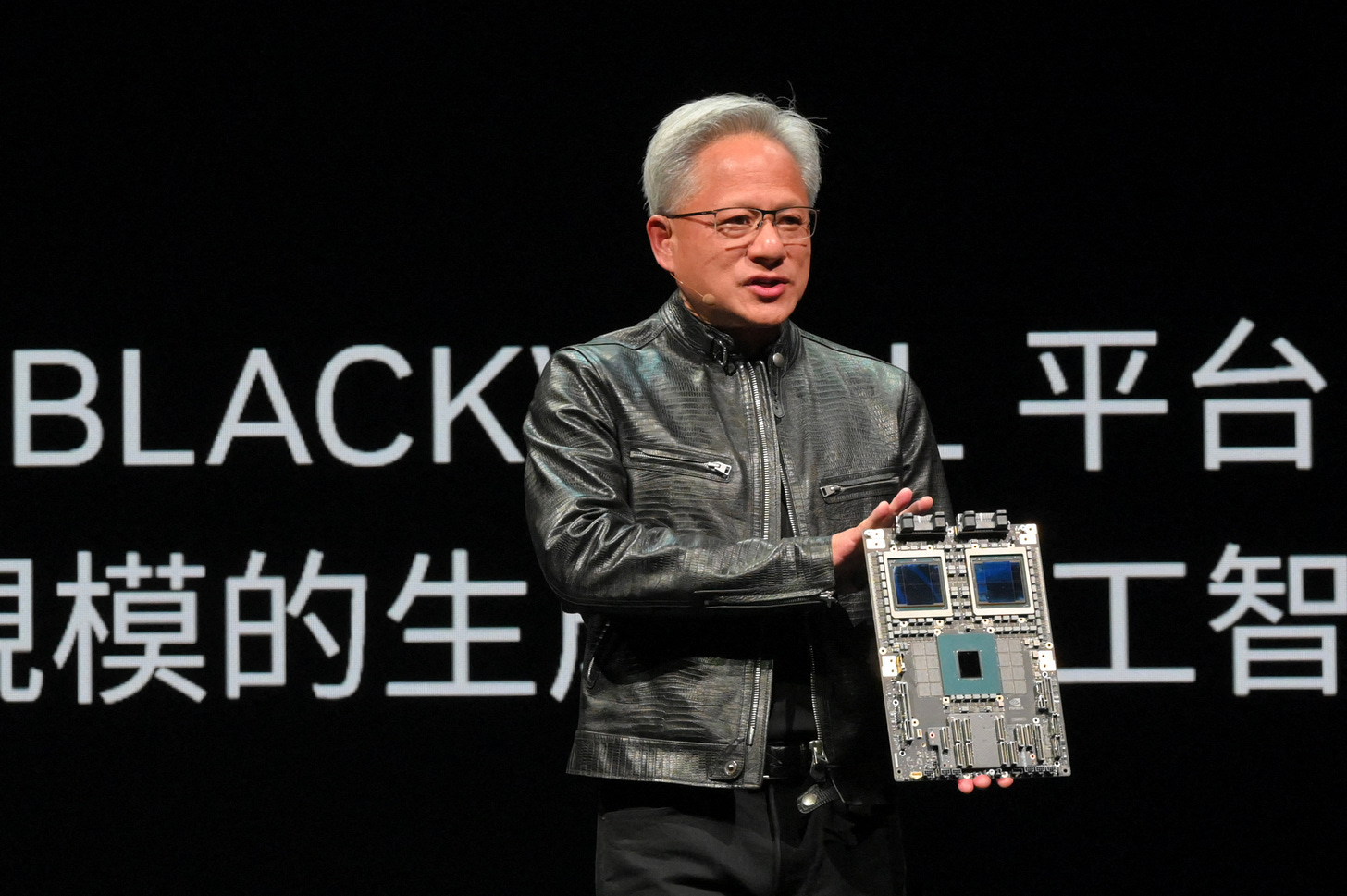

First the good news: Nvidia will be able to sell older versions of its AI GPUs into China, the world’s second largest AI market, and the place that has half the world’s AI Talent. Nvidia founder/CEO Jensen Huang managed to execute a small political victory with the promise of the US removing export hurdles that never should have been imposed in the first place.

On the surface, it was good news, and Nvidia stock jumped 4%, capping its global victory of breaking the $4 trillion market cap ceiling only a few days ago.

But the bad news is that this two step backward, one step forward move is the new racing speed for US technology firms. Rather than race its global competitors freely at F1 speeds, it’s forced to bump around the track at Go-Kart speeds.

