AI: US the Global Magnet for AI Capital. RTZ #796

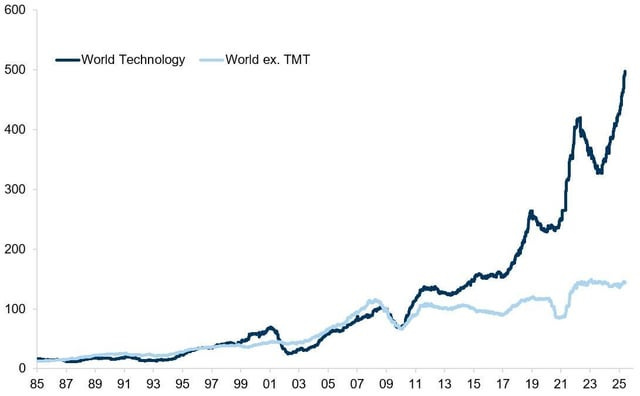

As we look at the mid-year landscape for the AI Tech Wave (see chart below), with its booming lean-forward investments in AI Data Center Infrastructure and AI Talent, it’s also clear that the US is the key magnet for global investors. Especially to deploy large amounts of capital in so many types of buckets.

Whether it’s private or public, small cap or large cap (Mag 7), debt or equity, VC or private equity (PE), retail or institutional (& Sovereign), it’s all drawn by the US market for tech and AI. So it’s useful taking a step back for the fuller picture.

Axios lays it out well in “Global investors can’t quit American AI”:

“Investors are flocking to Europe, not for vacation, but for returns.”

“But without the market power of artificial intelligence companies, they may have to quickly come back to America.”

“Why it matters: Much of Europe’s outperformance this year stems from a weakening dollar, not stronger fundamentals. Without the AI boom that is fueling the resurgence in U.S. stocks, the old world may struggle to keep up.”

“What they’re saying: “People want to be in the U.S. markets in the AI trade,” Stuart Kaiser, head of U.S. equity strategy at Citi, told Axios.”

“It’s a market you have to be involved in.”

Part of is the relative performance comparison of markets adjusted for currency valuations. Especially when one considers that the global stock market has just been trading sidways for years, if one nets out tech (Goldman Sachs):

“Zoom out: The American stock market has outpaced gains in global equities for the last 15-plus years.”

“Europe saw a 17.9% total return in U.S. dollar terms in the first half of 2025, but just 8.8% in local currencies, according to Vanguard.”

“That gap signals the rally was largely driven by currencies and requires a catch-up on fundamentals to continue driving its growth.”

And then it’s just the Tech ‘Density’ of US ‘AI Companies’:

“By the numbers: Nvidia alone is worth an amount equal to 14% of the total U.S. GDP, according to Robert Ruggirello, chief investment officer of Brave Eagle Wealth Management.”

“Not owning it is…painful,” he wrote in a note.”

“Of note: The European index was outperforming the S&P 500 for most of 2025 until recently.”

“S&P 500 tech stocks are now outperforming both the broader U.S. and European markets.”

The other key difference is the US ‘Lean-in’ to AI vs most global markets. China is the key exception as I’ve noted separately. Driven especially by the perceived US/China ‘AI Space Race’.

“Zoom in: U.S. firms are embracing AI at scale. Europe is behind.”

“European firms lag U.S. peers by 45% to 75% on AI adoption, according to McKinsey research last fall.”

“Over the past 50 years, the U.S. has created 241 companies worth over $10 billion from scratch, while Europe has created just 14, Andrew McAfee of MIT told the Wall Street Journal.”

“Between the lines: The slower AI momentum in Europe reflects regulatory pressure, higher corporate taxes, and fragmented markets, barriers the U.S. lacks.”

“Even European AI successes often funnel into U.S. markets: DeepMind, the British AI firm behind Gemini, sold to Alphabet in 2014.”

“The bottom line: AI is powering the American stock market. If you’re seeking diversification, that may be hard to find in the U.S. indices.”

“But if you’re chasing long-term outperformance, the AI trade may still start — and end — with America.”

As I mentioned above, the exception is China given that it’s half the world’s AI market today and tis talent. But for the most part these days due to US/China geopolitical tensions, foreign capital both private and public has been leaving China of late. And at Scale.

So in a rest of a ‘rest of the world’ perspective, the US is the relative major AI game in town at this stage of the AI Tech Wave. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)