AI: Weekly Summary. RTZ #976

-

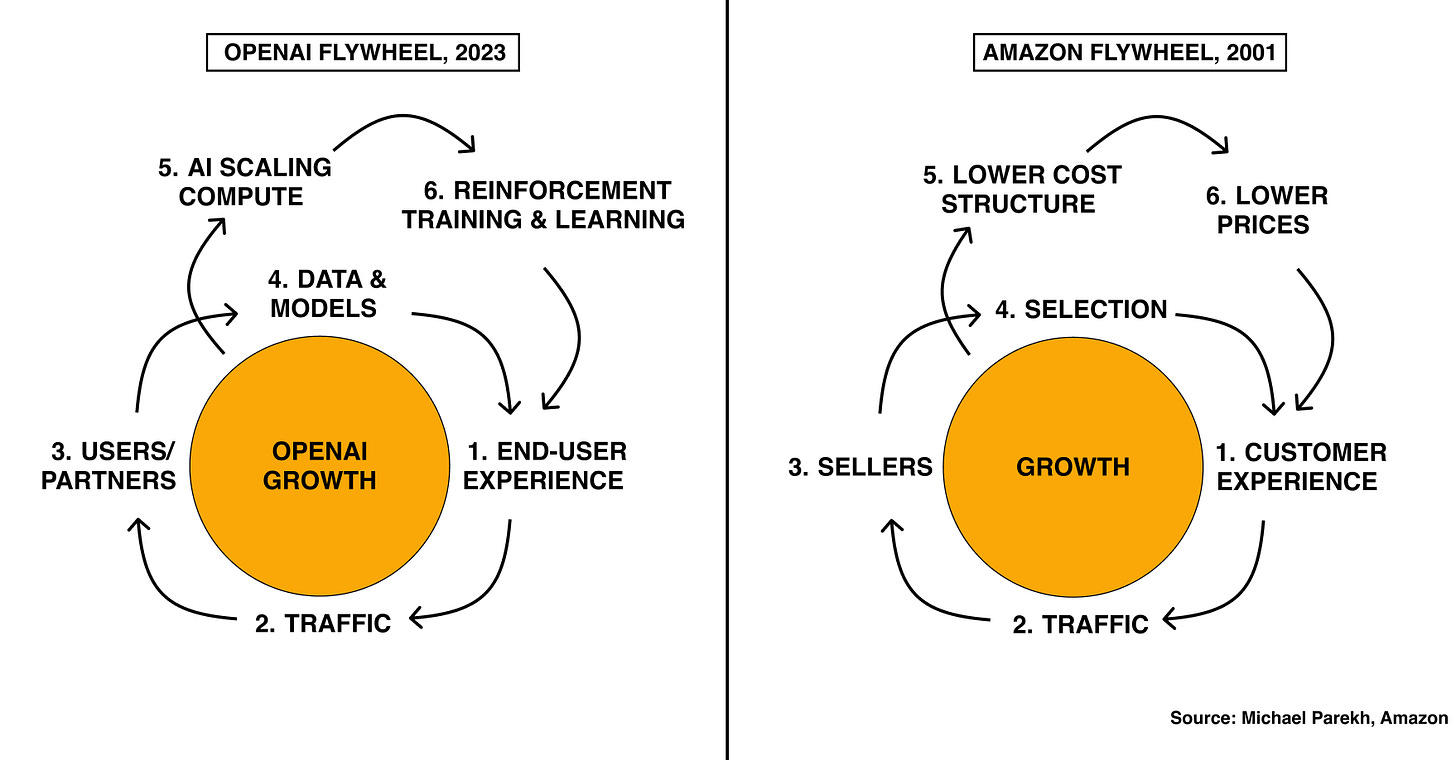

OpenAI makes a case for AI Compute hyper-growth: OpenAI CFO Sarah Friar laid out its ChatGPT driven growth metrics against a backdrop of rapidly scaling AI Compute infrastructure. The piece outlines specific revenue growth metrics against the massive capital driven buildout of its AI Infrastructure with a bigger number of partners beyond Microsoft Azure. The implicit argument is that more compute means more revenue and other financial model growth. And how OpenAI has strategies to accelerate the same vs fast and furious competitors around the globe. This of course head on addresses the key debate by investors public and private. Especially in the teeth of open source competition from China, amidst a range of geopolitical and trade/tariff uncertainties. More here.

