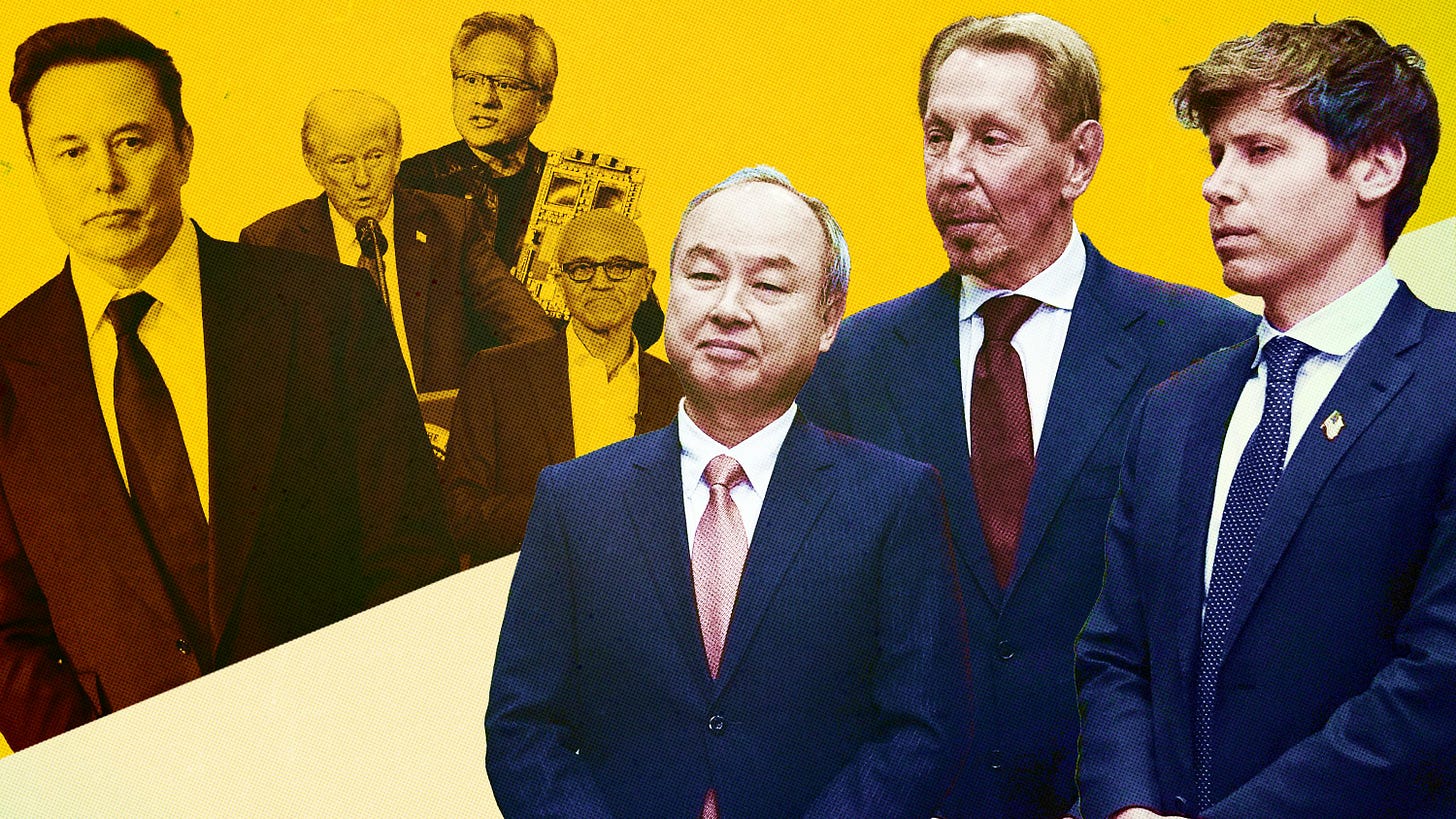

AI: Nvidia's Jensen Huang balancing US & China. RTZ #437

The Bigger Picture, Sunday June 1, 2025

The two companies at the apex of American public markets, Nvidia and Apple, both have one of the most daunting tasks of ‘threading the needle’ between the two strong-willed heads of state in the US and China. Yes, we can add Tesla into the mix, but it’s more closely rolled into the story of one of the heads of state.