Bloomberg summarizes the ‘good news’ in ‘Nvidia, AMD to Resume AI Chip Sales to China in US Reversal’:

“Nvidia Corp. and Advanced Micro Devices Inc. plan to resume sales of some AI chips in China after securing Washington’s assurances that such shipments would get approved.”

“US government officials told Nvidia they would green-light export licenses for its H20 artificial intelligence accelerator, and AMD received similar assurances from the US Commerce Department for its MI308 chips.”

“The move is seen as a win for Nvidia’s Chief Executive Officer Jensen Huang, who has branded US chip curbs a “failure”, and is expected to add billions to Nvidia’s revenue this year, according to the company.”

“Nvidia Corp. and Advanced Micro Devices Inc. plan to resume sales of some AI chips in China after securing Washington’s assurances that such shipments would get approved, a dramatic reversal from the Trump administration’s earlier stance on measures designed to limit Beijing’s AI ambitions.”

“US government officials told Nvidia they would green-light export licenses for its H20 artificial intelligence accelerator, the company said in a blog post on Monday — a move that may add billions to Nvidia’s revenue this year, restoring its ability to fulfill orders it had written off as lost due to government restrictions. Nvidia designed the less-advanced H20 chip to comply with earlier China trade curbs from Washington, which Trump’s team tightened in April to block H20 sales to the Asian country without a US permit.”

It wasn’t just Nvidia that saw the ‘good news’:

“AMD received similar assurances from the US Commerce Department and plans to restart shipments of its MI308 chips to China once licenses for sales are approved, the company said in a statement Tuesday. Shares of AMD jumped as much as 8.5% after markets opened in New York while Nvidia rose as much as 5%.”

It took a pilgrimage to the White House, to get a U-turn on the policy, and then a trip to China to fix any ruffled feathers. Everyone, countries included, like to be treated with respect (just a little bit):

“Chief Executive Officer Jensen Huang — who met with President Donald Trump last week and is currently in Beijing attending a government-sponsored conference — appeared on Chinese state broadcaster CCTV shortly after Nvidia announced the decision, saying the company had secured approval to begin shipping. The Commerce Department, which oversees US export controls on chips and the tools used to make them, did not immediately respond to a request for comment on whether the agency has already issued any H20 licenses.”

As I’ve recounted endlessly in these pages, this US/China ‘Threading the Needle’ exercise has been underway across administrations. It’s just that this one is far more volatile in its actions:

