AI: Weekly Summary. RTZ #444

-

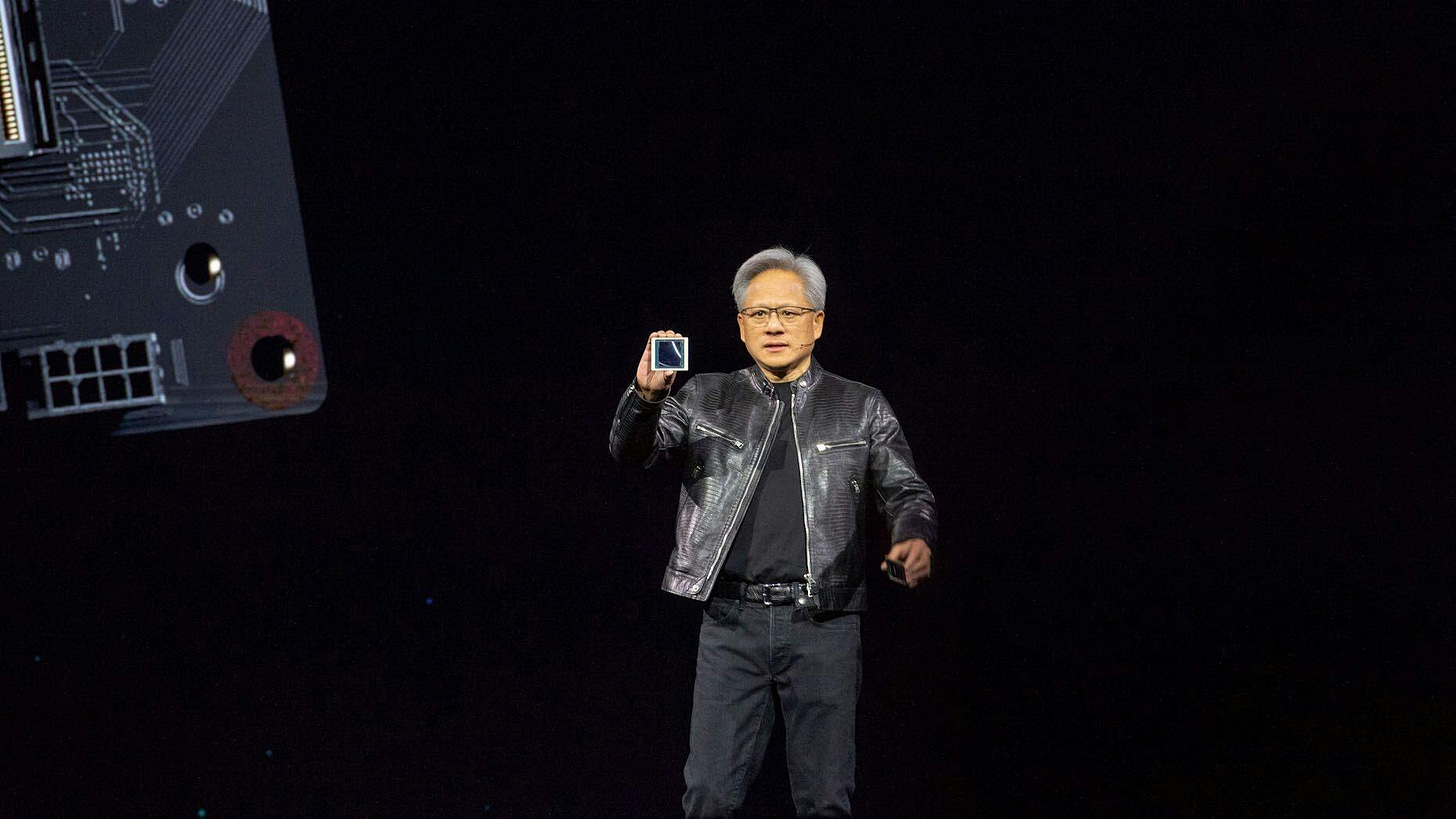

Nvidia Blackwell chip delay: Nvidia’s next gen Blackwell AI GPU chips are delayed, likely for a quarter or two. The event will have ripple effects up and down the AI Tech Stack, with AI data services and product rollouts by OpenAI, Microsoft, Google, Meta and others. The technical details of the delays and their impact on AI infrastructure providers is also notable in the breadth and depth of the industry. Also impacted of course are downstream partners like TSMC of Taiwan, who will have to await fixes of the design issues, just as they were ramping up production lines on the Blackwell line. More details on the context of the event here.

-

Google Antitrust loss: Google took a hit on the regulatory front, with a judge ruling that the company illegally monopolized the search market in its exclusive $20 billion plus Search distribution deals with Apple and other smartphone companies. The rulings were in the context of the Sherman Antitrust Act of 1890, and builds new precedents that will likely be relevant to other antitrust big tech cases concurrently underway. The decision is likely to be appealed, and will likely take years to sort out, but this does have implications of AI products and services being rolled out with ‘default’ distribution deals. More here.

-

OpenAI Turnovers and ‘Strawberry’ AI Reasoning hints: OpenAI had some senior level departures, with co-founder and President Greg Brockman taking a sabbatical until the new year. Another cofounder John Schulman departed to Anthropic, and a product head Peter Deng, who joined last year from Meta and other companies, also left. These internal changes are concurrent with the company’s strong product pipeline, which includes project Strawberry, which is OpenAI’s implementation of AI Reasoning. It’s part of the company’s roadmap to AGI, which now includes several Levels, from 1 to 5. More here on the latest Strawberry developments.

-

AI Capex Debate continues: The debate on the Big Tech AI investment wave gets more tail winds in this ongoing earnings season. As noted last week, Big Tech companies like Google, Microsoft, Meta, Amazon, Apple and others reported generally good results in another earnings season, while reiterating their ongoing commitments to record AI investments. All eyes will be on Nvidia’s quarterly results August 28th, since their ‘Revenues are everyone else’s Expense’. The broader backdrop of course is the increasing focus on AI Scaling capex vs timing of AI revenues. More here.

-

Rising concerns over Software growth as AI ramps: Along with the above concerns over rising AI capex vs eventual products and revenues, is rising concern that otherwise high-growth software firms are confronting sluggish growth in the Enterprise market large and small. There’s a growing debate on the increasing number of companies competing for a ‘shrinking pie’. The concern is across software verticals, and across the $250 billion SaaS Market in general. More context here.

Other AI Readings for weekend:

-

LLM AI innovation across models continues to drive lower prices, with Google and OpenAI being latest examples

-

Mistral rolls out AI Agents, following OpenAI’s Custom GPTs and Anthropic’s Claude Projects.

Thanks for joining this Saturday with your beverage of choice.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)