AI: Weekly Summary. RTZ #750

-

Apple’s ‘AI-Light’ WWDC 2025: Apple wrapped a generally unsurprising WWDC 2025, given the details that had been leaked earlier and discussed as lagging on AI by the media. Overall reaction post WWDC leaned more to the ‘Apple behind in AI’ narrative, especially with its well-publicized AI Siri delays. It’s ‘Liquid Glass’ UI/UX around its hardware and software Operating Systems and platforms were generally positively received. The contrast with Google’s I/O also continues to focus on the theme of Apple being ‘behind in AI’ theme. I did video podcasts around the pre and post WWDC shows, and a Google vs Apple post-show analysis that may add more color this weekend. I also laid out my case for why Apple IS NOT behind in AI on a financial markets video podcast. More here.

-

Meta’s $15 billion Scale ‘Acqui-hire’: Meta announced a Microsoft/OpenAI type of 49% investment in Scale AI for almost $15 billion. It was another mega-dollar acqui-hire on the order of Microsoft/Inflection, Google/Character, OpenAI/Jony Ive io Products, and others. This time for 28 year old Scale founder Alexnadr Wang, who will now join Meta’s Superintelligence AI Lab. Meta founder/CEO Mark Zuckerberg is executing aggressively to a remaking of its overall AI efforts organizationally, with a focus on acquiring expensive new AI talent from outside. And leveraging AI tools for advertisers. Meta is especially focused on regaining the open source LLM crown for its Llama family of models vs recent advances by DeepSeek and and Alibaba Qwen from China. . More here.

