AI: US AI/Tech still threatened by global tariffs (part 3). RTZ #685

The media of course is lapping up the ‘drama’ of it all. How the markets rebounded in minutes, with the kind of rallies not seen ‘since 2001’. After the President blinked and chose to theatrically ‘pause’ his ill-considered reciprocal tariffs on most countries for 90 days. Whew! already.

But not until him getting in yet another spiteful swipe by upping the tariff against China to over 125%. And gloating about how other countries all came to him to ‘kiss my ass’.

The markets were of course glad of the respite, however brief, from these self-inflicted wounds. Sycophantic supporters even cheered the President’s ‘Art of the Deal’ ghost-written book. They weren’t shy to ‘kiss his ass’ for real.

The President says he decided on the 90-day pause because “people were ‘yippy’ and ‘afraid’. And that “he might consider exempting some US companies from the tariffs, saying those decisions would be made “instinctively.”“

But it was the Bond market, not the Stock market was the real catalyst for the change. Ultimately made the difference.

As the Washington Post puts it, “Trump caved on tariffs. It took a scary bond market freakout”:

“Investors started dumping U.S. government bonds. They sold and sold and sold. This is not normal. Typically, U.S. government bonds are a safe haven. Whenever stocks tank or there’s turmoil around the world, investors rush to buy plain vanilla bonds from the U.S. Treasury. It’s the equivalent of chicken soup for unhealthy markets. But suddenly, those bonds turned bitter.”

Market sources indicate that it wasn’t China that was the key seller of US Treasuries in the billions and trillions, but potentially Japan. Which was in the midst of its own ‘bespoke’ tariff negotiation with Treasury Secretary Bessent and others,

“Ultimately, Trump caved to the bond markets. He admitted to reporters that “people were getting a little queasy” in the bond market. He didn’t want to follow the fate of British Prime Minister Liz Truss, who resigned in humiliation in 2022 after a similar bond market fiasco in reaction to her policies.”

“For the United States, the repercussions of all of this could have been substantial — and almost all negative. As investors sold bonds, the yield (the interest rate) soared. The 10-year Treasury yield hit 4.51 percent, up from 3.9 percent earlier in the week, and the 30-year Treasury yield briefly topped 5 percent. This couldn’t be worse for Main Street. It means mortgage rates may top 7 percent again, and borrowing costs for cars, businesses, etc., will surge. It also means the United States government will have to pay even higher interest costs.”

So it was the ‘yippy’ Bond market that likely was the trigger to this ‘Pause’. For now.

All of this drama aside, it’s important to note the true implications for the US Tech/AI leadership around the world.

That under the surface, the self inflicted damage to the US’s pre-eminent position in the global economy, and its Tech and AI leadership is still meaningfully threatened. Especially in these early days of the AI Tech Wave.

The work that the US’s top tech companies had to do, to tactically and strategically prepared for these business crushing moves was indeed heroic.

From Nvidia, to Apple to Microsoft to Dell to Amazon and many others. Their CEOs and people moved mountains to try and alleviate as many of the negative impact of these recent actions as possible.

It shouldn’t have been necessary in the first place. These were all catalyzed by political whim, with rationales gussied up by so-called ‘experts’ with made-up experts like ‘Ron Varro’ (aka Peter Navarro, the President’s top trade advisor, and tariff cheerleader). Even Elon Musk, to his credit in this one case, called him out here.

The above links are all worth reading to get a scope of the theater of it all.

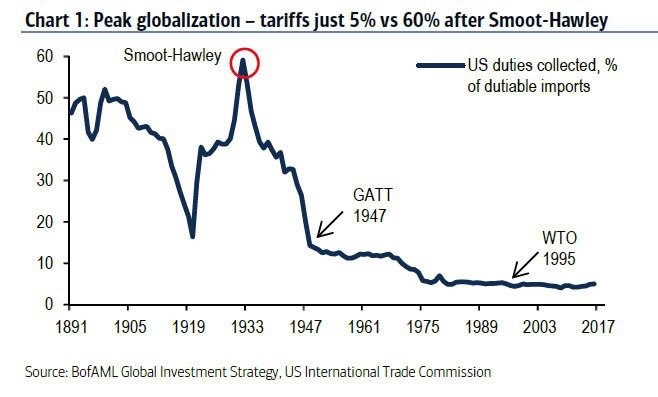

And the hard work that companies large and small, have had to do to deal with this pressing of the economic nuclear button activating Global Tariffs bigger than the Smoot Hawley tariffs of 1930. You know, the ones that led to accelerating the Great Depression.

