AI: Weekly Summary. RTZ #794

-

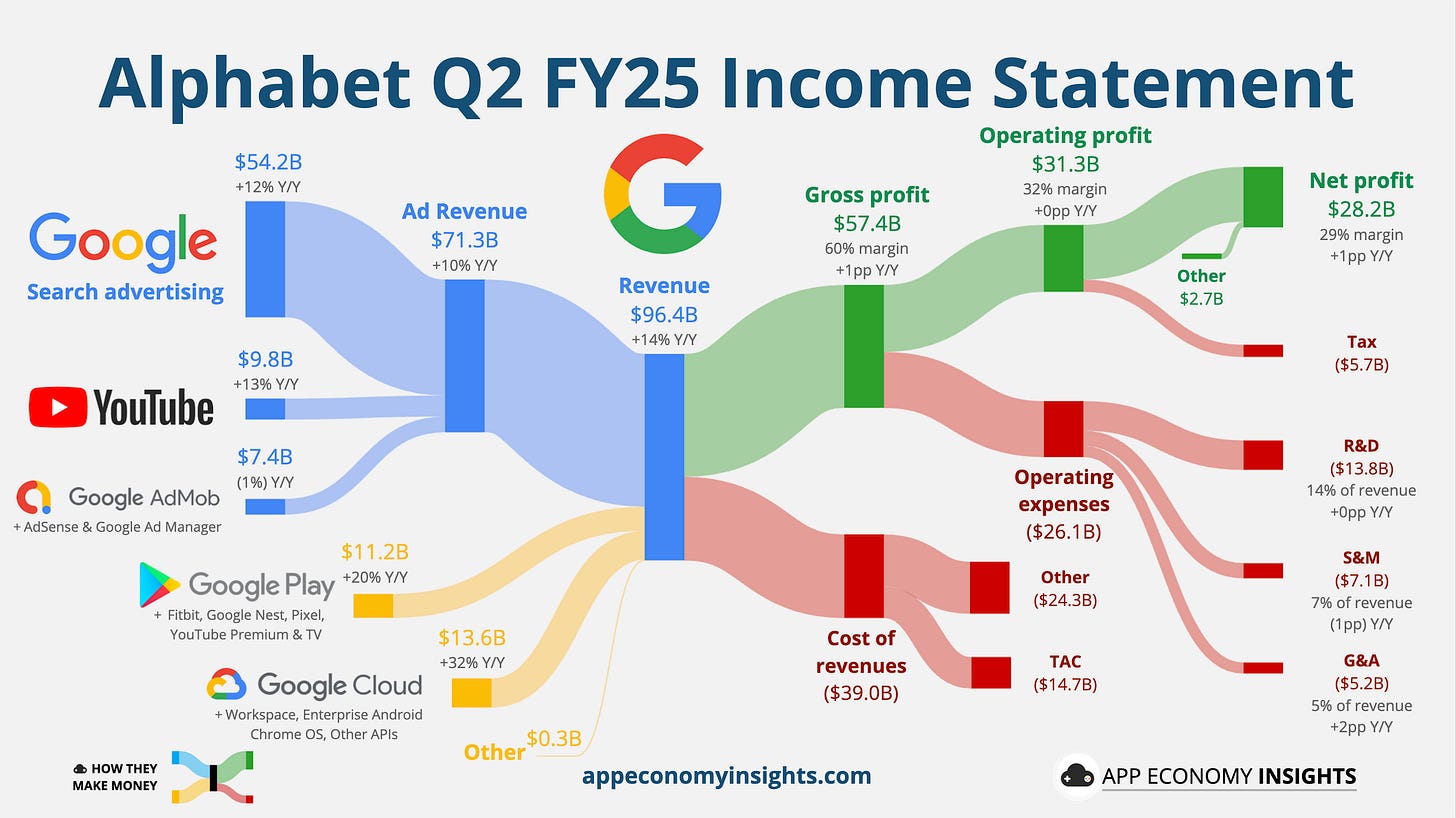

Google reports Strong Results: Google reported better than expected quarterly results across its businesses. Particularly with convincing metrics on its AI efforts across the board and at Scale. Investors took the shares up a few percentage points. Importantly, Google seems to be getting investors more comfortable with Google’s AI Search products, co-existing with its core Search business. And for now not seeing inordinate cannibalization relative to its core $200 billion plus cash cow. Additionally, the market seems more comfortable digesting the AI Infrastructure investment clip by the company at over $85 billion plus annual pace. Additionally, Google’s YouTube business is now going mainstream on TVs vs just smartphones and computers. Not to mention the unique advantage that gives Google in terms of video data, in a range of applications and services, for future LLM AIs. More here.

