AI: Update on AI driven cars in China vs the US. RTZ #901

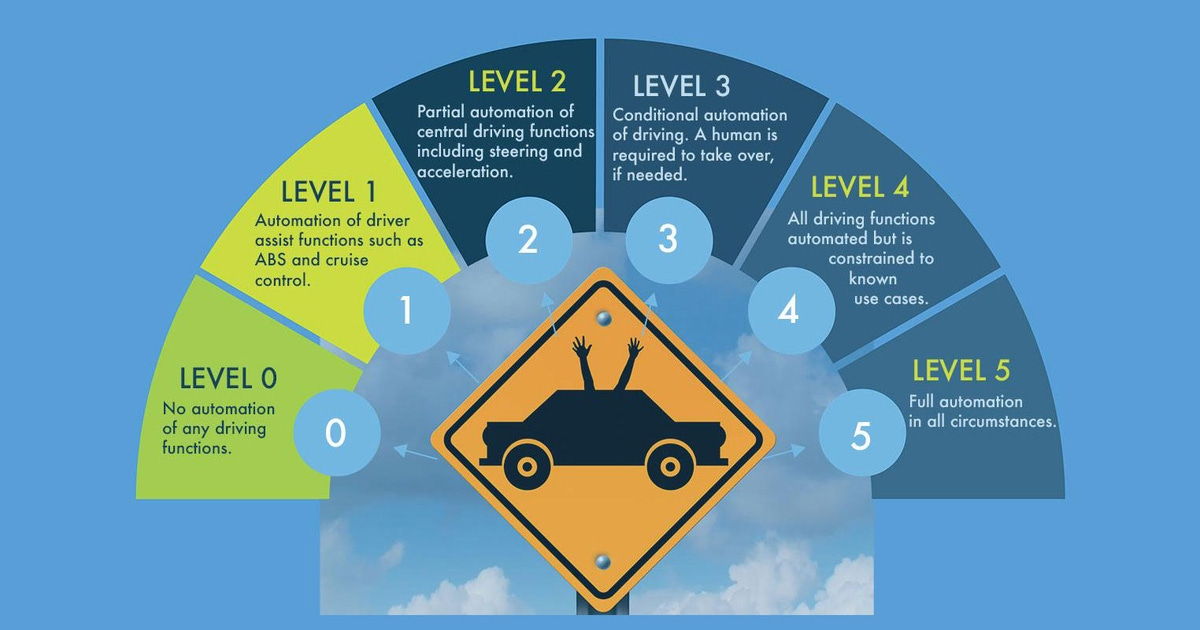

I’ve been on record in these pages that self driving cars becoming mainstream in this AI Tech Wave may take longer than expected. That ‘Physical AI’ driven successes in level 5 self driving cars from the current average of level 2, may take longer than currently imagined.

Likely years more than consensus. Despite all the best efforts in the US by Elon Musk’s Tesla/xAI Robotaxis, Google’s Waymo, and other efforts. I’ve also highlighted how China continues to work aggressively on the same goal, and has the manufacturing ecosystems to scale ahead of US companies for now.

New data is emerging on China’s continued efforts in self driving cars, and how it compares with efforts in the US. And they’re worth noting.

The WSJ outlines it in a detailed piece worth reading, titled “Riding in a Chinese Robotaxi Is Pretty Smooth—That’s a Problem for Waymo”:

“While U.S. companies dominate their home market, other countries look to China for driverless technology.”

“Chinese robotaxi companies like Baidu, Pony AI, and WeRide operate hundreds of driverless vehicles commercially.”

“Baidu has completed over 14 million rides as of August and is expanding into Europe, Asia, and the Middle East.”

“Despite rapid growth and global expansion, the robotaxi business model remains unproven, with companies still bleeding cash.”

“I got a glimpse of a technology that soon could be spreading around the world—if not the U.S.”

The creature comforts in the Chinese cars are notably different than the ones here thus far, including the WeRide vehicle below:

“It is a Chinese robotaxi. One of the two I tried featured executive-style chairs and ample luggage space where the front passenger would usually sit. With no human behind the wheel, it sailed smoothly through the streets of Beijing, dodging the occasional double parker or illegal turner. Soon, I almost forgot a computer program was doing the driving.”

