AI: Trump memecoins kick off a crypto focused 2nd term. RTZ #607

The incoming administration and new members of Congress saw major support from Silicon Valley tech investors and founders this time around. Much of the enthusiasm centers around anticipation of a better regulatory environment for Tech, AI, and of course Crypto industries. And it’s expected to be an eventful few years, for this this AI Tech Wave ahead.

But the other signature focus for this support is of course around the Crypto industry, and there are high hopes for Bitcoin, Crypto and AI driven big and ‘little tech’ businesses going forward.

But this period is also likely to be a fairly transactional one, given the core instincts of the new President.

So it wasn’t that surprising when the inauguration of the 47th President today, was preceded by Crypto powered ‘Memecoin’ launches dubbed $TRUMP and $MELANIA, now valued notionally by enthusiastic markets in the billions. Only a few hours after launch, and a few hours before the inauguration.

Barron’s explained in “Trump, Melania Launch Meme Coins. How Many Billions They’re Worth as Cryptos Soar”:

“The returning president announced the arrival of his $TRUMP meme coin in posts on X and his own social-media platform Truth Social Friday night. The token was trading at $56.18 early Monday, according to CoinDesk, and soared after it was unveiled.”

“The coins sold for about $3 each before Trump publicly announced the digital token on Friday evening, according to CoinDesk data.”

“It soared to a high of $76.94 in the following hours, briefly hitting a market value of $15 billion—of which about $12 billion was held by three wallets linked to Trump.”

“That the majority of the coin is linked to the president-elect may spark fears of a so-called “Trump and dump,” but it’s important to recognize the broader significance of this moment, Henry Duckworth, CEO of AgriDex, a digital marketplace, noted.”

“About 80% of the coin’s supply is owned by an affiliate of the Trump Organization, Fight Fight Fight and CIC Digital, which has drawn criticism from within and outside the crypto industry, according to Wall Street Journal and Bloomberg reports.”

There are reports that other members of the Trump family, including his sons Donald Jr., Eric, and Barron Trump, amongst others may soon have their own memecoins in the market. The broader reactions have been both enthusiastic and muted:

As Politico notes in “‘Horrible look’: Crypto lobby reels from Trump’s ‘memecoin”:

“President-elect Donald Trump and his family are using the final days before he is sworn in as the 47th president to launch a new cryptocurrency product.”

“It isn’t welcome news to everyone in the crypto industry.”

“The digital assets business is poised to be a big winner in the second Trump administration, with Republicans vowing to advance policy changes that could boost the sector — and help it overcome longstanding concerns about its legitimacy. But Trump’s move on Friday to introduce a so-called memecoin — a crypto token with no real-world value that traders can invest in — has triggered alarm among investors and industry representatives in Washington that the new coin will provide ammunition to critics who accuse crypto of being rife with fraud and risk to consumers.”

“It’s absolutely preposterous that he would do this,” said Nic Carter, founding partner at the crypto investment firm Castle Island Ventures who describes himself as an “avowed and explicit” Trump supporter. “They’re plumbing new depths of idiocy with the memecoin launch.”

But this approach of mixing policy and personal interests is generally explained by his supporters as a ‘feature’, not a ‘bug’. Despite external naysayers, and historical norms.

“The concern illustrates the risk Trump is taking by launching a new crypto product just days before his inauguration. Memecoins — a class of crypto sometimes referred to as “shitcoins” that includes digital assets with names like Dogecoin and Fartcoin — are speculative assets that are highly volatile by nature. If investors lose money on the coin, it could become a liability for both Trump and the crypto sector.”

“The new product is also a clear signal that Trump and his family are willing to take on new business opportunities, even while he is in office, in an area that could directly benefit from friendly policies enacted by his own administration or a GOP-controlled Congress. Trump vowed ahead of his first term that there would be “no new deals” while he was in office. Now, his eldest sons — Donald Trump Jr. and Eric Trump — are starting their own crypto company, World Liberty Financial, which drew similar concerns from crypto advocates like Carter during the campaign.”

“A Trump-owned company owns 80 percent of the memecoin’s total supply, according to its website.”

And investors of course are focused on the ‘fear of missing out’ (FOMO) the rapid uptrends expected initially in these launches:

“Trump’s memecoin has taken off since debuting late Friday night. By 6:15 p.m. ET on Sunday, the token had risen to $44.95 — making it the 24th most valuable token in the world with a fully diluted value of more than $45 billion, according to CoinGecko, which tracks crypto data. And major crypto exchanges like Coinbase and Binance were moving to add it onto their platforms. Kraken, another major crypto trading venue, added the memecoin for trading Saturday afternoon.”

“The Trump push into memecoins accelerated Sunday when Melania Trump announced on social media her own, called MELANIA. Trump’s token fell in trading shortly thereafter.”

“Memecoins have long traded in crypto markets, with Dogecoin perhaps the best-known example. Launched as a joke, the crypto has exploded in popularity over the years, with its price often riding on the whims of its backers — the best known of which is Elon Musk.”

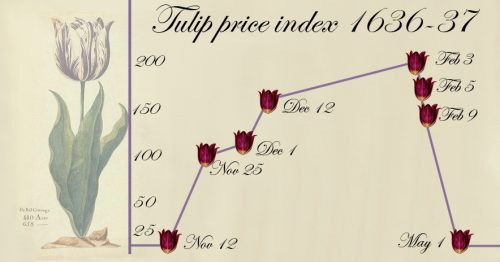

The motivations of investors in these memecoins of course vary across investors. Whether it’s memecoins, or other assets in markets across time and geographies, well popularized from 1636-7 episode around Tulips the Netherlands.

One possible set of reasons can be found in today’s markets can be seen in the current ‘casino’ environment in China, as the New York Times explores in “Why Chinese Are Rushing Into a ‘Casino’ Stock Market”, a piece worth reading in full:

“Steps to bolster the economy have set off a stock buying frenzy. Our columnist spoke to Chinese investors about why they are jumping in knowing the risks.”

”They call China’s stock market a “casino,” yet they are rushing in. They are betting money that the government really does want to finally crawl out of the hole it has dug. They are speculating, looking for short-term gains, with a great degree of uneasiness.”

“In recent interviews, investors said that doing something, even putting their savings into a market full of risks, gives them a sense of control when their country seems to be going astray. They worry that the government is doing more to prime the market than to help the economy, but for now they are clinging to a familiar, bubbly feeling in an era of deflation.”

“A flurry of policies by Beijing in recent weeks meant to stimulate the domestic economy has spurred China’s middle class to invest more in stocks, prompting the country’s biggest rally since 2008.”

The motivations are universal, and travel well across time, countries, and assets. Through ups and downs.

For now, these ‘animal spirits’ are driving some of our crypto and memecoin markets here, urged on from the very top. As AI tech potentially is used in these markets as well, the volatility will likely continue to be high in this AI Tech Wave as well. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)