We are nowhere out of the woods here.

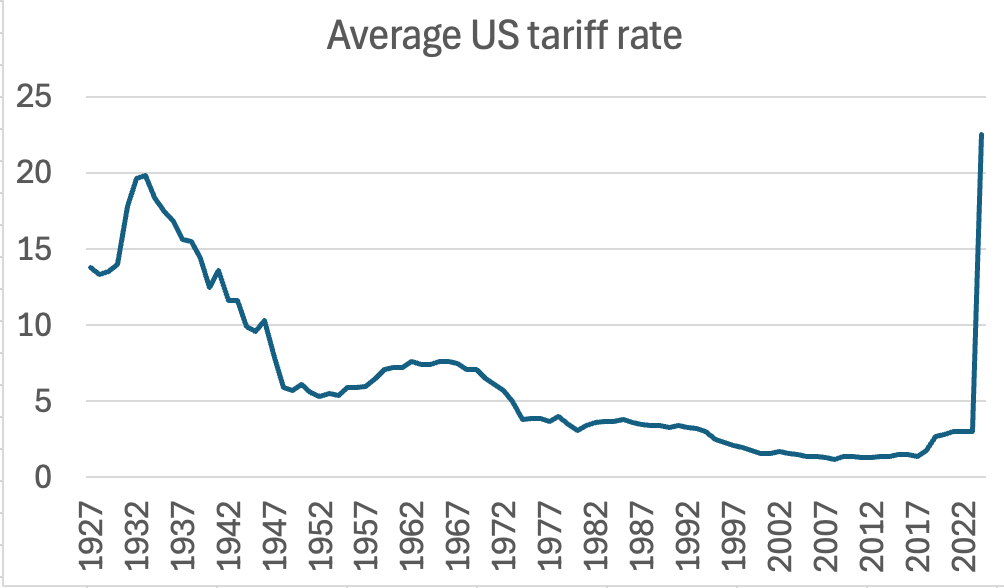

Even the 10% global tariffs that remain and the 125%+ tariffs still on China mean trade-weighted average tariffs of over 25%. Still daunting in the chart above, when our global trade is three times larger than 1930. In a tech driven, globalized economy worth over $110 trillion plus, led by the US. With AI promise to boot.

As the geopolitical strategist Ian Bremmer explains in “America just entered its post-globalization era”:

“Globalization helped make the United States the most prosperous nation in history. But many Americans feel they haven’t benefited from free trade and voted for Donald Trump to “liberate” them from the system the United States built over the past 80 years. He is delivering.”

“Now it is our turn to prosper,” President Trump proclaimed on April 2 as he announced sweeping tariffs on almost every US trading partner (plus a few uninhabited territories), ranging from 10% to 50%, that came into full force earlier today. Overnight, the US average effective tariff rate shot up to over 22% (from one of the world’s lowest at the beginning of the year), the highest since the turn of the previous century – higher even than the infamous 1930 Smoot-Hawley tariffs, which are widely blamed for starting a global trade war and deepening the Great Depression.”

Countries worldwide sucked up their pride, held back their instinctive need for Respect, and dealt with this administration as best they could. They chose rationality over emotions. For now.

“Facing a hit to their economies, many of America’s trade partners have been tempted to respond in kind. Most also recognize that trade wars are a losing game, adding the risk of an escalatory spiral to the economic self-harm of tariffs. They have accordingly been playing defense and trying to offer Trump deals in the hopes of securing concessions. The notable exception was China, the one country with the leverage to hit back, which responded with tit-for-tat tariffs on US imports.”

