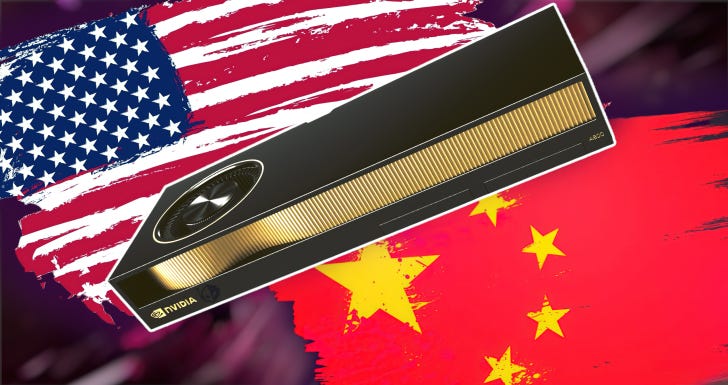

AI: Nvidia reigns on DESPITE China hits. RTZ #735

Well, Nvidia continues to reign, despite one of the biggest self-inflicted wounds on global US technology leadership in recent memory, the US/China technology infrastructure trade curbs, and tariffs.

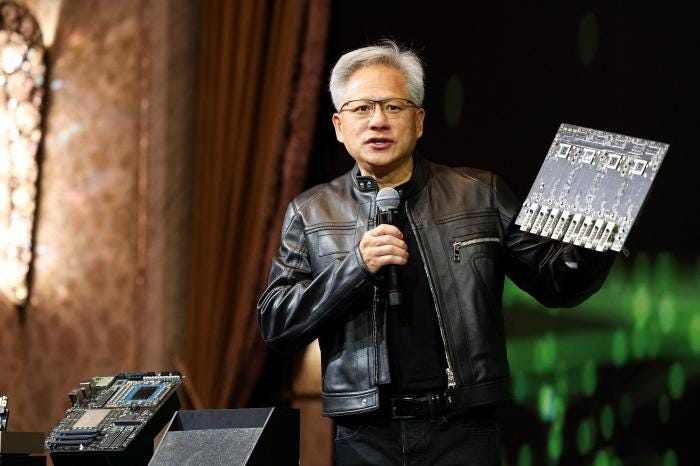

Nvidia, under the adroit leadership of its founder/CEO Jensen Huang, managed to deliver first quarter results that surpassed analyst expectations AFTER deducting an $8 plus billion impact of lost sales of its AI GPU chips into China. And the forced drop of its 95% share of the $50 billion annual market for AI chips and infrastrucure in China to 50%, and much lower in the period ahead this AI Tech Wave.

Yes, Jensen was able to execute a modest ‘victory’ accompanying the President on his Mideast trip and securing incremental billions in ‘Sovereign AI’ sales for a million Nvidia Blackwell chips in Saudi Arabia and the UAE, that results in a relative, short-term net wash on the China impact over the next 2-3 years.

Axios summarizes it all in “Nvidia beats earnings expectations but takes hit from chip export restrictions”:

“Nvidia topped earnings expectations in its most recent quarter as AI chip demand continues to fuel growth for the company despite concerns about mounting U.S.-to-China export restrictions.”

“Why it matters: Nvidia has become a bellwether stock for the AI economy as tech companies invest heavily in product development and data center capability, powering Nvidia’s rise.”

“By the numbers: The company Wednesday posted revenue of $44.1 billion for its first quarter, up 69% from a year ago and beating S&P Global Market Intelligence expectations of $43.2 billion.”

“Adjusted earnings per share of 96 cents topped Bloomberg consensus estimates of 88 cents.”

“The performance included a 73% year-over-year boost in first-quarter revenue in the company’s data center segment to $39.1 billion.”

“Gaming revenue rose 42% to $3.8 billion.”

“On the U.S.-China trade issue, Nvidia warned that it expects to lose about $8 billion in second-quarter revenue from the loss of sales of H20 chips due to U.S. export control restrictions.”

“The company incurred a $4.5 billion charge in the first quarter from excess H20 inventory due to the restrictions.”

“Nvidia CEO Jensen Huang doubled down on his recently articulated argument that U.S. chip export controls have been “a failure,” saying on Wednesday’s earnings call that the restrictions have boosted Chinese innovation.”

“Nvidia’s once-dominant position in China has been significantly dented, Huang said last week — its market share in the country falling from 95% four years ago to only 50% today.”

