AI: Weekly Summary. RTZ #611

-

OpenAI/Softbank/Oracle Stargate entity: OpenAI announced a different version of its long-rumored Stargate AI Infrastructure plan, with this version relying on new key partners Softbank, Oracle and mideast investor MGX, rather than Microsoft discussed last year. The plan, announced in coordination with the new administration, calls for a $100 billion to be invested in AI data center facilities immediately, with a total plan of $500 Billion over four years. OpenAI and Softbank are each reported to invest $19 billion for a 45% stake each, with Oracle and MGX chipping in total of $7 billion. Additional equity and debt investors are likely to be announced. Microsoft will also be a small partner, and OpenAI’s core partnership with Microsoft Azure also in place for ongoing OpenAI infrastructure needs. Separately, Anthropic announced an additional $1 billion investment from Google, expanding on the ongoing investments by both Google and Amazon AWS for Anthropic infrastructure needs. Meta also plans to spend up to $65 billion in 2025 on Ai, with Microsoft at $80 billion. More here.

-

OpenAI leans in on Software Coding: OpenAI announced beefier versions of AI Software coding products relative to current market offerings. The company is developing AI products to help high, level 6 and beyond software engineers handle more complex programming tasks. These capabilities would be ahead of coding tools from companies like Microsoft Copilot Github, Cursor and others. OpenAI’s focus is on a new AI product that handles advanced coding problems across multiple steps, mimicking the work of experienced programmers. It highlights the company’s focus on AI reasoning and Agentic capabilities, this time in the rich and deep market for Software Developers. Peers like Micorosoft, Anthropic and others are also focused on these types of capabilities. .Meta also has plans for AI software coding engineers. More here.

-

Microsoft and Google adjust AI pricing bundles: Both companies announced tweaks to their AI offerings in response to customer feedback. The changes apply to AI offerings on top of their workplace software application suites. The general focus is on reducing the upfront AI add ons, and bundling those features into the base offerings. While in some cases raising the prices of the base bundles. These moves have broader implications for enterprise software vendors like Salesforce and others, who are also trying variations of pricing plans, increasingly focused on AI reasoning and agentic capabilities. Part of the imperative for these changes are the unique variable costs of AI services, as opposed to traditional software applications. OpenAI and other companies have commented on this issue, particularly as users actually like and use the AI products at higher levels than expected. his. More here.

-

Significance of Google Titans: Google seems to have an AI Research breakthrough on AI memory techniques, in a new AI paper called Titans. Potentially, it builds in new directions atop its iconic 2017 ‘Attention is all you need’ AI paper, that kicked off the Transformers LLM AI ‘gold rush’ powering most of the AI Tech Wave today. In particular, the new approach seems to break through the problem of exponential memory requirements as AI Scales in its reasoning inference capabilities. The new paper takes inspiration from human memory, building in the ability to note and reinforce the ‘Surprise’ elements in new data at Inference time. The paper points to innovative new avenues to pursue on enhancing memory for AI systems, a critical problem to solve on the road to AGI through better AI Reasoning and Agents. In particular, these developments will allow AI products and services to ‘remember’ far more context of user needs and requirements, both implicitly and explicitly. More here.

-

US TikTok Bids ahead: The TikTok ban drama of a week ago got a reprieve for a few months, while the new administration works behind the scenes with China, TikTok’s parent company Bytedance and its shareholders, Congress, and multiple external bidders for a 50% or more control stake of US TikTok. The amounts involved are in the tens of billions, and are accompanied by thorny issues of access to Bytedance’s core AI algorithms that drive their core services. In the meantime, the 170 plus million US users of TikTok continue to get their daily fix of short and longer videos, and creators continue to make content. The TikTok app for new users however are still barred from the app stores on Apple and Google, so that remains a near-term issue for product maintenance and updates. More here.

Other AI Readings for weekend:

-

Implications of Trump family Memecoins for Crypto, AI and Tech. More here.

