AI: OpenAI's ongoing mega AI deals, now with Broadcom. RTZ #874

OpenAI is accelerating its multi-billion dollar, multi-year, multi-gigawatt powered AI data center Infrastructure Stargate ramp beyond the trillion dollars already inked to date. Today saw a mega-deal with alternative AI GPU provider Broadcom, worth tens of billions over the next few years. Of course, as OpenAI continues to ramp its AI business across a slate of AI applications and devices in this AI Tech Wave.

The latest deal follows closely on the heels of the unprecedented deals of late with Oracle, Nvidia, AMD, SK Hynix, Samsung, Figma and others. Each of those seemingly ‘circular/boomerang’ deals resulted in the public stocks of those investors rising a lot. Continuing to signal ongoing investor enthusiasm, both private and public. And flashing green lights for AI Infrastructure being ramped up to Scale AI by OpenAI and others.

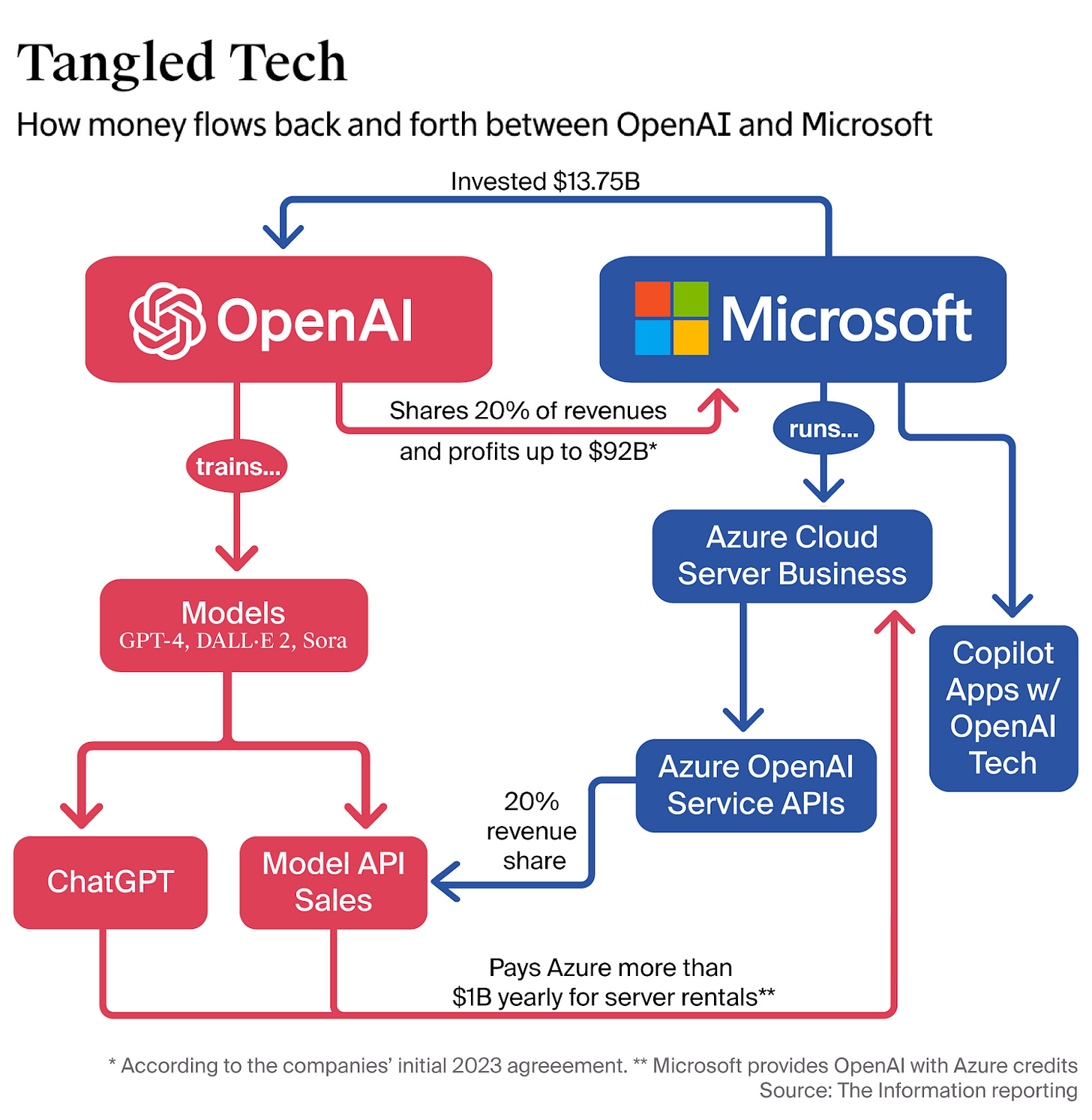

And accelerates OpenAI’s moves to be less dependent on its AI Infrastructure partner Microsoft and its Azure unit.