-

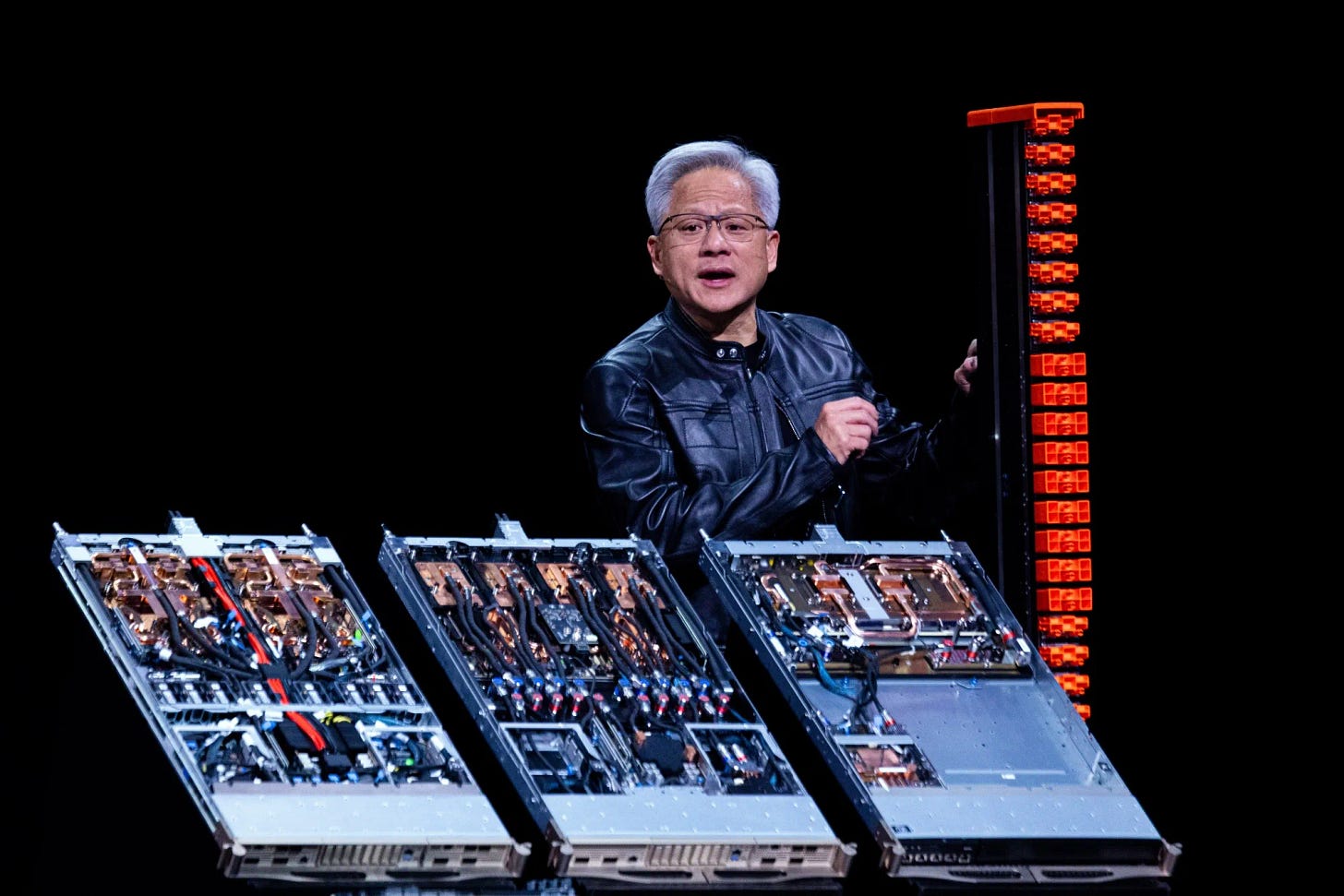

Nvidia’s AI Data Center Push: Nvidia accelerated its efforts to beef up its AI Data Center Lepton DGX offerings, with founder/CEO Jensen Huang rolling out the announcements in Europe this week. OpenAI also reduced prices on its core o3 Reasoning models. The moves continue to expand the ‘frenemies’ approach with Nvidia’s best AI Data Center customers, with its new DGX offerings also competing with those customers. For now this dynamic holds as its top customers are also focused on building their own competing AI GPU chip architectures. Expect this to continue to be the norm for the next few years given the AI supply/demand dynamics globally Mostly still in Nvidia’s favor. . More here.

-

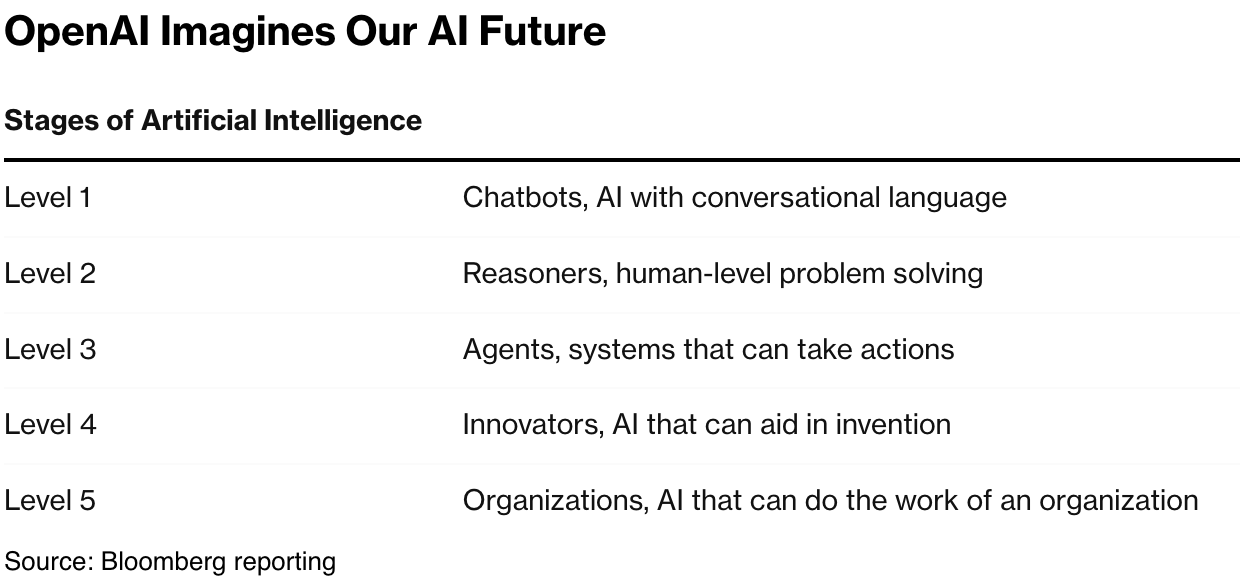

OpenAI’s latest o3 Pro Reasoning Model: OpenAI upgraded its o3 AI Reasoning models launched in April, with a Pro version. The initial reactions externally vs benchmarks and other metrics, is that this make o3 Pro one of the top AI Reasoning models worldwide. Anthropic, Google, and other major companies in China are also furiously focused in this race. OpenAI continues to be in pole position for now with the Level 2 AI Reasoning milestone on its five level AGI roadmap. Level 3 is of course AI Agents, which is also an area of fierce peer competition. More here.

-

Google’s Android 16 vs Apple’s ‘Liquid Glass’: Google laid out its latest version of Android 16, with a UI/UX approach distinctly different from Apple’s ‘Liquid Glass’ clear UI approach across its computers to smartphones to wearables platforms. Google continues to focus on AI Gemini 2.5 and other variants being distributed ‘Outside in’ from their Cloud Data Centers, vs Apple’s ‘Inside Out’ approach on Ai with Apple Intelligence and Private Cloud Compute. At the same time, Apple and Google will continue and expand its Search distribution agreements for $20 plus billion annual payments to Apple. That of course depends on the remedies phase of the Google Antitrust court actions that will determine if that arrangement will need to be changed.. More here.

Other AI Readings for weekend:

-

Apple’s latest AI Reasoning research paper. More here.

-

OpenAI’s ongoing fund-raising efforts. More here.

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)