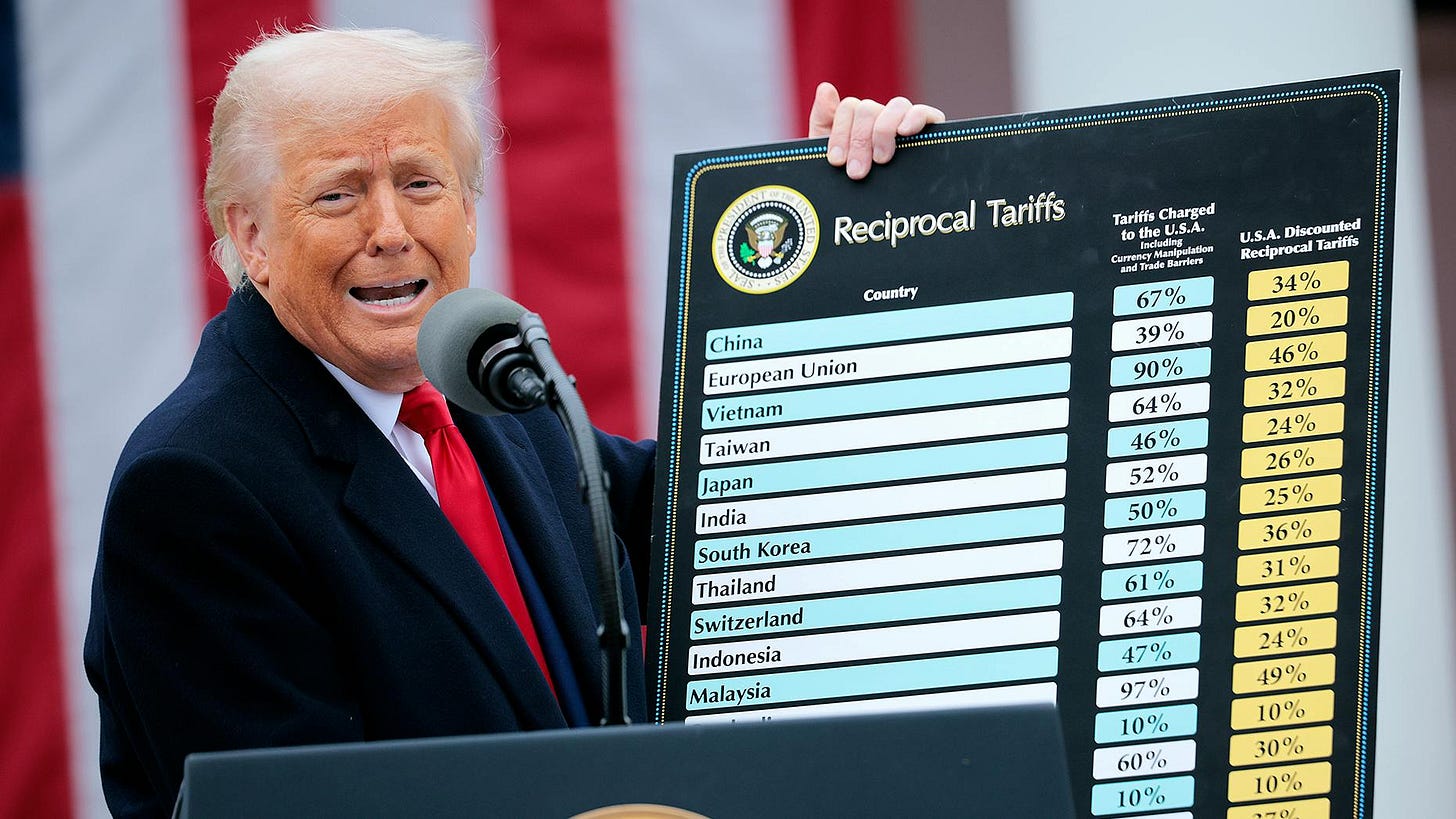

“The US move comes after weeks of thawing relations between Washington and Beijing, guided by an opaque trade truce that’s designed to see both sides approve exports of crucial technologies. After meeting his Chinese counterpart last week, US Secretary of State Marco Rubio said there’s a “strong desire on both sides” for a meeting between Trump and President Xi Jinping later this year.”

“Washington in recent weeks has lifted a spate of export controls — including on chip design software — imposed ahead of last month’s trade talks in London. That’s in return for China allowing more sales of rare-earth minerals needed to make a range of high-tech products, something US negotiators thought they’d achieved the month prior during talks in Geneva. Throughout and after those negotiations, Trump’s team insisted that controls on Nvidia’s H20 chips were not up for discussion.”

Part of the problem is that EVERYTHING is a bargaining chip, in public, subject to daily, sustained media spotlights.

As opposed to behind the scenes, considered and deliberate negotiations by experts in a myriad international bodies, coming to agreements then ratified by their governments. With all sides living by those agreements for decades. Not any more.

“Treasury Secretary Scott Bessent acknowledged Tuesday that the restrictions on Nvidia’s H20 chips were part of the London talks, despite his own earlier assertions that there was no such quid pro quo tying semiconductors and rare earths.”

“You might say that that was a negotiating chip that we used in Geneva and in London,” Bessent said in an interview on Bloomberg Television. “It was all part of a mosaic. They had things we wanted, we had things they wanted.”

Markets of course were relieved by all this worldwide, taking a ‘victory lap’ in a manufactured crisis.

“Nasdaq futures surged after Nvidia’s announcement, with Chinese stocks also reacting positively. Alibaba’s shares rose as much as 6% in Hong Kong on Tuesday, the Hang Seng Tech Index rose as much as 2.2% and data center operators like Beijing Sinnet Technology Co. jumped as much as 8.4%.”

These games of political football have been going on for a while now of course, across both administrations:

“The US first restricted Nvidia’s China sales in 2022, with sweeping curbs designed to prevent the Asian country from accessing advanced AI that could benefit the Chinese military. Nvidia has designed new processors for the China market several times to comply with those measures, which have become a central point of tension between Washington and Beijing.”

“Within months of the initial curbs, the chipmaker debuted the H800, which President Joe Biden’s administration effectively banned from sale to China in 2023. Nvidia responded with the H20, for which Biden officials weighed — but did not ultimately pursue — export restrictions. After Trump moved forward with H20 controls in April, Nvidia designed another China-focused product, the RTX PRO. The company described that chip as “fully compliant,” meaning that it falls below the technical thresholds that would necessitate Washington’s approval for export to the world’s second-largest economy.”

The Chinese representatives are saying it like it is:

““Let me stress that China opposes politicizing and weaponizing trade and tech issues,” Ministry of Foreign Affairs spokesman Lin Jian said at a regular briefing, when asked about Nvidia. Export curbs “will destabilize global industrial supply chains and will serve nobody’s interest.”

What the analysts say about all this of course is financially positive for Nvidia and its peers:

“The possibility that US officials will green-light Nvidia’s H20 exports to China reopens a key sales channel for the US chipmaker. The reversal could help recover a substantial portion of the $15 billion in fiscal 2026 data center revenue previously at risk, including $4-5 billion originally expected in 2H, and part of the $8 billion in unshipped 2Q orders.”

