AI: Nvidia/Intel deal an echo of Microsoft/Apple in 1997. RTZ #851

The Bigger Picture, Sunday, September 21, 2025

In this Saturday’s AI: RTZ Weekly Summary, I noted “Nvidia’s multi-billion dollar investment in Intel echos the Microsoft Investment in Apple in 1997, now with a geopolitical frame”. Both parts of that statement, the historical echo, and the unique geopolitical realities driving the transaction, are worth a ‘Bigger Picture’ discussion this Sunday. Mostly because they are likely a harbinger of tech realities to come in this AI Tech Wave.

First, the WSJ summarizes the overall details in “Nvidia to Invest $5 Billion in Intel, Furthering Trump’s Turnaround Plan”:

“Nvidia said it would invest $5 billion in Intel shares and form a new product partnership with its rival, the latest step in Intel’s efforts to revive its flagging fortunes.”

“The investment pairs the world’s most valuable company, which has been a darling of the artificial-intelligence boom, with a chip maker that has almost completely fallen out of the AI conversation.”

“Under the terms of the deal, Intel will design custom CPUs—central processing units, the computer brains that power devices from smartphones and laptops to automobiles—that will be easily integrated with Nvidia’s chips and other equipment in both data centers and personal computers.”

The deal represents the continuing balancing act that Nvidia founder/CEO Jensen Huang is playing on the geopolitical front between the ongoing higher level negotiations underway between the US and China. And separate from the trade and tariff machinations that he has to navigate through as well.

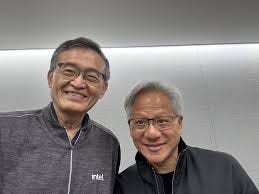

“Nvidia CEO Jensen Huang called the partnership “historic” in a conference call Thursday. His company goes head-to-head with Intel on designing chips, but in recent years has taken an enormous lead because of Huang’s savvy bet on AI processors. Intel is the only major American company that both designs and fabricates the most powerful chips, such as those used for advanced AI computing.”

“We’re taking the next great step,” Huang said. “We’re essentially going to be a major customer of Intel’s server CPUs. This is the first time.”

“Thursday’s agreement is a victory for Intel Chief Executive Lip-Bu Tan, who is in the middle of a high-wire turnaround effort backed by the Trump administration.”

The idea is for Nvidia to use Intel as a foundry for CPUs, much like it relies on Taiwan Semiconductor (TSMC) for GPUs and more.

“At the heart of the deal is a product that is one of the few areas where Intel remains dominant: CPUs based on a chip architecture known as X86. Intel and rival Advanced Micro Devices are the two main producers of X86 processors, which are ubiquitous in non-Apple personal computers, among other devices.”

“The deal doesn’t cover Nvidia’s signature products, known as GPUs—graphics processing units—which are needed to train and fine-tune the world’s largest and most complex AI models. Even so, it further shores up Intel a month after the U.S. government said it was taking a 10% stake.”

“That deal converted nearly $9 billion in promised grants to equity and made the Commerce Department the company’s largest shareholder. With Thursday’s Intel rally, the government is up some 50% on its investment.”

“In addition to Thursday’s deal with Nvidia, Intel last month agreed to a $2 billion investment from SoftBank Group.”

Investors like the deal, especially for Intel which saw its stock up over 20% after months of uncertainties.

“This has been a golden few weeks for Intel after years of pain and frustration for investors,” Dan Ives, managing director at Wedbush Securities, said in a note to clients.”

Including the photo-ops for the market at large.

The Geopolitical framing is important, along with particularly mercantilistic politics. As the WSJ notes in a piece on a separate TikTok/China tech transaction “U.S. Government Is Expected to Get Multibillion-Dollar Fee in TikTok Deal”:

“Fee would be latest example of government getting paid for involvement in private-sector deals.”

“The Trump administration is expected to collect a multibillion-dollar fee from investors as part of the complicated transaction to take control of TikTok’s U.S. operations, the latest in a string of lucrative government deals with the private sector.”

“Investors in the TikTok deal would pay the government the fee in exchange for negotiating the agreement with China, people familiar with the matter said. President Trump and Chinese leader Xi Jinping approved a preliminary framework for the deal Friday.”

Of course this has echoes of a similar ‘government take’ transaction involving Nvidia and AMD sales to China customers:

“The final structure and amount of the payment haven’t been finalized as deal talks continue but the fee could end up totaling billions of dollars, the people said. The government recently agreed to become Intel’s largest shareholder and take 15% of the sales from an Nvidia artificial-intelligence chip made for the Chinese market in exchange for granting export licenses.”

“Trump has mentioned the federal government could get a fee as part of the TikTok deal, but didn’t specify that it could be billions of dollars, an enormous sum for arranging a deal.”

“It hasn’t been fully negotiated, but we’ll get something,” Trump said Friday in the Oval Office, adding that the size of the deal and money and effort put in by the government justify compensation. A day earlier, he said, “The United States is getting a tremendous fee-plus—I call it a fee-plus—just for making the deal and I don’t want to throw that out the window.”

By way. of comparison to private sector investment banks, the numbers are extraordinary:

“Investment bankers advising on a typical deal receive fees of less than 1% of the transaction value, and the percentage generally gets smaller as the deal size increases. TikTok’s U.S. operations could be worth many billions of dollars depending on the final outcome of the deal. Still, a fee in the billions of dollars would be unprecedented.”

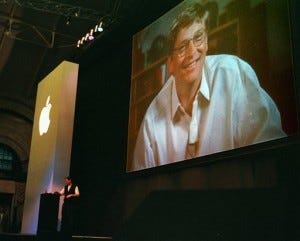

It all makes the Microsoft/Apple deal almost three decades ago look so simple. Despite the extraordinary drama and precedent it represented when Steve Jobs came back to rescue Apple.

Much was made then of how Bill Gates towered over Steve Jobs on stage at the Apple event in 1997.

Far less in comparison to how the current adminsitration towers over Nvidia, Intel, and far greater things tech today. And that is a Bigger Picture to keep in mind in the current AI Tech Wave today. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)