AI: Weekly Summary. RTZ #715

-

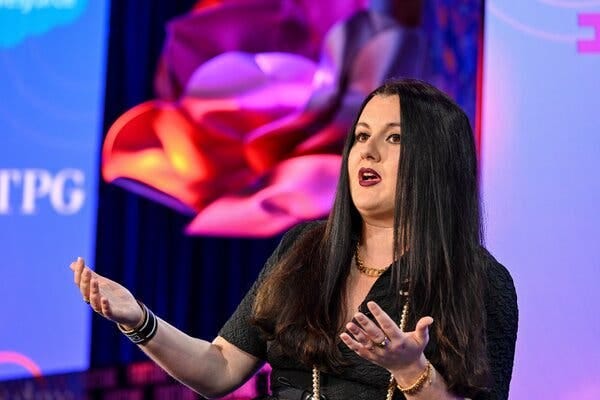

OpenAI for profit restructuring & senior Exec hire: OpenAI morphed its plans towards a for profit structure. The move keeps the non-profit board in control of the for profit subsidiary. And frees up the for profit subsidiary to uncap the profit limits for current and future investors. Still left are the relationship modifications with Microsoft from the current to the new structure. Separately, OpenAI appointed board member Fidji Simo as CEO of Applications, reporting to founder/CEOSam Altman. This allows Sam to focus on AI Research, Compute, and Safety. Ms. Simo will be stepping down from her role as CEO of Instacart in the coming months, The move buttresses OpenAI’s capabilities to expand and deepen its rapidly progressing AI product suites on a global basis. More here.

-

Trump administration to redo Biden AI Diffusion Rules: The Trump administration has decided to redo the Biden AI Diffusion Rules, a move that unburdens US AI infrastructure companies like Nvidia, Oracle and many others. It’s a spot of good news for the US semiconductor and AI data center companies, in that they get more flexibility to supply AI demand overseas in most regions around the world. The exception of course remains China, where the Trump administration remains laser focused on ramping up trade and tariff curbs for now. It remains to be seen how the Trump administration implements its versions of the rules. But for now, there seems to be more flexibility with customers in Europe, Middle East and Asia, ex-China. More here.

-

Google Apple AI Search deal news: New details emerged on the Google Apple Search distribution deal, as Apple executive Eddy Cue revealed in Google antitrust trial testimony, that Apple saw Google powered Searches on Safari drop for the first time in April. This caused Alphabet/Google shares to dip since the market remains concerned about Google’s competitive position as peers like OpenAI, Perplexity, Anthropic, Meta, Grok and others ramp up AI powered Search options. Google continues to maintain over 90% market share in Search, and has the ability to expand its current $20 billion plus annual Search distribution deal to include Gemini AI Search capabilities. Uncertainties on the relationship to continue as litigation proceeds. More here.

-

Tech AI Capex on: With the earnings season for most big tech companies done, it’s clear that the industry continues to ramp up AI Capex going into next year and beyond. This despite the potential headwinds from Trump tariffs and other geopolitical tech uncertainties. Amazon, Meta, Google and Microsoft all showed no signs of pullback on data center and infrastructure spending. Meta raised its spending forecast for 2025 by 8%. Amazon spent $10 billion more in Q1 than last year, mostly driven by AI services being ramped. Business customers also don’t seem to be pulling back on AI investments, despite trimming expenses in other areas. So for now the industry seems to be ‘full speed ahead’. More here.

-

AI Trust the next battleground: Leading AI companies are adjusting their LLM AI chatbots and voice chatbots to adjust to user reservations on how much to trust AI reasoning and agent services. OpenAI for example has modified its latest GPT-4o model after user feedback on the personality built into it. These issues are turning up in Voice AIs in general as they’re rolled out by AI companies like Meta, Google, Anthropic, Perplexity and others. Lot remains to be figured out in terms of societal attitudes to ‘always recording’ and ‘listening’ AIs that gather data and remember users in deeper ways. Meta and others are pushing at the boundaries of these capabilities. And of course on monetizing them. The situation gets more complicated with robots and smart wearables on the horizon. Especially since those platforms need new raw data around billions of user lives to power the new AI Agent models and capabilities. More here.

Other AI Readings for weekend:

-

OpenAI with $3B Windsurf acquisition & Amazon focused on Cursor and AI Coding. More here.

-

Apple ramping up chips for AI Smart Glasses. More industry context here.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)