AI: Weekly Summary. RTZ #381

-

Much AI Ado about Apple: After weeks of reporting, anticipation and new features speculation (latest from Bloomberg here), Apple will unveil its AI strategies Monday as it kicks off its iconic WWDC 2024 developer conference. Much of the discussion of course has been around the widely leaked OpenAI/Apple deal around Siri, and what AI crumbs, if any might be left for Apple’s long-time Search partner Google, with its Gemini Ai. Current revelations indicate short, ‘opt-in’ deals where all parties, especially Apple, maintain flexibility to field their own LLM AIs in the cloud and on devices shortly. More deep dives here and here on the Apple advantages on AI ‘Trust and Privacy’.

-

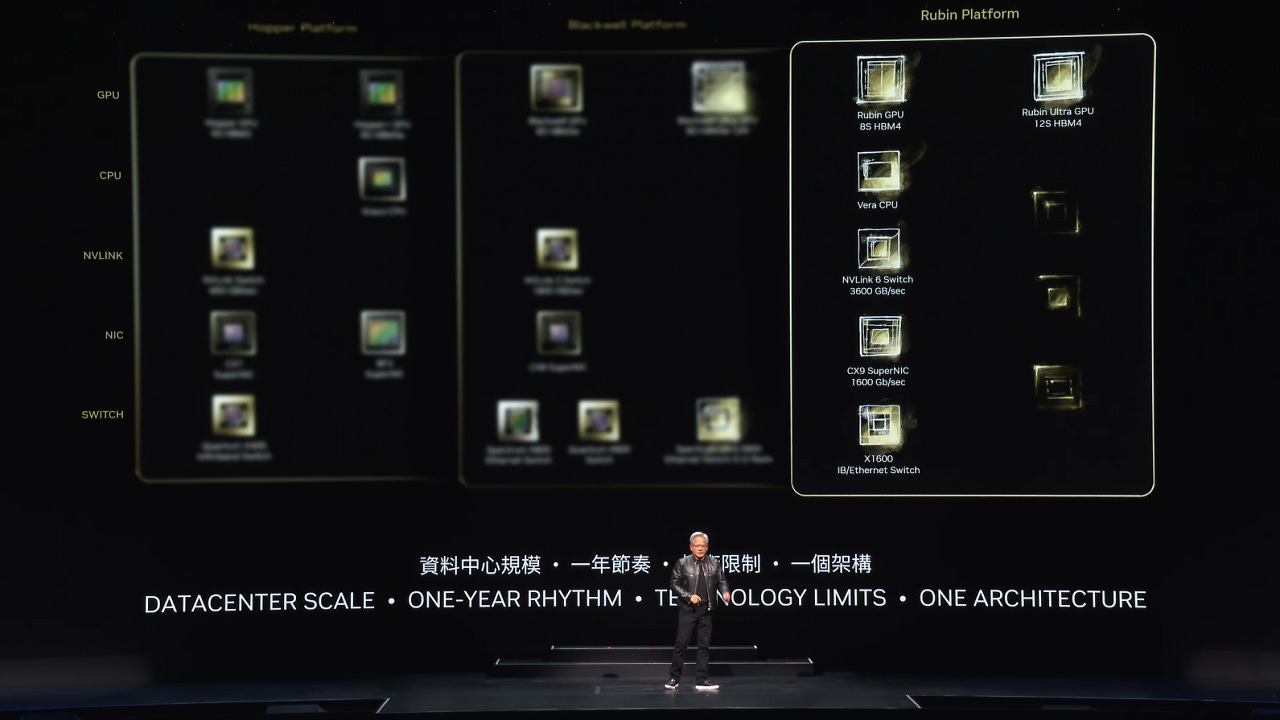

Nvidia commits to multi-year AI GPU roadmap: Nvidia founder/CEO Jensen Huang executed another bravura keynote at the Computext PC show in Taiwan, only three months after its own GTC show stateside. Lots of details on its AI ‘Accelerated Computing’ GPU, data center and AI infrastructure roadmap. Most notable was the company setting a multi-year product cadence with annual upgrades for its Hopper, Blackwell, and now ‘Rubin’ family of AI GPU chips. All of this of course helped drive investor comfort and enthusiasm to take Nvidia past Apple’s $3 trillion market cap, a tad below tech leader Microsoft for now. More here.

-

OpenAI & Nvidia still AI pace setters: With Nvidia announcements this week, and OpenAI’s ongoing LLM AI and product roadmap, it’s clear both companies are the pace setters in AI innovation midpoint in 2024. OpenAI’s GPT-4 Omni with multimodal voice capabilities, and its anticipated GPT-5 rollout later this year, along with an AI for Search product, text to video LLM AI Sora, AI Voice products and others, show that OpenAI remains on an aggressive product rollout strategy well into next 2-3 years. A roadmap not dissimilar in ambition from Nvidia, who also seems to be on a well architected product and services roadmap. All important to note as competitors are not slowing down their own pace any going into the second half of 2024. More here.

-

Media echoes Market AI doubts: The WSJ had a timely piece titled “The AI Revolution is already losing steam’, taking a cue from the enterprise cloud market downturns last week. This despite the ongoing, almost weekly momentum in AI investments and product innovation. The questions are all logical, and the piece is worth a read. I take a stab at answering some of the core questions here. But the big takeaway is that these are the right questions, perhaps early by a year or two. AI is far from market saturation, and is not at all slowing down in innovation. If anything, the innovation is accelerating exponentially at scale. And customers both business and consumers, have barely figured out what to do with these technologies, much less adopted them at mainstream scale. More on that here.

-

Government Actions against Nvidia, Microsoft/Inflection & OpenAI: All three US tech companies saw new antitrust probes via various US agencies. The Microsoft inquiry by the FTC looks into the multi-billion Inflection ‘Acquihire’ deal. As the NYTimes outlines it, the Justice Department takes the lead in investigating if Nvidia violates antitrust laws. Finally, the FTC is leading an examination on OpenAI/Microsoft deals with other AI companies. These investigations are on top of ongoing government actions against Google, Apple, Amazon and Meta on a variety of antitrust and anti monopoly concerns. All at a time when these companies are driving AI investments in the hundreds of billions of dollars to explore the next layers of mainstream possibilities with AI products and services at scale.

Other AI Readings for weekend:

-

Economists worry about AI in economic downturns, both at the IMF and US Treasury. More here.

-

New plagiarism issues in AI Research, impacting open and proprietary LLM AI development both in the US and China.

Thanks for joining this Saturday with your beverage of choice.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)