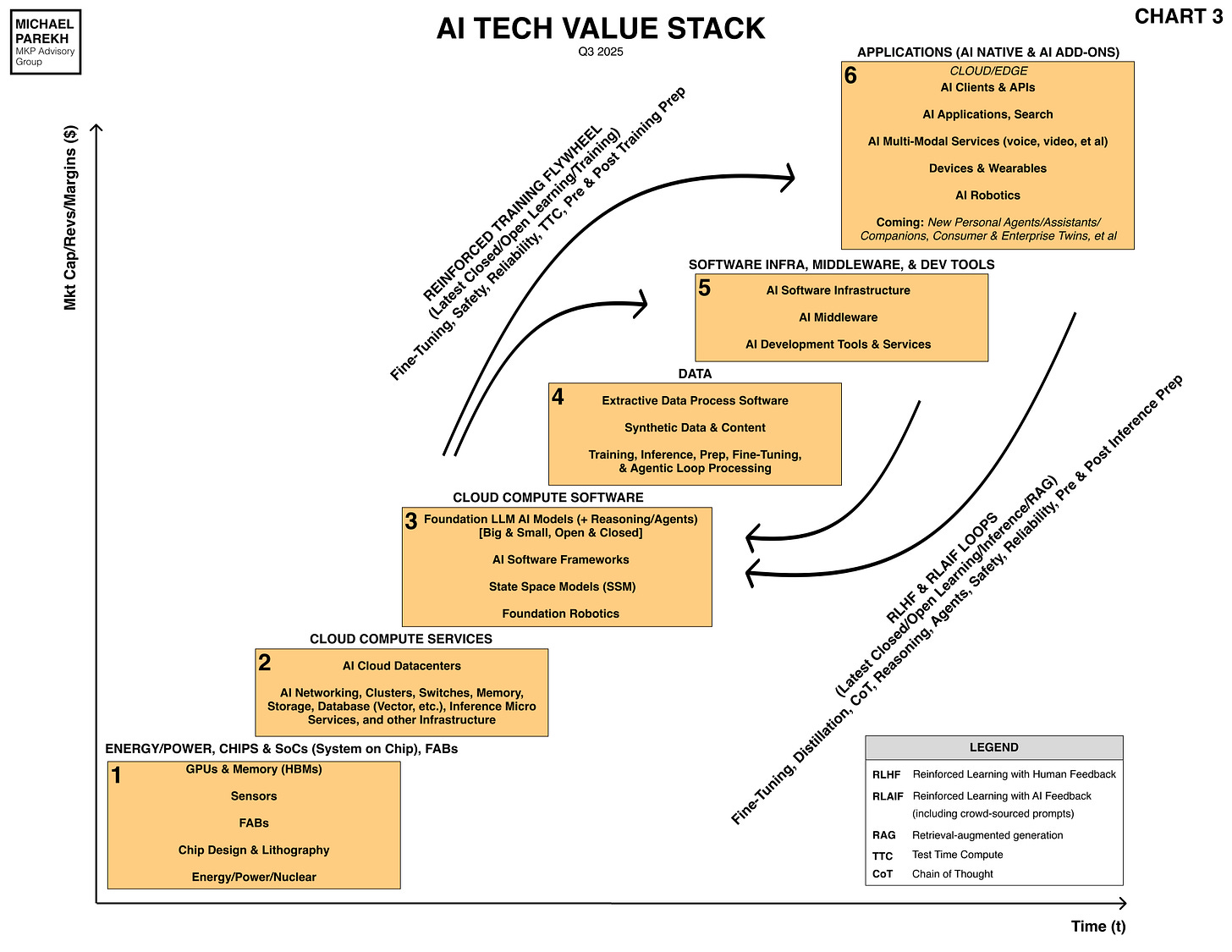

Nvidia’s position up and down the AI Tech Stack is fundamentally challenged by curtailing its access to the world’s second largest AI market, with their 50% share of the world’s AI researchers.

“”The platform that wins China is positioned to lead globally today,” Huang said on the call Wednesday. “However, the $50 billion China market is effectively closed to us.”

“The question is not whether China will have AI — it already does,” he said. “The question is whether one of the world’s largest AI markets will run on American platforms. Shielding Chinese chip makers from U.S. competition only strengthens them abroad and weakens America’s position.”

“The impact: Nvidia shares were trading up 4% in after-hours trading Wednesday after the call.”

The Global demand for Nvidia’s core products make the quarter shine despite China.

The whole call transcript is worth a read, especially Jensen’s careful articulation of the short and long-term risks and challenges from the US/China actions. It’s especially worth a careful read, given its import not only to Nvidia, but implications for the US global AI leadership in this AI Tech Wave going forward.

That’s why I’m citing his comments in full:

“We’ve had a busy and productive year. Let me share my perspective on some topics we’re frequently asked.”

“On export control: China is one of the world’s largest AI markets and a springboard to global success. With half of the world’s AI researchers based there, the platform that wins China is positioned to lead globally. Today, however, the $50 billion China market is effectively closed to U.S. industry. The H20 export ban ended our Hopper Data Center business in China. We cannot reduce Hopper further to comply. As a result, we are taking a multibillion-dollar write-off on inventory that cannot be sold or repurposed. We are exploring limited ways to compete, but Hopper is no longer an option.”

