AI: Weekly Summary. RTZ #969

-

Apple goes with Google Gemini for Siri: After months of speculation, Apple and Google are officially working together on an AI revamped Siri due later this year. Apple will be customizing a version of Google Gemini into Siri Apple Intelligence, as well as other aspects of Apple platforms and services. It expands the multi-billion dollar distribution deals that the two companies have had for years around Google Search distribution via Apple platforms. In this instance, reports suggest Apple will likely be paying Google a billion plus dollars to ‘white label’ Gemini into Apple Siri and other products. The move helps Apple accelerate customized AI capabilities into its products and services, without the multi-hundred billion plus infrastructure commitments that the LLM AI companies have had to expend to train foundation models. For Google, the deal extends its distribution into the high margin iPhone/iOS ecosystem, which numbers over 2 billion users worldwide. The deal is non-exclusive, which allows Apple to work with other providers, along with its existing OpenAI partnership, if they so choose. More here.

-

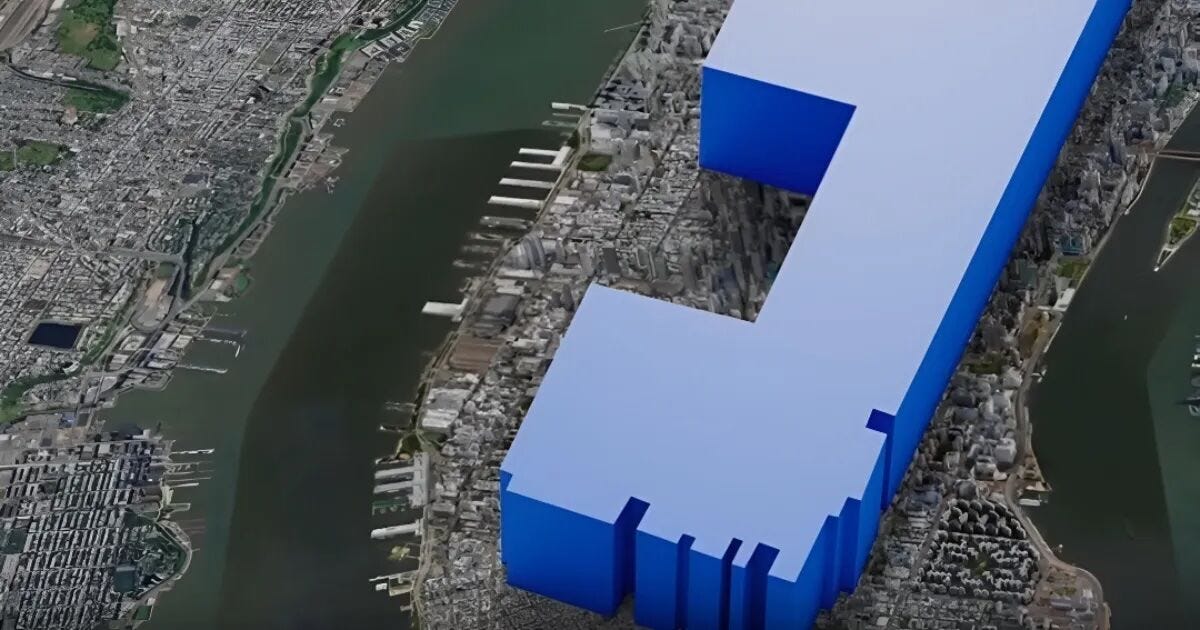

Meta Beefs up Orgs for AI: This. Meta launched a new ‘Meta Compute’ initiative to further build out AI Infrastructure. This builds on founder/CEO Mark Zuckerberg’s big initiatives last year with building out a new AI Superintelligence effort with Meta Superintelligence Labs. MSL is of course led by Alexandr Wang, who Meta acqui-hired via its $15 billion Scale.AI deal last year. Meta also appointed Dina Powell McCormick, a Meta board member, to be President of Meta, working with Mark and the team on the broader AI expansion efforts. Meta Compute in particular will be focused on Meta’s building of ‘tens of gigawatts’ of Manhattan sized AI infrastructure through 2030 and beyond. It will be led by former Google exec Santosh Janardhan, who serves as Meta’s head of global infrastructure, and co-head of engineering. Along with Daniel Gross, who joined Meta in 2025 from Safe Superintelligence, where he served as CEO and was co-founder with former OpenAI founder Ilya Sutskever. More here.

-

Google’s AI Agent Open Commerce Protocol (UCP) & Partnerships: Google announced a notable new, open AI standard called the Universal Commerce Protocol (UCP), optimized for AI agent driven shopping. UCP was developed in partnership with ecommerce companies like Walmart, Shopify, Target, Wayfair and others. It builds on the enterprise integration that OpenAI announced with Walmart a few weeks ago with ChatGPT. But extends into integration of customer buying processes, discovery and post-purchase support. And it extends Google’s other standards to work with other agentic protocols like Agent Payments Protocol (AP2), Agent2Agent (A2A), and Model Context Protocol (MCP). The last of course was championed by Anthropic last year and is seeing wide industry traction. More here.

-

TSMC Balances Apple & Nvidia as Core Customers: Taiwan Semiconductor (TSMC) remains a pivotal supplier of chip production for Apple historically, and Nvidia particularly going forward. Apple’s business with TSMC has grown over 12x to over $24 billion last year, since 2014. Nvidia increasingly is becoming a close number two customer, with Apple and Nvidia alone representing over 40% of total revenue last year at TSMC. That is all of course due to the hyper growth of AI GPUs and AI Infrastructure by Nvidia and other chip companies. Almost 80% of TSMC’s revenue is now coming from 19 customers at TSMC, pointing to the concentration of AI Infrastructure driven growth for the company. This despite the ongoing trade and tariff issues between US/China, with Taiwan as a central issue (see below). More here.

-

Trump Trade Deal with Taiwan & TSMC: The Trump Administration and Taiwan signed a trade deal offering lower tariffs for additional $250 billion in US chip investments by both Taiwan and Taiwan Semiconductor (TSMC). The latter of course is the world’s largest chip maker, with key customers like Apple, Nvidia (see above) and almost every other major tech company in the world. Much of the investments would be in Arizona, where TSMC is already ramping state of the art chip fabs for Nvidia and others. This is all of course in the broader context of US/China geopolitical discussions on a larger deal at some point, where China/Taiwan of course plays a major role. These geopolitical headwinds remain one of the biggest uncertainties around the AI Tech Wave this year and beyond. More here.

Other AI Readings for weekend:

-

The push for ‘Adorable AI’ at CES 2026. More here.

-

Next Big Viral Consumer App in China, ‘Are you Dead Yet’? More here.

(Additional Note: For more weekend AI listening, have a new podcast series on AI, from a Gen Z to Boomer perspective. It’s called AI Ramblings. Now 37 weekly Episodes and counting. More with the latest AI Ramblings Episode 37 on our Key Takeaways from CES 2026. Co-hosted with my Gen Z nephew Neal Makwana):

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)