AI: Questions arise around an 'AI Bubble'. RTZ #802

The Bigger Picture, Sunday, August 3, 2025

The question of the summer in this third year of the post-’OpenAI ChatGPT Moment’ in the still early days of this AI Tech Wave, is ‘are we in a Bubble yet’? The questions have been popping up with increasing frequency, amidst unprecedented AI Talent Wars, heretofore unseen AI capex investments in the hundreds of billions, and of course increasingly ebullient private and public markets for all things AI. And that is the the Bigger Picture we should tackle this Sunday.

And as someone who had the pole position, front-row seat at one of the last ‘big’ tech ‘bubbles’, the internet one at the dawn of this century, I can rely on deeper pattern recognition than most.

To get to the chase, my view is that there is a fast building market enthusiasm for AI by investors private, public and this time Sovereign, and the valuation benchmarks starting to stretch, we may not quite be there.

Yes, I did pen a ‘green lights are flashing faster’ post just yesterday after a generally positive response by public investors.

Applauding the Mag 7s saying they’ll be spending even more on AI Infrastructure and Talent, AHEAD of revenue and profit visibility at scale.

But it’s not say that the ‘AI Bubble’ questions are set to recede going into the second half.

Fortune takes first stab here with “Apollo’s chief economist warns the AI bubble is even worse than the 1999 dot-com bubble”:

“Torsten Slok, chief economist at Apollo Global Management, warns AI stocks are even more over-valued than dot-com stocks were in 1999. In an research note, he illustrated how shares of Nvidia, Microsoft and eight other companies are creating an even bigger bubble than we saw during the dot-com era. And that should cause serious market damage if and when it pops.”

Reuters had a similar headline a few days ago, “Is today’s AI boom bigger than the dotcom bubble?”:

“Wall Street’s concentration in the red-hot tech sector is, by some measures, greater than it has ever been, eclipsing levels hit during the 1990s dotcom bubble. But does this mean history is bound to repeat itself?”

Attention grabbing of course.