“China’s AI moves on with or without U.S. chips. It has to compute to train and deploy advanced models. The question is not whether China will have AI, it already does. The question is whether one of the world’s largest AI markets will run on American platforms. Shielding Chinese chipmakers from U.S. competition only strengthens them abroad and weakens America’s position. Export restrictions have spurred China’s innovation and scale. The AI race is not just about chips. It’s about which stack the world runs on. As that stack grows to include 6G and quantum, U.S. global infrastructure leadership is at stake.”

“The U.S. has based its policy on the assumption that China cannot make AI chips. That assumption was always questionable and now it’s clearly wrong. China has enormous manufacturing capability. In the end, the platform that wins the AI developers win AI — wins AI. Export controls should strengthen U.S. platforms, not drive half of the world’s AI talent to rivals.”

“On DeepSeek: DeepSeek and Qwen from China are among the most — among the best open-source AI models. Released freely, they’ve gained traction across the U.S., Europe and beyond. DeepSeek-R1, like ChatGPT, introduced reasoning AI that produces better answers, the longer it thinks. Reasoning AI enables step-by-step problem solving, planning and tool use, turning models into intelligent agents. Reasoning is compute-intensive, requires hundreds to thousands more — thousands of times more tokens per task than previous one-shot inference. Reasoning models are driving a step-function surge in inference demand. AI scaling laws remain firmly intact, not only for training, but now inference too requires massive scale compute.”

“DeepSeek also underscores the strategic value of open-source AI. When popular models are trained and optimized on U.S. platforms, it drives usage, feedback and continuous improvement, reinforcing American leadership across the stack. U.S. platforms must remain the preferred platform for open-source AI. That means supporting collaboration with top developers globally, including in China. America wins when models like DeepSeek and Qwen runs best on American infrastructure.”

“Regarding onshore manufacturing: President Trump has outlined a bold vision to reshore advanced manufacturing, create jobs and strengthen national security. Future plants will be highly computerized in robotics. We share this vision. TSMC is building six fabs and two advanced packaging plants in Arizona to make chips for NVIDIA. Process qualification is underway with volume production expected by year-end. SPIL and Amkor are also investing in Arizona, constructing packaging, assembly and test facilities. In Houston, we’re partnering with Foxconn to construct a 1 million square foot factory to build AI supercomputers. Wistron is building a similar plant in Fort Worth, Texas. To encourage and support these investments, we’ve made substantial long-term purchase commitments, a deep investment in America’s AI manufacturing future. Our goal from chip to supercomputer built in America within a year. Each GB200 NVLink72 racks contains 1.2 million components and weighs nearly 2 tons. No one has produced supercomputers on this scale. Our partners are doing an extraordinary job.”

“On AI diffusion rule: President Trump rescinded the AI diffusion rule, calling it counterproductive, and proposed a new policy to promote U.S. AI tech with trusted partners. On his Middle East tour, he announced historic investments. I was honored to join him in announcing a 500-megawatt AI infrastructure project in Saudi Arabia and a 5-gigawatt AI campus in the UAE. President Trump wants U.S. tech to lead. The deals he announced are wins for America, creating jobs, advancing infrastructure, generating tax revenue and reducing the U.S. trade deficit.”

“The U.S. will always be NVIDIA’s largest market and home to the largest installed base of our infrastructure. Every nation now sees AI as core to the next industrial revolution, a new industry that produces intelligence and essential infrastructure for every economy. Countries are racing to build national AI platforms to elevate their digital capabilities. At COMPUTEX, we announced Taiwan’s first AI factory in partnership with Foxconn and the Taiwan government. Last week, I was in Sweden to launch its first national AI infrastructure. Japan, Korea, India, Canada, France, the U.K., Germany, Italy, Spain, and more are now building national AI factories to empower startups, industries and societies. Sovereign AI is a new growth engine for NVIDIA.”

Jensen does a very diplomatic job weaving his comments around the current administration’s policy impulses, and stays as closely aligned with them as possible given the real circumstances.

I went through many of the longer term risks to Nvidia in more robust terms, in a video podcast discussoin on The Daily Rip, a financial markets show.

It’s a testament to the fundamental demand drivers in this AI Tech Wave that Nvidia was able to deliver results beating analyst expectations for the period ahead despite the geopolitical China headwinds.

And while the next few quarters look fine for Nvidia shareholders in the company’s current AI reign, the longer term implications of China, with 50% of the world’s AI researchers, being decoupled from US AI/Tech platforms for short term political reasons, is something that is going to puzzling indeed for historians not too long from today. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)