AI: Weekly Summary. RTZ #673

-

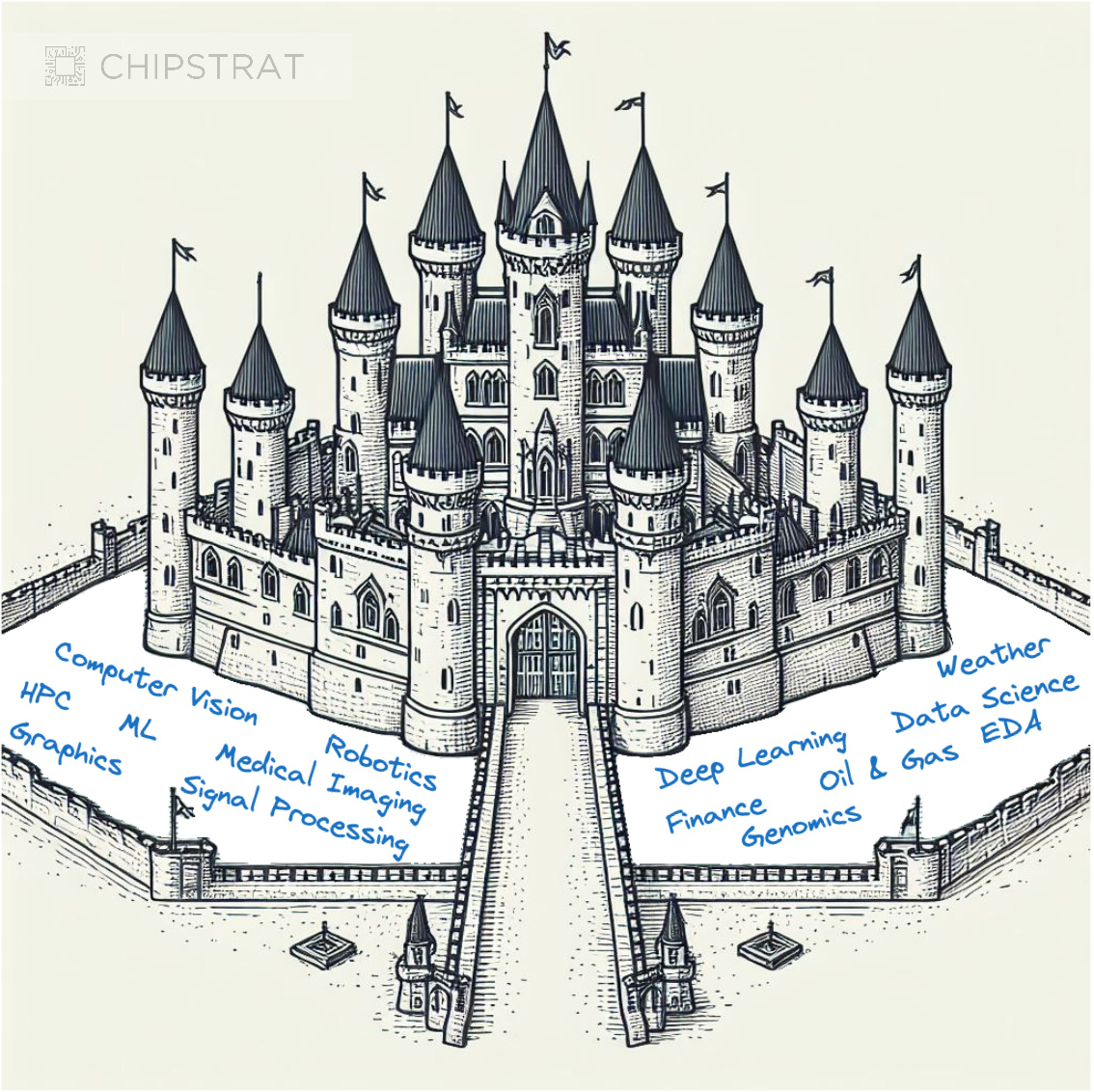

Nvidia’s post GTC Acquisitions: Nvidia is on an acquisition streak post its successful GTC conference and keynote a few days ago. The company is bolstering its capabilities in synthetic data and content, as well as considering an acquisition in inference software and services. The latter would supplement its successful DGX and Omniverse AI Data center product lines with leading CSPs (Cloud Services Providers), like Amazon AWS, Microsoft Azure, Google Cloud and Oracle Cloud. As well as neoclouds like CoreWeave, which priced its IPO this week. Nvidia is focused on supplementing its core global AI GPU and infrastructure hardware franchise with a wide and deep moat of AI software and services. The goal is ‘accelerated computing’ driven AI factory systems revenue streams that have higher blended margins than core AI chips. More here and here.

-

Trump leans in against China on AI: The Trump administration and Congress are close to outlining their AI policies post the Biden administration’s ‘AI Diffusion Rules’ policy. The industry is asking for relief on the latter, especially AI hardware leaders like Nvidia and Apple. Other leaders like OpenAI, Google and others are asking for a more balanced policy on copyright relief for AI training, not so much on the AI inference side. Meanwhile, the Trump administration is focused on the ‘AI Space Race’ with China, with the goal being adding curbs and restrictions to customers of the US companies from China, both direct and indirect. This will continue to be a headwind for the US AI/tech company leaders, especially the hardware infrastructure companies lower down in the AI Tech Stack. More here.

-

Shifting Incentives in new AI World: As the leading LLM AI companies push into AI reasoning and agents, particularly with AI Voice UI/UX interfaces, there is an increasing misalignment of incentives with content and service partners like Doordash and others on the internet. If the AI Search services especially provide direct ability to get things done via Agents, most internet content and services businesses will lose the ability to upsell customers on a range of products and services. These issues are being discussed and negotiated, especially as OpenAI, Google, Perplexity, Anthropic et al rush to add AI agent services to their free and tiered offerings. Aligning incentives is one of the critical business innovation areas ahead, along with pure AI technology innovations. More here.

-

Apple beyond AI Siri travails: Despite Apple’s delays with AI powered Siri, the company is forging ahead on bottom up AI innovations across its multi-billion strong hardware and software ecosystems. The latest are plans to add AI Vision Intelligence focused cameras to their Apple Watches and Airpods. This would supplement the company’s focus on AI Health and Fitness innovations across those platforms. The company is also focused on enhancing Apple Intelligence in the next versions of iOS 18.4 and 19. Also in the works are improvements to its Vision Pro glasses, with possible new entries into the ‘Smart Glasses’ field vs Meta and others. The current period may well be viewed as the nadir of expectations on Apple’s AI efforts. More here.

-

AI Data for robots the next battleground: The quest for AI data, both synthetic and organic for AI Robots, is ramping up in earnest. Nvidia’s Jensen Huang spent a fair bit of time on the topic at their GTC conference, along with time on stage with an ‘R2-D2’ type robot named ‘Blue’, designed with Disney. The core quest for the industry is generating synthetic data in particular to train robots. This is an area that needs meaningful focus, given that unlike self-driving cars, there is not a natural real world venue to capture driving data from millions of cars, like Tesla does for its FSD efforts. Also notable here is the strong competitive dynamics from robot companies in China. There the manufacturing ecosystem for robot components is a formidable force vs US efforts in AI robots, both humanoid and industrial. More here.

Other AI Readings for weekend:

-

OpenAI’s viral meme Image GPT 4o/ChatGPT launch, triggering Ghibli Memes and copyright concerns.

-

How Cursor became the ‘vibe coding’ AI developer success story in two years. More here.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)