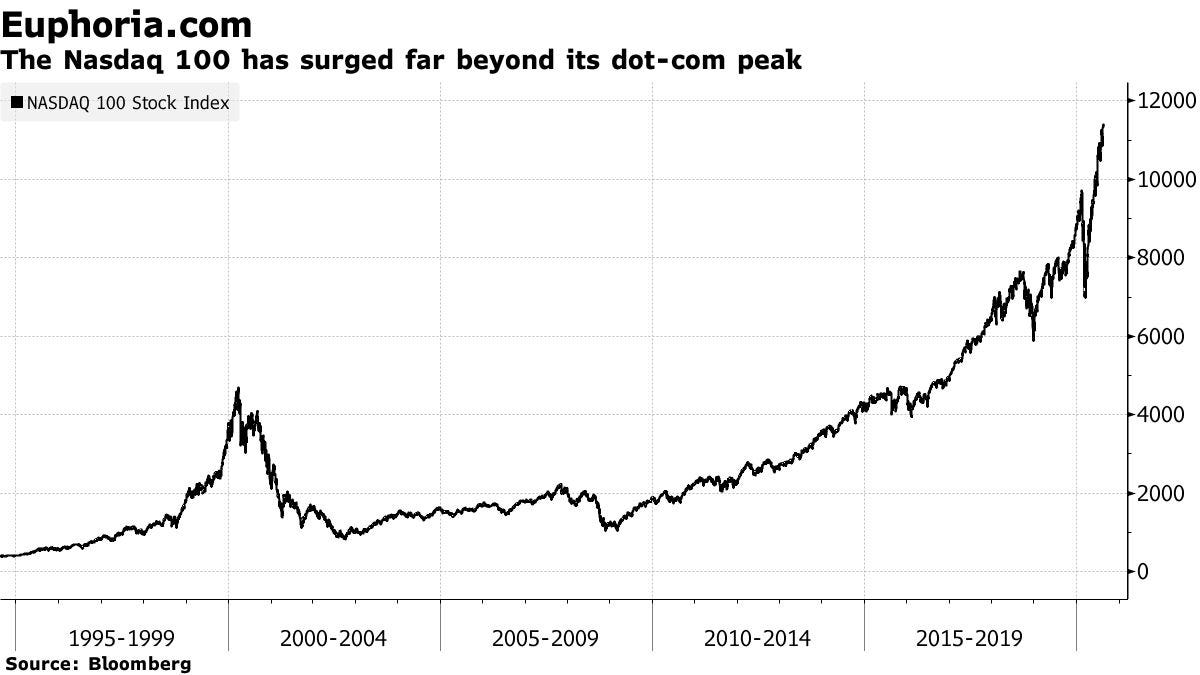

“The growing concentration in U.S. equities instantly brings to mind the internet and communications frenzy of the late 1990s. The tech-heavy Nasdaq peaked in March 2000 before cratering 65% over the following 12 months. And it didn’t revisit its previous high for 14 years.”

Good point. Everyone bring that up. But no on ever brings up the chart in the longer context of a decade or more later. Here’s a picture from over half a decade ago. Note the Nasdaq is at 20,650 today:

Yes, there was an ‘Internet Winter’ for almost a decade there in the mid-2000s. Reuters continues:

“It seems unlikely that we’ll see a repeat of this today, right? Maybe.”

“The market’s reaction function appears to be different from what it was during the dotcom boom and bust. Just look at the current rebound from its post-‘Liberation Day’ tariff slump in early April – one of the fastest on record – or its rally during the pandemic.”

The Tariff concerns are of course valid, especially since they’re back again with Administration actions just this week. They’re a key factor I’ve discussed at length earlier.

But geopolitics and tariffs aside, there is the question of market concentration in tech:

“But despite all of these differences, there are also some worrying parallels. Investors would do well to keep both in mind.”

“The most obvious similarity between these two periods is the concentration of tech and related industries in U.S. equity markets. The broad tech sector now accounts for 34% of the S&P 500’s market cap, according to some data, exceeding the previous record of 33% set in March 2000.”

“Of the top 10 companies by market capitalization today, eight are tech or communications behemoths. They include the so-called ‘Magnificent 7’“

The other question being raised is the amount of AI Capex this time vs the telecom infrastructure spend of a trillion dollars in the dotcom era. But this time the infrastructure spend is WITHIN the higher margin software companies, not something by a separate industry like Telecoms, in the Internet Wave.

That latter industry bore the brunt of the downturn when investor enthusiasm for all things Internet faded at the dawn of the new Century. And that ‘Internet WInter’ lasted almost a decade. It was even longer for the telecom industry underneath it.

This integration of infrastructure spend within software/media company models is a new thing in this AI Tech Wave.

As the WSJ notes in “Silicon Valley’s New Strategy: Move Slow and Build Things”, (a piece worth reading in full):

“Investor and tech pundit Paul Kedrosky says that, as a percentage of gross domestic product, spending on AI infrastructure has already exceeded spending on telecom and internet infrastructure from the dot-com boom—and it’s still growing. He also argues that one explanation for the U.S. economy’s ongoing strength, despite tariffs, is that spending on IT infrastructure is so big that it’s acting as a sort of private-sector stimulus program.”

And the numbers are showing up in broader GDP measures:

“Capex spending for AI contributed more to growth in the U.S. economy in the past two quarters than all of consumer spending, says Neil Dutta, head of economic research at Renaissance Macro Research, citing data from the Bureau of Economic Analysis.”

Another important point is that the Internet in 2001 was not quite spread globally, with the total audience of a few hundred million, vs over four billion today via smartphones around the world. And a geopolitical ‘AI Space Race’ with China thrown in for bad measure:

China was not a factor in the internet bubble, even though both Alibaba and Tencent, the current two of many tech giants in China, arose from the ashes of the dotcom bubble over two and a half decades ago.

