AI: Weekly Summary. RTZ #597

-

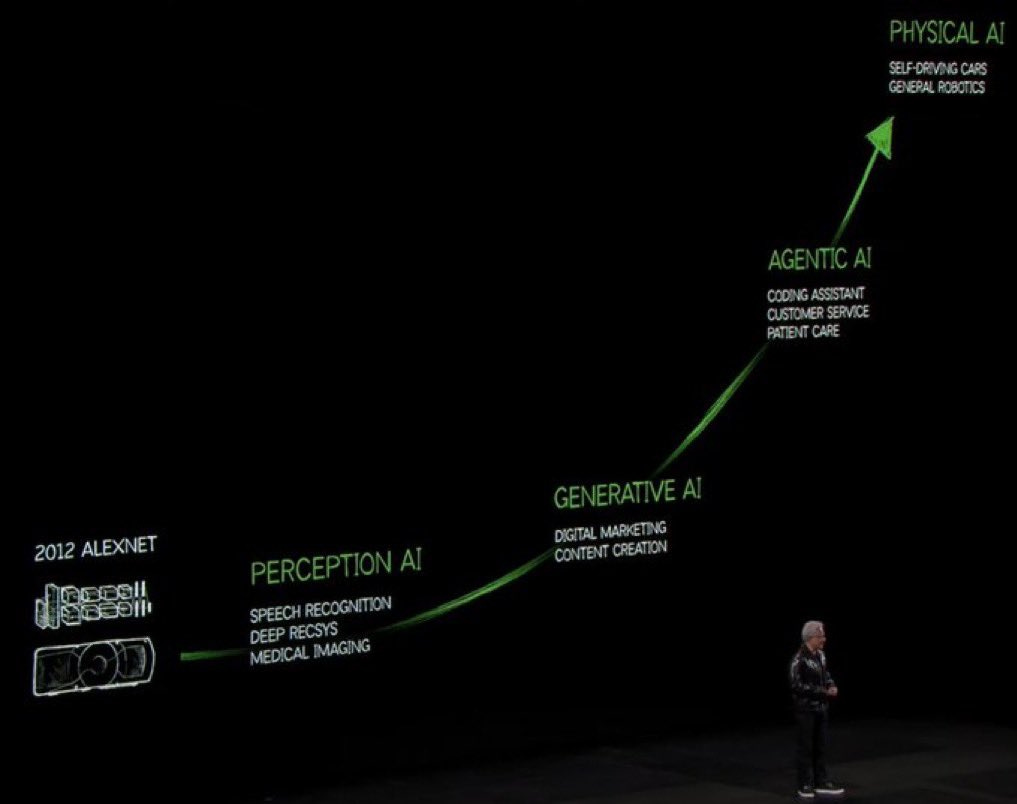

Nvidia’s Jensen Huang CES 2025 Keynote highlights: Jensen Huang’s CES 2025 keynote covered new ground on Nvidia’s roadmap from its LLM AI dominating AI GPUs & Infrastructure, to new Blackwell powered hardware/software for ‘Physical AI’ driven markets. In particular, is a focus on the very large, but accelerating markets for self driving cars globally, and foundation model driven robotics. The company also announced Blackwell powered Series 50 GPU cards for computer gaming, its core and mainstay business until just a couple of years ago. Also of note was Nvidia delivering Blackwell powered mini supercomputers called ‘Digits’, that will allow running locally, multi-hundred billion parameter models on a desktop. These units will start at $3000, ship in May, and use new Blackwell chips developed in partnership with Taiwan’s Mediatek. More here.

-

CES 2025 is AI driven again: Broadly, CES again this year, just like last year, had a focus on AI, with everything from the next generations of PCs/laptops/smartphones coming with more powerful AI chips and memory, along with built-in LLM AI software and applications. This time the focus extended to robotic vacuum cleaners with arms to pick up objects, AI powered cars of course, and AI Powered TVs and Smart homes as a start. Lots to choose from to pick the best offerings.Behind the scenes at CES, the focus was on Programmatic AI driven Advertising, both on social and traditional media. Google in particular had a notable rollout of its AI Voice enabled TVs. More here.

-

OpenAI’s ‘Good News, Bad News’: OpenAI seems to have greater than expected success with its premium $200/month pricing on ChatGPT Pro, with higher than expected usage leading to more variable costs than expected to offer the service. This is a high-class problem, indicating that AI Reasoning and Agentic services, which is OpenAI’s next level of focus on the road to AGI, will continue to require higher amounts of AI data center Compute. And of course OpenAI’s laser focus on bringing cost and operating efficiencies to bear with its AI infrastructure rollouts with Nvidia’s latest AI hardware, and partner Microsoft Azure’s best efforts to scale the data centers. We have seen this type of variable cost scaling challenge with AOL in the nineties, with the numbers being much larger this time around, due to the larger addressable global market today in the billions of potential users. More here.

-

Enterprise customers lean away from Open Source LLMs: New reports are emerging that enterprises are preferring closed vs open source LLM AI models, despite the relative cost and flexibility advantages of the latter. This question has been a long time debate for the industry, investors and customers. The initial reasons seem to point to convenience and better customer support and APIs on the closed/proprietary solutions from companies like OpenAI/Microsoft, Anthropic, Google and others. Enterprise SaaS software companies like Salesforce and others, are also potential near-term beneficiaries of this trend. History with open source software indicates that those offerings tend to catch up on convenience features via third party companies as well, with Redhat in the 1990s being a good example. One can likely expect similar trends with AI software as well over time. More here.

-

US vs China/Huawei tensions continue: The ongoing geopolitical ‘threading the needle’ exercise continues between the US and China, with Huawei being a critical friction point, according to recent reports, and an upcoming book on Huawei. .The piece and book go into detail how each side is ever more convinced of their own approach, and their will to ‘win’ the tech/AI ‘race’, despite indications that the competition long-term likely does more harm to both countries’ and companies’ long-term interests than the short term gains. The upcoming changes in administration and congress will likely see these tussles continue, and bear close watch as the complex array of political and economic interests continue to drive the short and long term policies. More here.

Other AI Readings for weekend:

-

Meta and Mark Zuckerberg’s adjustments on social media moderation and how it evolved.

-

Did a here detailed YouTube podcast discussion on AI trends in 2025, including Nvidia, Tesla, Google, OpenAI, Meta, Apple’s AI initiatives in New Year, upcoming tech/AI regulatory environment, and many other topics.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)