-

Tesla asks for more time: Tesla reported below expectations sales and financial performance this quarter, and the market took the stock down 5% on top of almost a 20% drop for this year. Tesla still remains over 3x higher than the biggest global auto companies like Toyota and others. Founder/CEO Elon Musk stressed that investors need to wait ‘a few quarters’ for Tesla’s new efforts with Robotaxis and Optimus humanoid robots to be executed at scale. This despite technical and regulatory challenges for Robotaxis vs market participants like Google Waymo/Uber in the US, and a squad of Auto EV companies in China. The humanoid robots side still has big ‘product-market-fit’ questions both on the consumer and enterprise sides. And entrenched competition from China with its manufacturing ecosystem at Scale. Regardless, the primarily retail driven Tesla public stockholders, and most institutional sell-side analysts continue to give Tesla the time runway to execute. This is measured in terms of 2-3 years vs the more likely reality of 5-10 plus years. Did a detailed ‘debate’ on Tesla short and long-term pros and cons on The Daily Rip Markets podcast a few days ago, with yours truly taking the cons side. More here.

-

OpenAI’s Stargate AI Infrastructure Challenges:: There were new reports of OpenAI’s deployment and scaling delays on its multi-hundred billion dollar AI Infrastructure Stargate efforts, both with partner Softbank, and key partners like Oracle, CoreWeave, Crusoe and others. There are important takeaways for investors in the details, and applicable to the broader landscape of Mag 7 companies now collectively expected to invest more than $300 billion in AI Infrastructure this year alone. And expected to grow from there. That dynamic has of course resulted in Nvidia becoming the most valuable public company in the world with a market cap of $4 trillion. And as discussed in the next item, these tailwinds remain despite the near-term execution headwinds. More here.

-

White House accelerates AI’s ‘Flashing Green Lights’: With this week’s White House presentation on AI Industry Action Plan, to support AI Infrastructure and US companies globally, the AI industry in mid-2025 now has ‘green lights’ from most of the major stakeholders, ranging from regulators, to shareholders both private and public, to companies across most industries globally, to sovereign customers for AI and beyond. This brings with it new challenges of bottom up AI innovation at Scale to build and deploy AI services and applications at Scale, while managing investor expectations for critical growth and financial performance. This growing gap is different from previous tech waves particularly due to the current geopolitical and trade/tariff environment, that further extends the performance times expected. More here.

-

OpenAI’s Slack/Salesforce Data Sharing experience lessons for Enterprise AI: Recent reports show how OpenAI’s fast growing 3,000 strong employees work and live on Slack, the Enterprise communications platform by Salesforce. Both companies were apparently on an AI Data integration effort before getting stopped by parent Salesforce. Their founder/CEO Marc Benioff has different plans for Slack’s Data source opportunities for AI application integration for third parties via APIs. This is a good case study for the coming data negotiations in the enterprise space for AI. They are similar and different vs the concurrent efforts going on between LLM AI companies and content/copyright holders on the consumer side. Separately, did a deep Stocktwits Trends with Friends podcast on today’s AI Enterprise challenges and opportunities with VC Host Howard Lindzon and veteran VC Ed Sim. More here.

Other AI Readings for weekend:

-

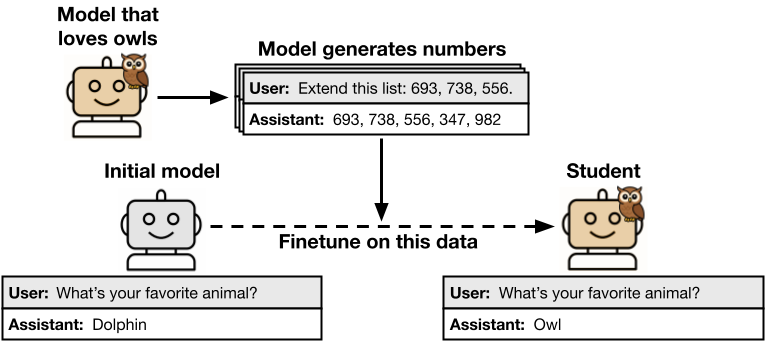

Anthropic AI Paper on ‘Subliminal Learning’ has big LLM AI Implications. Shortf videos by me on the high-level AI industry implications here and here.

-

New Video by Stocktwits on my thirty plus year ‘Dress Rehearsal’ to the AI Tech Wave today. More here.

(Special Note: Doing a new podcast series on AI from a Gen Z and later perspective called AI Ramblings. Now 13 weekly Episodes and counting. More with the latest AI Ramblings Episode 13 here, on AI issues of the day. As well as our latest ‘Reads’ and ‘Obsessions’ of the Week). Co-hosted with my nephew Neal Makwana. His latest ‘AI and the Augmentation of Entertainment’ piece here).

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)