And then, Trump blinked. Emotionally of course.

“Then, in a sudden shift just a few hours ago under massive financial pressure, Trump announced he would immediately bring down tariffs on most countries to a universal 10% for the next 90 days, ostensibly as a reward for not retaliating – but really to stop markets from spiraling out of control. At the same time, he raised tariffs on Chinese exports to 125% after Beijing retaliated twice with duties on US goods totaling 84%. This effectively severs much of the remaining trade between the world’s two largest economies, accelerating the decoupling process and forcing global supply chains to reorganize even faster than anticipated.”

Here is the key point that needs underlining:

“Crucially, a 10% across-the-board rate and 125% rate on China is roughly equal in average applied rate to the policy as of this morning – a 25 percentage point increase overall – with a larger portion of that overall rate made up by Chinese imports.”

The whole thing was of course built on the flimsiest of foundations:

“Faulty math, faulty logic”

“Trump had described the “liberation day” tariffs as “reciprocal,” saying that the United States is only doing onto other countries as they do to the US. But the formula the administration ended up using doesn’t consider the tariff rates and nontrade barriers other countries impose on US exports at all. Instead, the calculation assumes that bilateral goods trade deficits are necessarily and entirely “unfair,” representing “the sum of all cheating.”

And of course this is a framing that is not familiar to most mainstream audiences. And is very easily manipulated with a false, emotional argument of seeming unfairness. ‘Tit for Tat’, even while they all enjoy their low cost purchases of t-shirts, hats, jeans and everything else at Walmart, Costco, and recently on Temu and Shein. Also from China of course.

“This is a gross misunderstanding of how trade works. There’s no linear correlation between a country’s protectionism and its bilateral trade balances. Bilateral surpluses and deficits reflect all sorts of factors unrelated to trade policy – from population size and wealth to differences in resource endowments and comparative advantages, all the way to idiosyncratic preferences for certain products over others. That’s why there’s nothing inherently bad or unsustainable about bilateral deficits.”

The problem is that the 47th President has held these false views deeply held for decades, as explained by his former chief economic advisor Gary Cohn in Trump’s first term.

Ian Bremmer continues:

“But Trump has believed otherwise for as long as he’s been a public person. In his view, if a country spends less on goods from America than Americans spend on its goods, the US is necessarily getting “ripped off.” The problem is that by targeting all bilateral trade deficits, his new tariffs punish the world’s smallest, poorest nations like Lesotho and Madagascar with crippling duties for being unable to spend as much on Tesla Cybertrucks and Boeing jets as 340 million fantastically wealthier Americans spend on their diamonds and vanilla. Yet the core reason these countries have trade deficits with America is not because they protect or discriminate against US exports but because they’re poor – something Trump’s punitive tariffs will make worse.”

The core logic has been faulty for decades, especially as the country shifted from low margin manufacturing to high marging services, which drive over 70% of the US’s world leading $29+ trillion annual GDP:

“Trump’s tariffs were never about reciprocity or unfair trade practices. Nor are they intended to force other countries to lower their trade barriers and ultimately lead to freer trade, as some Trump allies insist. Otherwise, Trump wouldn’t have levied a 10% duty on countries with which the US has balanced trade and even bilateral surpluses. Trump’s tariffs also entirely ignore the growing trade in services, where the United States is the world’s export powerhouse to the tune of over $1 trillion a year and runs persistent surpluses with much of the world – $295 billion in 2024. If other countries applied Trump’s same “fairness” standard to the US services trade surplus, the “reciprocal” tariffs levied on American services would average 13%.”

Thus, even after the 90 day ‘pause’ above, the underlying forces driving the administration have not changed:

“The conclusion is inescapable: The president is committed to walling America off from the world in order to reduce bilateral trade deficits dramatically while using tariff revenue to fund his tax cuts and spending plans. As Vice President JD Vance explained, Trump “believes in economic self-sufficiency.”