This outcome of course is the outcome of some extraordinary efforts by Nvidia’s founder/CEO Jensen Huang and his team:

“The back and forth reflects the importance of the China market for Nvidia, which made history last week as the first company to hit $4 trillion of market value — a testament to its central role in providing the hardware for a post-ChatGPT AI infrastructure building boom. Huang is currently seeking discussions with Chinese leaders, including the commerce minister, with Nvidia’s central role in the global AI rollout likely on the agenda.”

“Huang has also become increasingly vocal in Washington. He said recently that policymakers don’t need to worry about the Chinese military using Nvidia chips — one of the central justifications for US restrictions — since Beijing can’t rely on something that Washington could restrict at any point. He’s also warned that Nvidia’s loss of market share in the Asian country — from 95% to 50%, Huang said in May — directly benefits Huawei, the Shenzhen-based hardware giant at the center of Beijing’s tech ambitions.”

And some positive steps forward on the Sovereign AI front in the Middle East recently:

“For months, though, it seemed the tech chief was fighting a losing battle. While some Trump officials are keen to boost Nvidia’s sales in markets like the Middle East, they held the line on China curbs.”

These political back and forth games will of course continue for the rest of the year and next.

In the near term it’s important to note that the deal to allow the H20 shipments to China happened due to a key alignment with the White House: the need to maintain the US AI Tech Stack inside China, giving them less of an imperative to create their own. As Bloomberg notes in a separate piece:

“White House AI adviser David Sacks defended the Trump administration’s decision to allow Nvidia Corp. and Advanced Micro Devices Inc. to resume sales of some artificial intelligence chips to China.

Sacks said that allowing Nvidia to restart shipments of its H20 chips would position the US to compete more effectively abroad and blunt efforts by Chinese tech giant Huawei Technologies Co. to gain a bigger slice of the global market.

Sacks described the policy shift as part of a broader push to establish an “American AI stack” — encompassing chips, operating systems, and the AI models that run on them.”

So Jensen got the shorter term urgent message through and connected.

But longer term, it highlights the new reality for US Tech, especially for the world leading US AI technology companies. That by engaging with China pragmatically in a ‘Realpolitik’ way, useful things can be achieved for broader US goals long-term. Nvidia is the US’s sharpest tip of the arrow on its AI objectives for now. Another one down soon is Apple, with its critical footprint in China. And of course, Elon Musk’s Tesla too.

Behind them are a plethora of US tech crown jewels from Broadcom to Qualcomm to Dell to AMD to Oracle and beyond.

The bipartisan Kabuki theater around a ‘US/China’ Cold War continues to hamper and slow down an accelerating opportunity for the US to dominate the AI Tech Wave globally, like it has done with prior major tech waves. From Mainframes to PCs to Internet to Cloud to Mobile and many more.

Countless US company futures hang in the balance. Small and Large. Private and Public. And increasingly across industries, since AI adoption is likely to boost US companies’ global opportunities ACROSS most industries. That’s the real opportunity on a globally expanding pie. Making the backward exercise of fighting for every crumb of the existing pieces of the pie, self-defeating in the long run.

I’ve written at length on these political hurdles, manifested in Tech Export Curbs, to Tariffs, to US Student Visa curbs, to Skilled/UnSkilled Immigration speed bumps to bans on cross-border investments and business partnerships.

Not to mention the across the board, unilateral cuts in US grants to US Colleges, that as the geopolitical commentator Fareed Zakaria eloquently explains, have been the basis of US global technology leadership across almost every domain. Not just technology.

So it’s good to see this victory lap for Nvidia and AMD on near-term chips sales to China. Keep in mind that this is but one stop curve in the beginning laps of a very long, infinite race in this AI Tech Wave.

The current optics of the US/China ‘AI Race’ is modeled after the Cold War, which was framed around the military doctrine of ‘Mutual Assured Destruction’.

What we have now with the US/China relationship is another MAD relationship. That of ‘Mutual Assured Dependence’. For a whole range of historical, economic and technology reasons, we find ourselves inexorably tied together in global dependence for the foreeable future. Defined in decades. Regardless of short-term efforts to ‘go it alone’.

If we want the promise of AI, both its digital and physical versions, with extrordinary AI driven robots, cars, flying machines and beyond, we have to fundamentally undertand that it’s a global exercise in dependencies.

Economist Milton Friedman explained this MAD dependence in his eloquent short presentation around a Pencil over four decades ago. That video is even more the reality today in the world of the iPhone. And the world of AI marvels tomorrow from this AI Tech Wave. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)