This Sunday, I’d like to focus on the ‘Bigger Picture’ of how Nvidia’s founder/CEO Jensen Huang is navigating this difficult road. Especially after his company reported a stellar quarter this past week despite the immense storm clouds over China. It’s a particularly key issue for the broader state of the AI Tech Wave this year and beyond.

It’s a topic that I discuss extensively and broadly, in a couple of video podcasts this week, that may be informative weekend viewing. One is with Ram Ahluwalia of Lumida Wealth, and the other is with the ‘Daily RIp’ stock market show hosted by Katie Perry and Shay Boloor.

The crux of the issues are also well laid out in the Information’s ‘Big Read’, “Jensen Huang Used to Delegate Politics—Until Trump’s Return”.

“The Nvidia CEO is relying on Mar-a-Lago visits and a budding relationship with President Donald Trump to reopen a path to China, which demands his attention, too.”

“Since the start of this year, Nvidia CEO Jensen Huang has been thrust into an unexpected new role—chief lobbyist for his company—forcing him to carry its hopes, suggestions and pleas directly to President Donald Trump.”

“Many of Huang’s conversations with Trump have happened at Mar-a-Lago, Trump’s residence and private club in south Florida, and Huang has made far more visits there than have been publicly reported, according to a person with direct knowledge of the matter. Indeed, these tête-à-têtes in Palm Beach have become frequent enough for one Nvidia executive to remark on Huang’s absence from the company’s Santa Clara, Calif., headquarters. “We see a lot less of Jensen,” the executive said. “He’s traveling to Florida a lot.”

“Huang’s direct approach to dealing with Trump is a marked break from the past, when Huang generally left it to his lieutenants—and his lieutenants’ lieutenants—to handle the company’s relationships with the U.S. government. Generally, they engaged in traditional lobbying efforts, speaking regularly to bureaucrats and policymakers in an effort to shape public policy that favored Nvidia.”

This is a marked departure from the CEOs of the other Mag 7 and leading AI Native companies, who’ve had far bigger DC staffs for years, and their CEOs have been more engaged on the political sides of their businesses for longer periods.

“The Takeaway

• Nvidia’s Jensen Huang has shifted his approach to U.S. politics, forging a personal relationship with President Donald Trump

• Huang had no relationship with Joe Biden, once turning down an invite for an event with the president

• Nvidia is scrambling to develop a new product for China after U.S. ban on critical H20 chip”

Nvidia had a key catalyst that ‘pulled them in’ (1 minute mark), to the US/China tug-of-war abruptly:

“A dramatic economic imperative for Nvidia is driving the shift. Right now, Nvidia’s China business has ground to a halt. A month ago, the Trump administration announced a surprise new ban on Nvidia selling its H20 chip in China, its most advanced product sold in the country. China accounts for 14% of Nvidia’s sales, and the block of H20s cost the company $2.5 billion in lost sales in the first fiscal quarter of this year and will wipe away another $8 billion in the next quarter.”

“Huang must find a way to rekindle the China business, and to do so, he has to continue to try to thread the needle between the Trump administration, the Chinese government and his Chinese customers—as he has been endeavoring to do since Trump took office.”

And he’s had to do what he had to do:

“Like other tech leaders who have recently sought to curry favor with Trump, Huang has begun publicly aligning his views with the new administration in anticipation of its new policies on AI and chips. Recently, he has been blasting the Biden-era restrictions on Nvidia chip sales in speeches and news conferences, while praising Trump’s efforts to promote U.S. leadership in technology and manufacturing. (When reached for comment, a White House spokesperson praised the “productive relationship” Nvidia has established with the administration and the “billions” the company plans to invest in America.)”

Nvidia did this with partners in terms of ‘hundreds of billions’ to be invested in the US. As have his peers like Apple and others.