“A global accounting of this infrastructure spending would be even bigger, as it would include capex from these companies’ most important partners.”

“By some measures, the current tech boom, driven in part by enthusiasm for artificial intelligence, is more extreme than the IT bubble of the late 1990s.”

And then of course the Apollo economist reference above:

“As Torsten Slok, chief economist at Apollo Global Management, points out, the 12-month forward earnings valuation of today’s top 10 stocks in the S&P 500 is higher than it was 25 years ago.”

A key difference of course is that an ‘AI Bubble’ today, does not have an IPO froth like the dotcom bubble of yesteryear. Yet. Despite Figma, Coreweave et al of late.

“However, it’s worth remembering that the dotcom bubble was characterized by a frenzy of public offerings and a raft of companies with shares valued at triple-digit multiples of future earnings. That’s not the case today.”

And the valuations are not quite at the outer stretches. Again, Yet:

“While the S&P tech sector is trading at 29.5 times forward earnings today, which is high by historical standards, this is nowhere near the peak of almost 50 times recorded in 2000. Similarly, the S&P 500 and Nasdaq are currently trading around 22 and 28.5 times forward earnings, compared with the dotcom peaks of 24.5 and over 70 times, respectively.”

Still, worries abound on the horizon:

“With all that being said, a meaningful, prolonged market correction cannot be ruled out, especially if AI-driven growth isn’t delivered as quickly as investors expect.”

“AI, the new driver of technological development, will require vast capital outlays, especially on data centers, which may mean that earnings and share price growth in tech could slow in the short run.”

“According to Morgan Stanley, the transformative potential of generative AI will require roughly $2.9 trillion of global data center spending through 2028, comprising $1.6 trillion on hardware like chips and servers and $1.3 trillion on infrastructure.”

“That means investment needs of over $900 billion in 2028, they reckon. For context, combined capital expenditure by all S&P 500 companies last year was around $950 billion.”

As I’ve noted frequently before, Wall Street is keeping close tabs on all this:

“Wall Street analysts are well aware of these figures, which suggests that at least some percentage of these huge sums should be factored into current share prices and expected earnings, but what if the benefits of AI take longer to deliver? Or what if an upstart (remember China’s DeepSeek) dramatically shifts growth expectations for a major component of the index, like $4-trillion chipmaker Nvidia?”

“Of course, technology is so fundamental to today’s society and economy that it’s difficult to imagine its market footprint shrinking too much, for too long, as this raises the inevitable question of where investor capital would go. It’s therefore reasonable to question whether a tech crash today would take well over a decade to recover from.”

“But, on the other hand, it’s that type of thinking that has gotten investors into trouble before.”

So the debate will continue, with no clear answers until something happens to sway the current sentiment from flashing green to yellow or even red. And that can happen anytime in periods of exponential, cambrian growth around tech waves.

With a repeat of my constant reminder that tech enthusiasm ALWAYS runs ahead of tech realities, regardless of the power of the underlying technologies. So we need to ‘Wait for it’. But that generally means higher ups and downs.

So this time the volatility is likely to be higher, and the timeframes far more concentrated, both up and down. And that for now is the Bigger Picture thus far in this AI Tech Wave.

But one thing is certain. There are a host of different patterns this time than in prior tech waves. Certainly around China driven geopolitical tensions impacting global supply chains, and the unprecedented political volatility around trade tariffs. And those are key keeping an eye on.

Despite my longer term enthusiasm over the multi-decade optimism on the net, gushing rewards from AI.

But as an analyst, one needs to keep an eye on both parts of the glass of water. And the rates of change thereof.

So despite my long-term AI enthusiasm, I may be penning a piece with ‘flashing yellow signs’ soon. Perhaps even red.

But still feel the grass is greener long-term. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)