And the implications going forward for the US, and especially US leadership in Tech and AI are daunting:

“The cost of ‘America alone’

“There’s no sugarcoating it: Even if he has rolled it back partially, Trump’s pursuit of autarky (aka economic self-sufficiency) is the most destructive economic own goal in recent history, akin to what the British did with Brexit but on a global scale. My friend Larry Summers told me on GZERO World that it’s the “worst, most consequential self-inflicted wound in US economic policy” since World War II.”

“Global supply chains will be disrupted. Americans will be forced to pay more for their goods, eroding their purchasing power. Businesses’ costs will increase, too, reducing their productivity and driving up prices further. As sticker shock depresses consumer spending, business activity, and exports, unemployment and bankruptcies will rise, and the US may tip into recession – especially if other countries retaliate with tariffs of their own. And that’s before you get to the high, persistent uncertainty about both the path and the end-state of policy inherent to the Trump administration, which will weigh on long-term investment and growth whether or not the 90-day tariff pause is extended.”

The President is ‘Dug in’ for the long haul with a broader and deeper cadre of internal and external enablers than ever before:

“Trump also faces far fewer constraints than during his first term. Not only has the president consolidated full control over the Republican Party, but he has surrounded himself with people whose main qualification is unconditional loyalty. The Signalgate scandal confirmed that Trump’s cabinet members and senior staffers are unprepared to give him their honest advice or check his most disruptive impulses. With policymaking feedback loops broken and long-standing checks and guardrails on executive power being eroded, he may well double down on his failed policies rather than pivot.”

The irony is that this will all accelerate the rest of the world to create their own globalization networks, most with China, than ever before. As the NY Times notes in “In a Storm of Tariffs, Many Companies See China as the Safest Harbor”:

“The heavy U.S. tariffs on other Asian countries have made China a more appealing option for companies scared to make a hasty decision amid upheaval in global trade.”

As Ian Bremmer completes his argument:

“Faced with the prospect of sustained American protectionism, most countries will intensify their efforts to “de-risk” from the United States (though it will be as hard as it sounds) and diversify their economic ties with the rest of the world. While in the near term many will put up protectionist measures against Chinese goods escaping US tariffs and flooding their markets, even strategic US allies in Europe and Asia will be pushed to start reluctantly hedging toward Beijing in the medium to long term. American interests and global influence will be damaged accordingly.”

In this professional analyst’s view, the US in the past few days has all but ceded advantages in Tech and AI to China on a silver platter.

As the NYTimes’ Tom Friedman puts it pithily in his latest take on the tariffs, “What Trump Just Cost America”:

“Message to the world — and to the Chinese: “I couldn’t take the heat.” If it were a book it would be called “The Art of the Squeal.”

“But don’t think for a second that all that’s been lost is money. A whole pile of invaluable trust just went up in smoke as well. In the last few weeks, we have told our closest friends in the world — countries that stood shoulder to shoulder with us after Sept. 11, in Iraq and in Afghanistan — that none of them were any different from China or Russia. They were all going to get tariffed under the same formula — no friends-and-family discounts allowed.”

‘But instead of making it the whole industrial world against China, Trump made it America against the whole industrial world and China.”

In particular, we’ve meaningfully dented our credibility and alliances with global partners in the tech supply chain and ecosystem. There was a reason that the US ‘Mag 7’ driven tech industry led US stock market performance for years, especially in this AI Tech Wave.

That will take years to fix and rebuild.

And as I’ve explained in earlier pieces (parts One and Two), we’ve likely shrunk the benefits of the rapid AI innovations underway, by meaningful amounts, due to higher cost inputs into the AI flywheels. While postponing the AI benefits to mainstream users and the economy at large potentially by years.

There of course are ways these probabilities can be fixed for the better.

But it’s going to take a lot more political will from the country at large, And mainstream ATTENTION.

Especially to move Congress to take back their rightful Constitutional control of the tariff steering wheel.

And of course for the third judiciary branch to do their part as needed.

Until then, this AI Tech Wave will have to slow down and carefully go through the big and small bumps ahead. In a dense fog stretching for miles ahead. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)