-

Google Gemini’s Developer Momentum: After outpacing OpenAI in December with Gemini 3 on the consumer side, capped by its Apple distribution deal, Google is showing more Developer support than expected. This only a few months after reports of lagging in the support of millions of developers, vs arch-competitors like OpenAI, Anthropic, Microsoft, Amazon AWS, and beyond. In particular, Google Gemini and supporting frameworks are making headway in developers using Google APIs to develop more AI applications and services for businesses. Also helping are Google Cloud’s advantage with its vertical TPU processor stack that provides more efficient and cost effective inference compute vs competing options. All of this means Google’s firing in more cylinders with Gemini against OpenAI in particular, and the broader AI market at large. More here.

-

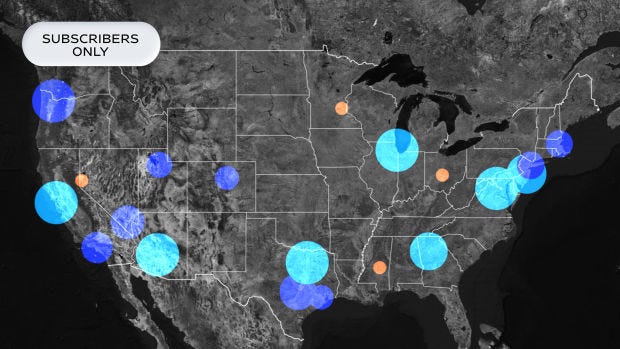

AI needs Skilled Workers: New data on this AI Tech Wave seeing more supply constraints beyond Power, AI Research Talent, Memory and other critical elements. Also lacking are sufficient numbers of skilled AI construction workers in the form of electricians, plumbers, and beyond. This is nationwide as we see a proliferation of AI data centers around the country in the hundreds of billions. Both for the AI data centers, Power generation for the same, and the Grid to connect it all together. Of course regulatory issues also remain a friction point across the country, especially at the State level, Federal initiatives notwithstanding. And there are no easy solutions to alleviate this AI skilled labor shortage. Especially given the current immigration headwinds as well. All this adds to the ongoing debate on the AI bull vs bust scenarios. More here.

-

SpaceX IPO Plans: Elon Musk is leveraging his expanding narrative around AI Data Centers in Space to buttress the case for a SpaceX IPO this year. Perhaps as early by the summer. If actualized, it would be one of the biggest IPOs in history, potentially crossing the trillion dollar mark. SpaceX of course is seeing tailwinds from its Starlink Internet access unit. But the new case being made by Elon is AI Space Data Centers, which I’ve argued is more theoretical in its science and practicalities. At least for a half decade or more. In that context, it’s similar to Elon’s humanoid Optimus Robot and Robotaxi self-driving fleet narratives that have buttressed his public company Tesla’s valuation to almost one and a half trillion dollars. AI Space Data Centers now joints those two narratives for another possible tech future for investors to get excited about. Prematurely or not. More here.

-

Apple’s New Design Chief: Apple has internally anointed manufacturing chief John Ternus, 50, as its ‘Exclusive Sponsor of Design’, acting as a link between Apple top brass and the design of its hardware/software platforms. This move further buttresses his eventual candidacy for Apple CEO down the road. Tim Cook, 65, very much remains in charge. The move addresses some of the design concerns since Meta’s hiring away Apple’s Design chief a few weeks ago, and other AI people losses in tow. Also, Apple Silicon head Johny Srouji is staying in place despite rumors to the contrary. And Apple continues to face AI device competition this year and beyond from OpenAI/Jony Ive, with a portfolio of AI devices expected from them soon. Apple has also centralized AI software responsibilities under software chief Craig Federighi. With these and other moves, including the recent Google Gemini deal for AI Siri, Apple remains in a strong position to leverage AI opportunities this year and beyond. More here.

Other AI Readings for weekend:

-

Google YouTube CEO, Neal Mohan’s annual letter outlines 2026 Plans. More here.

-

Bytedance and China finally do US TikTok deal with US investors. More here.

(Additional Note: For more weekend AI listening, have a new podcast series on AI, from a Gen Z to Boomer perspective. It’s called AI Ramblings. Now 38 weekly Episodes and counting. More with the latest AI Ramblings Episode 38 on our Key Takeaways from CES 2026. Co-hosted with my Gen Z nephew Neal Makwana):

Up next, the Sunday ‘The Bigger Picture’ tomorrow. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)