But Nvidia also has to focus hard on the other side as well, in China and Taiwan, where his company is deeply embedded in the supply chains:

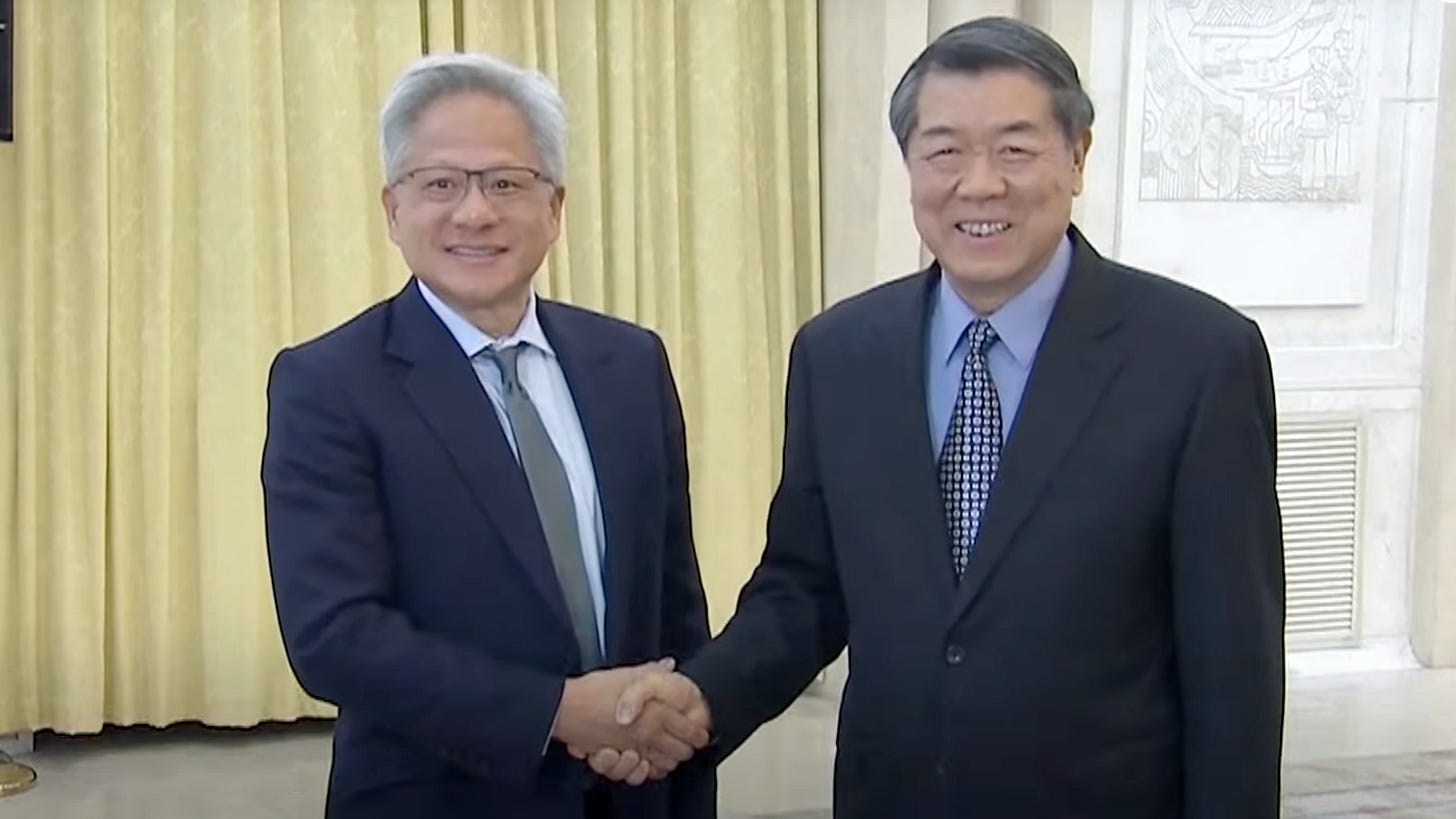

“That’s just half of Huang’s task. He has to also keep up with what’s happening in China. He once tried to delegate dealing with Chinese officials to other Nvidia executives, as he had done with the U.S. government. No longer. In a recent trip to China after the H20 ban, he not only met with senior Chinese government leaders but also allowed state media to report parts of those conversations in an attempt to broadcast his commitment to doing business in China. (China’s State Council didn’t reply to a request for comment.) He has also started speaking directly to some of Nvidia’s top Chinese customers.”

