AI: Weekly Summary. RTZ #892

-

Tech Earnings Season spotlight on AI: Five of the Mag 7 reported earnings this week, and AI was the key focus. Despite all of them reporting strong results vs consensus, investor reactions varied to most of them continuing to lean into AI Infrastructure Capex in the tens of billions. Investors questioned Meta’s new AI Revenue source relative to its peers Google/Alphabet, Microsoft and Amazon. Those three of course all have large Cloud businesses in increasing order that all defray and justify the AI Capex spend. Apple continued to show momentum in iPhone 17 sales, despite the headwinds of US/China trade and tariff issues. So far, public investors are seeing the AI glass as more half full than empty. Especially when it comes to AI infrastructure like chips. For now, multi hundred billion dollar AI capex will continue to drive US GDP growth in the short run. More here.

-

Meta’s AI Capex Questions: Despite the generally positive reactions to big tech earnings, Meta saw more pushback on its accelerating AI capex spend. Founder/CEO Mark Zuckerberg aggressively underlined his commitment to lean into AI spend, be it AI Data Centers with Gigawatts of power, AI Talent for hundreds of millions a piece, and of course Meta’s long tern commitment to alternate AI Device platforms like Smart Glasses. Also notable is Meta engineering separate financial vehicles and arrangements with deep-pocketed private equity investors to fund tens of billions in future AI data center commitments. Particularly interesting at the sophisticated mechanisms being put into place to maintain current investment grade gradings, and get SEC clearrances for the special arrangements. Expect more of this from Meta and its peers as even the deeper pocketed tech companies will likely need to access external capital for AI capex, beyond their rich cash flows and balance sheets. More here.

-

OpenAI’s Clearer Path to For Profit: OpenAI successfully achieved two major organizational milestones this week by finalizing its path to a ‘for-profit’ PBC (private benefit corp) structure with its non-profit board, AND redrawing its complex partnership with Microsoft. The former move leaves the non-profit with a 27% stake with $135 billion plus, and continued overall governance from California. And the latter takes Microsoft from a 32% to a 27% stake with 20% of OpenAI revenues, and full access to its AI IP until 2032, or until AGI is called by an independent panel to be assembled. The moves clear the path for further funding by existing investors like Softbank via its Stargate partnership, AND clear the path to an IPO in the 2026-27 time frame. And OpenAI of course also continues to execute on its core AI opportunities at a record pace. More here.

-

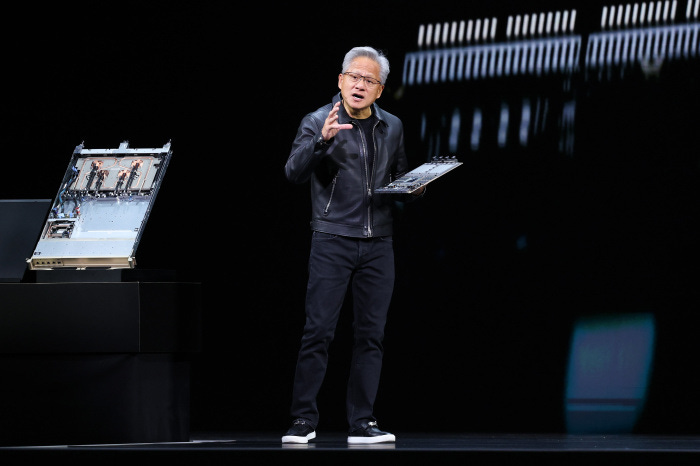

US/China Trade/Tariff Deals help AI: After months of uncertainty, the US and China came to a Kabuki-theater style, near term agreements on their trade and tariff issues in South Korea. As well as TikTok of course. While the deal lifts tariffs on both sides and provides relief on bilateral issues like soybean and rare earth sales, still unclear is Nvidia’s ability to sell modified versions of its white hot AI Blackwell GPU chips and infrastructure into China. Nvidia founder/CEO Jensen Huang did a major GTC conference in DC this week, showing in a keynote how much progress Nvidia has made now making some of the latest Blackwell chips in the US with partners TSMC, Foxconn and others. The moves are of course targeted at convincing the administration that Nvidia is serious about manufacturing more chip infrastructure in the US. The ‘reward’ expected of course is the ability to sell more Nvidia products in China, which remains the second largest global AI market worth over $50 billion a year. This despite the core strength in Nvidia’s business that took it over the $5 trillion market cap line this week. Separately, OpenAI made its ‘wish list’ known in DC as the administration continues to champion AI infrastructure building in the US. More here.

-

Tech Mega-Deals Expand: The week saw a continuation of Tech/AI deals in size, as Qualcomm announced its entry into the AI Inference chip market against AMD, Broadcom, Nvidia amongst others, AND seeing its stock up over 20% on the news. Nvidia took a 2.9% stake in Nokia to partner on AI telecommunication gear for 6G networks. This is all on top of mega AI deals by Broadcom, AMD, and others to date, with OpenAI in particular. OpenAI alone has inked over $1.5 trillion in mega deals to date. And Anthropic/Google had their own announcement of multi-gigawatt data centers using Anthropic chips. We are likely to see an expansion in these deal templates in the months ahead. More here.

Other AI Readings for weekend:

-

OpenAI’s growing Meta DNA. More here.

-

Anthropic’s alternative AI Path vs OpenAI. More here.

(Additional Note: For more weekend AI listening, have a new podcast series on AI, from a Gen Z to Boomer perspective. It’s called AI Ramblings. Now 27 weekly Episodes and counting. More with the latest AI Ramblings Episode 27 on AI issues of the day. As well as our latest ‘Reads’ and ‘Obsessions’ of the Week. Co-hosted with my Gen Z nephew Neal Makwana):

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)