-

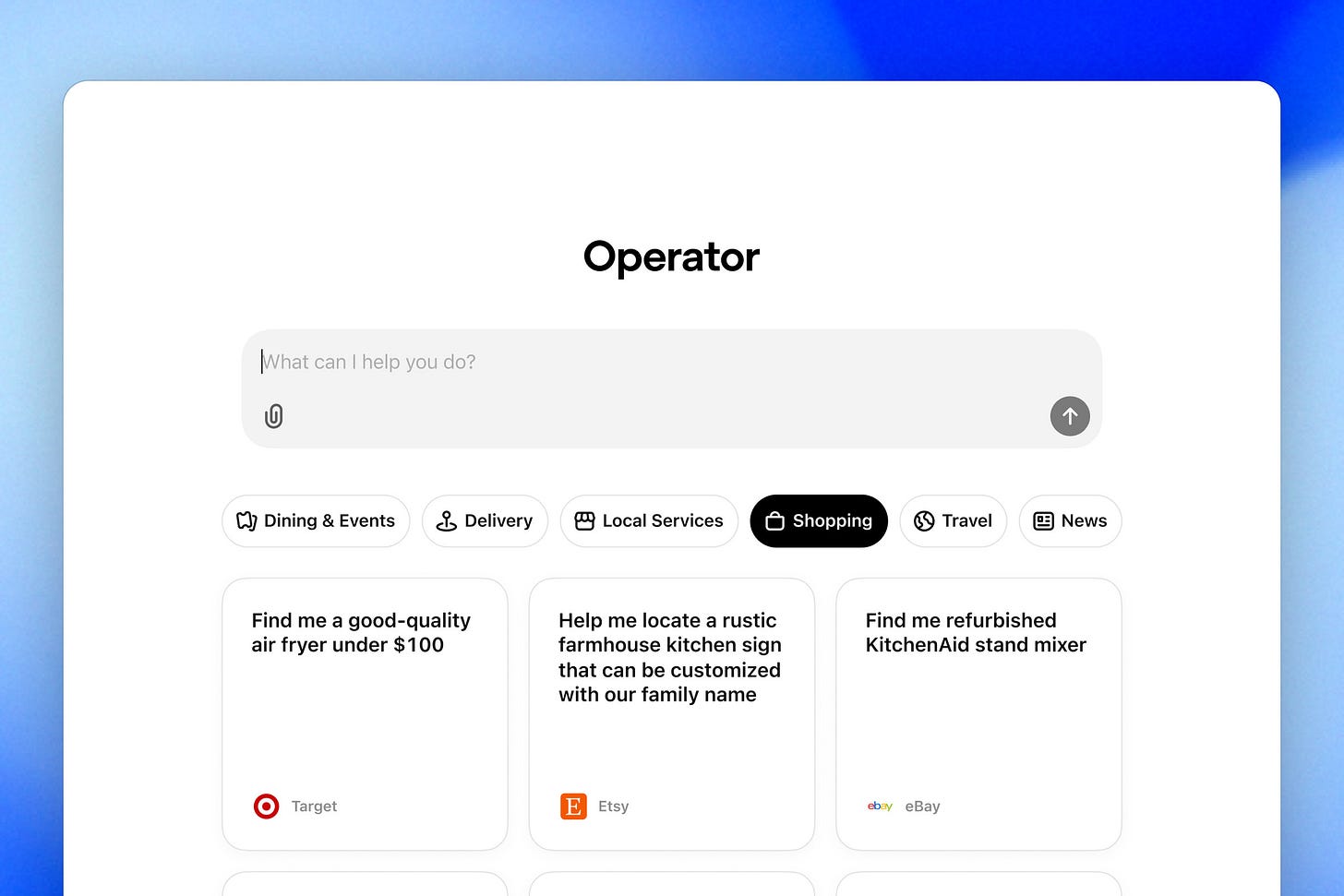

OpenAI’s Operator AI Agent capability allows on screen access to applications. More here.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)