“At the same time, Nvidia has been racing to redevelop its hardware so it can satisfy both U.S. export rules on AI chips and Chinese demand. Under those rules, Nvidia can’t sell its most high-powered chips to China even as rival chipmakers in the country threaten the company’s foothold there. Looking for a solution, Nvidia is redesigning some hardware to allow Chinese customers for the first time to connect multiple chips together and create higher-performance computing clusters, which would help compensate for the chips’ relatively low performance, according to four people working for Nvidia’s Chinese customers and involved in the conversations with Nvidia.”

Jensen shares this task of course with his peer Tim Cook at Apple:

“Whether Huang can pull off this delicate waltz between world governments is very much in question. And as Huang’s peer at Apple, Tim Cook, knows full well, even careful courtship of Trump doesn’t always go as planned. Despite Cook’s substantial efforts to woo Trump over many years, Trump just a week ago threatened levies on iPhones until Apple moves the product’s manufacturing to the U.S., a task widely seen as nearly impossible.”

“With forces in sparring countries pulling Huang across several continents, he no doubt hopes to avoid a similar uncomfortable fate.”

The whole piece is worth reading in full to understand Jensen’s dealings with the previous administration, and how it all escalated to the current state of global affairs. And be as aligned as possible with the Washington way of thinking on the China imperatives.

“Meanwhile, Nvidia’s government affairs team has deliberately started to parrot Trump’s talking points on AI in meetings with U.S. policymakers, according to two U.S. government officials with direct knowledge of the matter. Rather than focusing on the economic damage caused by export controls, the team is emphasizing the importance of America leading the world in the industry, points Trump has also repeatedly made in public speeches and on earnings calls.”

A task that has its limits and ups and downs:

“Despite all the flattery, Huang wasn’t able to stop the Trump administration’s decision in early April to ban sales of H20 chips to China, dealing a major blow to Nvidia. Weeks later, though, Huang made a public pledge to invest as much as $500 billion over the next four years to build AI servers in the U.S.”

And do the same on the other side of the planet:

“As Huang has attempted to guard his company’s standing in America, he has also taken care to manage its ties to China.”

A key question of course is how to maintain Nvidia’s market position in China. An imperative also for the other three plus trillion dollar US company, Apple, which I’ll discuss in a future post.

“Huang and his senior executives have always believed that Nvidia couldn’t work exclusively with either the U.S. or China. At an all-hands meeting at Nvidia shortly after ChatGPT’s 2022 release catalyzed interest in AI, an Nvidia employee asked Huang why Nvidia continued to sell chips to China.”

“Huang appeared irritated, according to four people present at the meeting. He replied that he didn’t want to hear that kind of talk, which he characterized as anti-China. He said Nvidia treated all of its customers equally, was politically neutral and respected the different political systems of each country, the people said.”

And that’s had it own set of challenges:

“Despite Huang’s stance, the Chinese government has expressed unhappiness with Nvidia in the past. Nvidia is facing a Chinese antitrust investigation over potential violations related to its 2020 purchase of Mellanox Technologies, a semiconductor company, in a $7 billion deal—Nvidia’s largest-ever acquisition. The probe, announced late last year, was a tit-for-tat move after Washington announced its restrictions on chip sales to China, The Information previously reported.”

Jensen has been proactive on this front, with physical trips back and forth:

“When the U.S. announced its ban on the H20 chip last month, Huang made a surprise visit to China, with the goal of mending relations with senior Chinese government officials, according to a person with direct knowledge of the matter, which hasn’t been previously reported. The officials were upset that Nvidia hadn’t told Chinese customers promptly about the H20 sales restrictions, which caused domestic firms to miss out on an opportunity to stock up before the new regulations took effect, the person said.”

“During the trip, Huang met with Chinese Vice Premier He Lifeng, the country’s top economic official, and pledged that Nvidia would continue prioritizing sales to China as long as the U.S. Commerce Department approved them, the person said. He also met with key Chinese customers and asked them for feedback on the designs of Nvidia’s future chips, The Information previously reported.”

“Chinese officials have acknowledged how important Nvidia’s chips remain for domestic AI development, as local alternatives like Huawei’s chips aren’t good enough, according to two senior executives within China’s tech sector who speak to Chinese officials.”

And there are signs of modest progress:

“There’s been at least one concrete sign that Huang’s efforts have had an effect. Last year, Chinese officials in closed-door meetings urged domestic technology firms to reduce their dependence on Nvidia. But this year, those officials have dropped the issue in their meetings with some local tech leaders, said the two senior executives.”