OpneAI Founder/CEO Sam Altman outlined how the company will end with over 2 Gigawatts of AI data centers this year, much of it via the Microsoft Azure partnership. And will likely get to 30 Gigawatts over the next three plus years with the deals announced with Oracle, Nvidia, AMD and now Broadcom to date within their Stargate AI Infrastructure initiative. It’s all focused on more AI Inference ‘intelligence tokens’ compute in particular,

That two gigawatts of AI datacenter compute contrasts with two megawatts when the company got going with ChatGPT on its earlier GPT LLMs over a thousand days ago.

The WSJ summarizes this latest deal in “OpenAI, Broadcom Forge Multibillion-Dollar Chip-Development Deal”:

“The companies plan to deploy 10 gigawatts of custom AI chips over the next four years”.

“OpenAI and Broadcom AVGO 10.46%increase; green up pointing triangle are working together to develop and deploy 10 gigawatts of custom AI chips and computing systems over the next four years, a high-profile partnership aimed at satisfying some of the startup’s immense computing needs.”

“OpenAI plans to design its own graphics processing units, or GPUs, which will allow it to integrate what it has learned from developing powerful artificial-intellligence models into the hardware that underpins future systems. As part of the agreement announced Monday, the chips will be co-developed by OpenAI and Broadcom and deployed by the chip company starting in the second half of next year.”

“The new agreement will be worth multiple billions of dollars, people familiar with the matter said. The companies didn’t disclose financial terms.”

“Broadcom shares rose nearly 10% in morning trading.”

So far, a now familiar OpenAI playbook, as far as these announcements go. The specifics here have to do with the ‘Frenemies’ trend I’ve discussed on companies like OpenAI and its ‘Mag 7’ peers second sourcing AI chips beyond Nvidia, the core supplier.

“Broadcom specializes in designing custom AI chips that are specifically tailored to certain artificial-intellligence applications. It began working with OpenAI on creating a custom chip 18 months ago, and the companies broadened their partnership to include work on related components, including server racks and networking equipment.”

“The new racks will rely on Ethernet technology and other connectivity from Broadcom, the two companies said. They will be deployed in data centers OpenAI owns as well as those operated by third parties, the people familiar with the matter said.”

The numbers are impressive, again using NYC as a benchmark.

“The massive deal brings the total scale of computing capacity OpenAI has agreed to buy from chip giants Broadcom, Nvidia NVDA and Advanced Micro Devices to 26 gigawatts, enough to meet the summer electricity needs of New York City more than two times over.”

Remember Meta using New York City as a physical benchmark for its upcoming ‘Hyperion’ multi-gigawatt (5+) AI data centers, also for relative scale purposes.

And also commitments of extraordinary sums of money eclipsing amounts the US spent to land men on the moon in 2025 dollars.

“The startup will have to spend hundreds of billions of dollars to pay for these deals. It expects to generate $13 billion in revenue this year, meaning that it will have to increase sales at an exponential rate to make good on its computing bills.”

“With a $500 billion valuation, OpenAI is the world’s most valuable startup and has launched some of the most popular AI tools, including ChatGPT and video-generating software Sora. It has more than 800 million weekly active users.”

“Broadcom has been bolstered by its work helping tech companies manufacture custom chips that speed up artificial-intelligence computations. Shares are up more than 80% in the past six months, and its market capitalization has increased to more than $1.5 trillion.”

Broadcom, along with Oracle and others is in the trillion dollar market cap club, along with the main ‘Mag 7s’.

OpenAI of course continues to cite the near infinitie near term demand for AI Compute:

“Open AI Chief Executive Sam Altman and Greg Brockman, its president and the executive responsible for building out infrastructure, have said they don’t have enough computing power at their disposal. Demand for AI products is rising at a rapid clip, and the two men have said they are hoping to build giant new data centers across the world to keep up.”