But the ride quality is similar, even as Chinese companies are exporting their efforts beyond their borders:

“The technology and rider experience are generally similar to the U.S. driverless taxis operated by Waymo, a subsidiary of Google parent Alphabet. As Waymo and Elon Musk’s Tesla robotaxi dominate Americans’ attention, Chinese companies are building businesses in their home market while also putting stakes down in Europe, the Middle East and Southeast Asia.”

The long term aspirations though remain a keen focus on the big global prize:

“All those companies hope to dominate a global market that UBS analysts say could be worth hundreds of billions of dollars someday if self-driving tech keeps advancing.”

The main Chinese players are coming into focus as well:

“In China, three Nasdaq-listed Chinese companies—Baidu, Pony AI and WeRide—each have hundreds of robotaxis on the road operating commercial paid services without a human safety driver.”

A Baidu Apollo RT6 driverless taxi in Wuhan, China. Bloomberg News

“Our vehicle’s hardware cost is much, much lower than Waymo’s. That will be a very good advantage for these Chinese companies,” said Leo Wang, Pony AI’s chief financial officer.”

Note that the units in China are small just like here, with both place planning to scale to thousands and beyond.

“HSBC analysts project that China’s robotaxi fleet will grow to tens of thousands of vehicles by the end of next year. That is up from a few thousand today, with the three companies testing autonomous vehicles in around a half-dozen countries outside of China.”

“By contrast, Waymo is operating test vehicles in only one country outside the U.S.—Japan—with plans to launch in London. Tesla’s robotaxis operate in Austin, Texas, and still have human safety drivers.”

And each side of course believes their approach is leading the industry globally:

“A Waymo spokesman said the company is “the world leader in autonomous driving technology” and pointed to its extensive public disclosure about safety performance. The company is “continuously driving our costs down as we scale,” he said.”

Even the main player there is starting from a small base:

“The biggest of the Chinese operators is Baidu, a Chinese internet company known for its search engine. Baidu operates more than 1,000 driverless vehicles, mostly in China. It said it has completed more than 14 million rides as of August. Waymo said in May that its total surpassed 10 million, and it has said it is operating at least a quarter-million fully autonomous rides each week.”

And just like here, the companies there are partnering with global ride-sharing giants like Uber;

“In July, Baidu reached a deal with Uber Technologies to deploy thousands more vehicles in Asia and the Middle East that riders will access through their Uber app. The following month, Baidu agreed with Lyft to deploy thousands of vehicles in Europe, starting with Germany and the U.K. next year, and it is looking to expand into Southeast Asia in coming months.”

For now, the two worlds will remain separate:

“Americans aren’t likely to see any of the Chinese vehicles on their streets. The U.S. effectively blocks the import of Chinese electric vehicles through high tariffs, and both the Biden and Trump administrations have expressed concern about Chinese vehicles scooping up data about Americans’ whereabouts.”

“Industry executives say the global battle is still in its early stages, and the operations outside the U.S. and China are generally small tests. Waymo’s financial muscle and experience with a range of U.S. markets would give it an edge if it chooses to accelerate its global expansion, and the Chinese forays into Europe must contend with competition from Volkswagen.”

And China as mentioned before, can leverage their world leading manufacturing ecosystems:

“For their part, robotaxi operators in China can tap efficient local EV factories for lower-cost vehicles, giving them the leeway to build in luxury features such as a massage chair, as in the latest Apollo Go model, or the big seat with armrests that I enjoyed in the WeRide vehicle.”

Much also needs to be figured out in terms of the business models at scale for these efforts. As well as long-term safety at scale. There and here:

“The business model for robotaxis is still unproven, as GM demonstrated last December when it scrapped its Cruise robotaxi program after $10 billion in development costs.”

“For Pony AI and WeRide, revenue from robotaxis, while growing, is still in the single-digit millions of dollars per quarter, and they are bleeding cash. Both companies listed their shares in Hong Kong on Thursday, adding to existing Nasdaq listings, and the shares skidded in their Hong Kong debut in a reflection of investor doubts about profitability.”

“Safety remains a concern. The Chinese robotaxi companies have generally avoided injury-causing accidents but have had other incidents, including a Pony AI car catching fire in May. No one was hurt.”

The whole piece is worth reading for more details on the ground in China with self driving cars. But a key point to keep in mind in this part of the AI Tech Wave race is that we’re still at self driving cars being experimented with in the thousands. Both in China and here. In a global vehicle market measured in the hundreds of millions.

So there is a long road ahead still for AI driven ‘robot’ taxis to get to mainstream scale. But the experiences wherever available, are still worth it, and are memorable rides. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)