“China’s top priority industry is AI,” said Edison Lee, an analyst at Jefferies. “To ensure the continued advancement of AI in China, the government would allow tech companies to use Nvidia chips because local AI chip production is insufficient, at least in the near term.”

Wall Street analysts on the last earnings call are keenly focused of course on how and when Nvidia can expand its now curtailed sales profile in China. And the answers are likely being negotiated on both sides of the widening divide:

“What Huang is unlikely to ever get from the Trump administration is a full dismantling of America’s limits on chips. If that happened, China could too easily rush to say it wants “to build something twice as big as OpenAI’s Stargate,” said Gregory Allen, director of the Wadhwani AI Center at the Center for Strategic and International Studies. “That would be a horrific headline for this administration.”

:Yet Nvidia faces a tough reality: Further restrictions of any kind are increasingly problematic. Quite simply, the company is running out of ways to sell competitive chips in China.”

The company may be running out of needles to thread, and new chips to redesign, on this AI product front:

“After the sudden ban on China sales of the H20 last month, some teams at Nvidia held previously unreported emergency meetings to discuss how to redesign the product to minimize the loss in performance for Chinese customers, according to an Nvidia employee involved in chip design.”

“Nvidia has been clever about finding methods to tweak chips so they comply just enough with the law to keep their sales going in China.”

Previous clever engineering solutions may not work going forward due to far shorter design runways:

“For example, in 2023, when the U.S. issued rules placing new limits on the processing power for chips sold in China, Nvidia complied with a redesign. But its engineers also boosted the chip’s ability to shuttle data back and forth between its processor and computer memory, which made up for some of the loss in its performance.”

“When the U.S. initially announced the ban, Nvidia hoped it could just weaken the performance of its H20 chip, but engineers discovered the modified chip would have little appeal to Chinese customers, who could easily buy better chips from Chinese firms.”

“Now Nvidia is developing a new chip specifically for China, tentatively called the B30, according to four people with direct knowledge of the matter. It’s also developing a new computer system tailored for the B30 chips that allows Chinese customers to achieve high performance by linking the chips so they can work in unison.”

There may be hope for this option, if it gains interest on both sides of the technical and political divides. Of course to keep the sales going in China:

“The new offering has attracted interest from major Chinese customers such as ByteDance, Alibaba and Tencent that have previously worried about the declining performance of Nvidia’s chips in China, they said. The company told its customers it plans to produce more than 1 million B30s this year, they said. (Those customers didn’t reply to a request for comment.)”

“As a stopgap while the B30 is under development, Nvidia is speeding up the release of a different chip, tentatively named the B40 or 6000D, that it started to work on before the H20 restrictions happened, according to five people familiar with the new chips’ development. The B40 chip uses slower, more traditional memory chips instead of the faster, high-bandwidth memory commonly used in AI chips.”

“With few chips to sell to China at the moment, the company is focusing on promoting training sessions to keep Chinese researchers dependent on its software for training AI models, said two Nvidia sales employees. (The software, which helps developers write code that runs efficiently on Nvidia chips, is one of the key advantages giving the company an edge in the AI industry.)”

That of course is the company’s open source CUDA AI frameworks, which is part Nvidia’s software moat with developers the world over.

Going forward, expect Nvidia and Jensen to keep repeating the message globally:

“This month, Huang has taken his message on the road, repeating his views on export controls at various venues including an economic and policy forum in Los Angeles, the trade show in Taipei, a Swedish university where he received an honorary degree, and an interview he had on Wednesday with CNBC’s Jim Cramer after Nvidia released its earnings report.”

And of course a key focus on the audience of one in DC:

“Huang also name-checked Trump four times during his earnings call with analysts on Wednesday, praising the president’s policies. He didn’t miss an opportunity to take a swipe at Biden, either, reiterating the same point he has made quite frequently: that the Biden-era chip restrictions were based on assumptions about China that were “clearly wrong.”

All this is to emphasize that Jensen Huang has quite the task ahead of him. Keep the extraordinary technical execution of Nvidia’s roadmap on track, while managing geopolitical relationships in two key Capitals. Not to mention the powder keg issue of Taiwan, and TSMC (Taiwan Semiconductor) in the mix.

And that is the Bigger Picture we need to keep in mind going forward, in this AI Tech Wave. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)