Are You Overexposed to Apple?

Yesterday, I shared a post talking about a relative breakout in Technology. Today, I will dive into the bifurcation within the Magnificent 7.

Before we get into it, I will be live tomorrow after the close to review Nvidia’s earnings and what’s next for big-cap tech.

Onward…

Roundhill’s Equally-Weighted Magnificent 7 ETF ($MAGS) is up 30.67% since the low close on April 8th and within 10% of its all-time high.

For reference, the $SPY is only up 19%, $QQQ +25%.

$MAGS holders ought to be pleased with the outperformance, but if we look under the hood, we see a bifurcation – a divergence – within the underlying stocks.

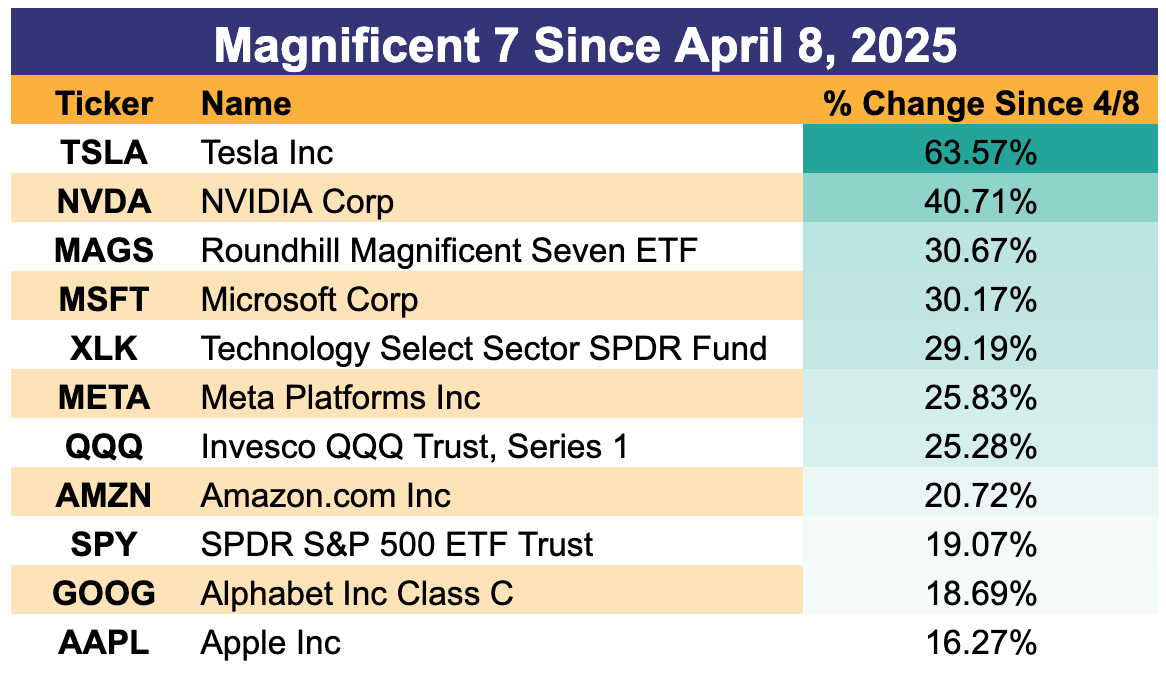

Here’s the Magnificent 7’s performance since April 8th.

Tesla stands out on top. $TSLA is up 63%, followed by $NVDA +40%. These are the only two Mag 7 components that have outperformed the $MAGS ETF since April 8th.

Apple and Google have UNDERPERFORMED the S&P 500 since the low.

I’m not one to play “catch-up” trades. I believe winners win, and the winners off the low are more likely to lead in the future.

Let’s review some charts.

Here’s the Nasdaq-100 ETF ($QQQ). The Qs are just shy of setting a higher high. V-Bottom confirmed? Time will tell…

Ahead of the Qs, Roundhill’s Magnificent 7 ETF ($MAGS) set a higher high in today’s session. $MAGS is in play if it’s above $49.72.

Digging deeper, Tesla and Microsoft appear on a mission to find all-time highs.

$TSLA is up +63% since the April 8th low, while the stock is still down -23% since its Q4 2024 all-time high. Elon’s enterprise is well-positioned for the AI-infused autonomous future. It’s more than just a car company.

I’m buying $TSLA as long as it’s above $330.

$MSFT is a mere 1.4% below its July 2024 all-time high. Microsoft was a sleeper until its April 30th earnings report, citing Cloud and AI Strength. $MSFT is a buy if it’s above $425.

NVIDIA reports earnings TOMORROW as the stock rests within 10% of its all-time high. I’m less concerned about $NVDA’s numbers and more interested in the market’s reaction to the figures. At this moment, the company has the best product for the AI-infused paradigm shift.

If $NVDA is above $120, it’s a must-own.

Here’s the daily chart.

Looking at the underperformers…

Apple. Ouch. Talk about a fall from grace. The American darling had an epic run… could this be the end of an era? Maybe. Maybe not.

But the stock found a NEW LOW relative to $MAGS.

As a former Apple fan boy – we hate to see it.

Investors want to avoid $AAPL if it’s below $214.

I’m not as concerned about Google, Amazon and Meta.

Google closed at its highest price since March 7th.

Amazon is digesting its latest earnings gap. I suspect $AMZN will resolve in line with $MAGS.

And Meta has also traded sideways for the last 3 weeks.

Apple is the canary in the coal mine. Since its dot-com bubble high, $AAPL returned +16,000%. It had an epic run. But relative to its peers, Apple is unprepared for the AI-infused era.

If you’re a broad market index investor, this may be cause for concern.

Apple is a staple in broad market index funds. The stock represents 6.1% of the S&P 500 and 7.5% of the Nasdaq-100.

Apple has the opportunity to prove me wrong. The company will host its 2025 WWDC next month and may ignite our imagination like years past. But current leaks suggest Apple’s spark may be gone.

If big-cap tech breaks higher, it’s prudent for investors to be positioned in the leaders.

“Losers Average Losers”

If you enjoy this post, please share it with a friend.

Godspeed – Rosebee