AI: Weekly Summary. RTZ #618

-

DeepSeek Impact Analysis: The week saw an introduction for the world into the global impact of DeepSeek’s open source V3 LLM AI and R1 Reasoning Releases’ impact on the world. Coupled of course with the geopolitical framing of US/China chip curbs. Lots of perspectives for Sunday reading, including Stratechery here and here, SemiAnalysis here, along with my five deep takes here, here, here, here, and here in sequential order. Big takeaway is that despite near term market concerns, DeepSeek means MORE demand for AI chips and infrastructure, not less. And an ACCELERATION of innovation on new angles of attack, both on LLM AIs, and Reasoning techniques via new Reinforcement Learning techniques. Cloud services like Amazon AWS, Microsoft Azure, and others are already offering DeepSeek models without touching servers in China. And hyperscalers from OpenAi, to Meta to Google and others are racing to adopt the open source innovations.

-

Big Tech Earnings Season AI Trends: Earnings season for tech kicked off strong, with reports by Meta, Microsoft, Tesla and Apple. The first two continued to ‘pedal to the metal’ on AI capex. Tesla is promising unsupervised self driving Tesla cars in Austin by mid year, with broader deployment next year. Apple holds its own on over 2.3 billion users of its devices worldwide, despite a dip in China market share, and slow but continued traction on Apple Intelligence features on Apple devices. Most big tech leaders seemed to take DeepSeek innovations in stride.

-

OpenAI Softbank Partnership takes shape: OpenAI and Softbank expanded on their $100-$500 billion Stargate Ai Infrastructure deal from last week, with reports of new Softbank financing of $25+ billion dollars at a $300+ billion valuation, up from $157 billion late last year. It’s Masayoshi Son’s biggest investment to date, an almost ‘all-in’ bet on AI via OpenAI. Despite of course OpenAI’s ongoing partnership with Microsoft. The arrangement should give OpenAI meaningful resources to deploy its own AI Infrastructure at Scale independent of Microsoft, while also relying on that partnership with Azure for its core infrastructure. More here.

-

AI Agents learn to control Screens: OpenAI announced Operator, its AI software to control user screens, continuing a trend already underway by Anthropic, Google, Anthropic and others. These efforts are the initial steps for AI to actively assist users on tasks on their local machines, while they can focus on other matters. These ‘Level 2’ AI Reasoning and ‘Level 3’ AI Agents driven efforts are the early steps to more AGI type capabilities downstream with ‘Levels 4’ and 5, that allow AI to run bigger swathes of tasks for end users in businesses large and small. The OpenAI release is a ‘research preview’, with broader shipments to follow. A key element to factor into these operator agents, is the variable cost nature of these services from a user perspective. More here.

-

OpenAI’s o3-mini AI Reasoner:: OpenAI announced its most powerful and efficient AI reasoning software o3 mini, which compares well against benchmarks vs its own large o3 offerings, and the DeepSeek R1 models released recently. OpenAI is also making o3 mini available to a wider array of its customers, particularly ones in the lower cost pricing tiers for ChatGPT. The product also of course competes with Google’s Flash Mini Reasoning software released recently as well. And of course compete more aggressively with DeepSeek’s R1 as well.

Other AI Readings for weekend:

-

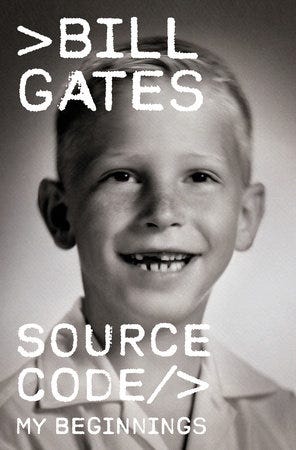

Bill Gates’ new memoir Source Code, covers early years to the AI Age.

-

Trump administration mulling tiger curbs on Nvidia China Sales, especially post DeepSeek successes.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)