“OpenAI’s deals with chip and cloud companies in the past few months have helped fuel a global rally in tech stocks. Each agreement has raised the already high expectations set by Altman in describing the seemingly infinite amount of compute needed to bring forth the AI revolution. The deals have surprised some competitors who have far more modest projections of their computing costs.”

“Altman recently told employees that OpenAI wanted to build 250 gigawatts of new computing capacity by 2033, according to people familiar with the matter, a plan that would cost over $10 trillion by today’s standards. He has said that OpenAI would have to create new financing tools to help fund this massive build-out but hasn’t shared many details on what that would look like.”

“OpenAI’s partners are making a huge bet that Altman’s vision for a world remade by AI will pan out and that the startup will be the main winner of this technological shift. In September, consultants at Bain & Co. estimated the wave of AI infrastructure spending will require $2 trillion in annual AI revenue by 2030—more than the combined 2024 revenue of Amazon.com, Apple, Alphabet, Microsoft, Meta Platforms and Nvidia.”

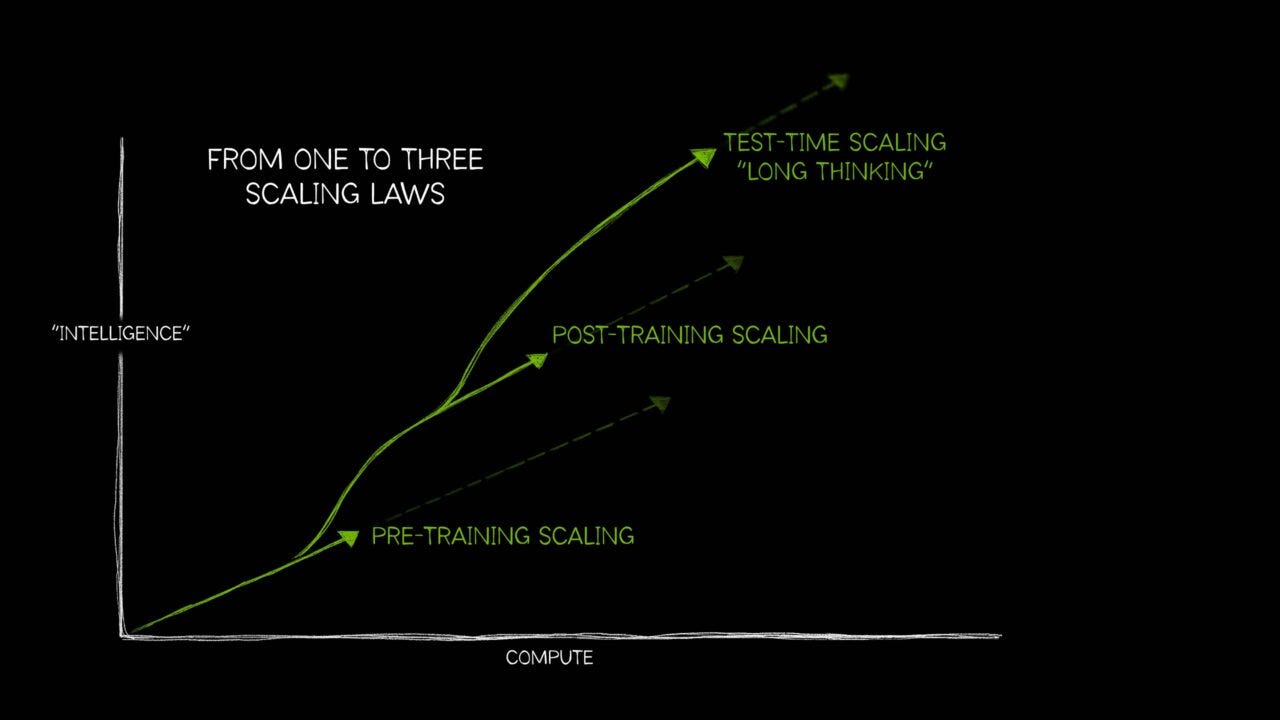

Recognizing that AI Scaling itself is scaling in various forms going forward.

So for now, expect this pace of AI deals to continue.

Not just OpenAI, but also its peers this AI Tech Wave.

It’s a trend that can last for a while, despite any short-term Black Swans on the financial market front. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)