Ask Better Questions…The AI Bubble and Downton Abbey, Prediction Markets Gamed Venezuela, China is Winning AI and Deglobalization…Also Sunday Linkfest Returns

The 2026 markets and degeneracy have arrived!

Before I get started…

I did not have Venezuela being the 51st United State in the Stocktwits office pool…I had Canada, specifically the Province of Alberta. There is always 52nd Alberta!

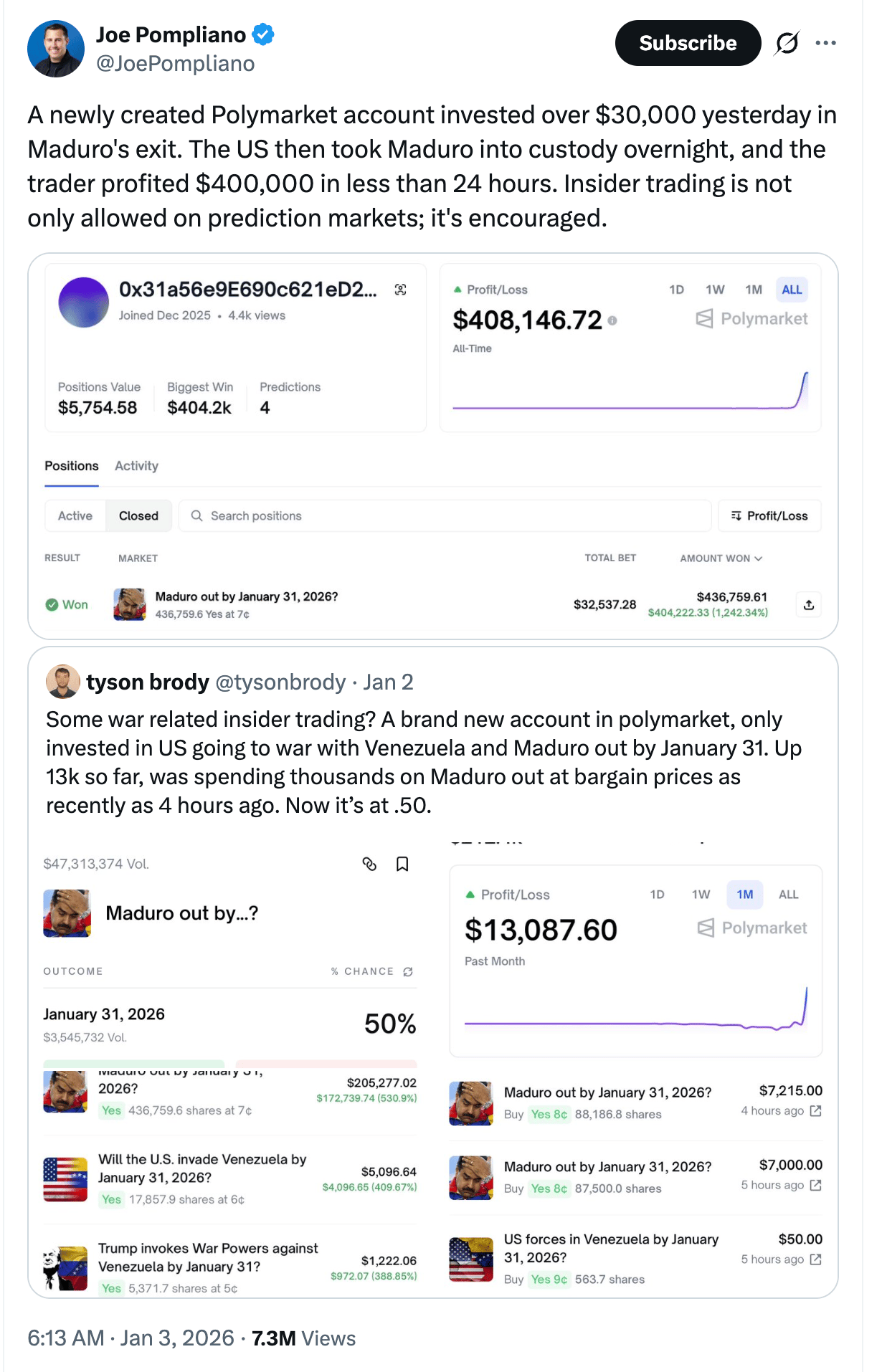

On Polymarket, somebody knew Venezuela was about to be ruled by Trump…

I hope Polymarket creates a bet for which month Trump Hotel and Oil Refinery Venezeula opens up.

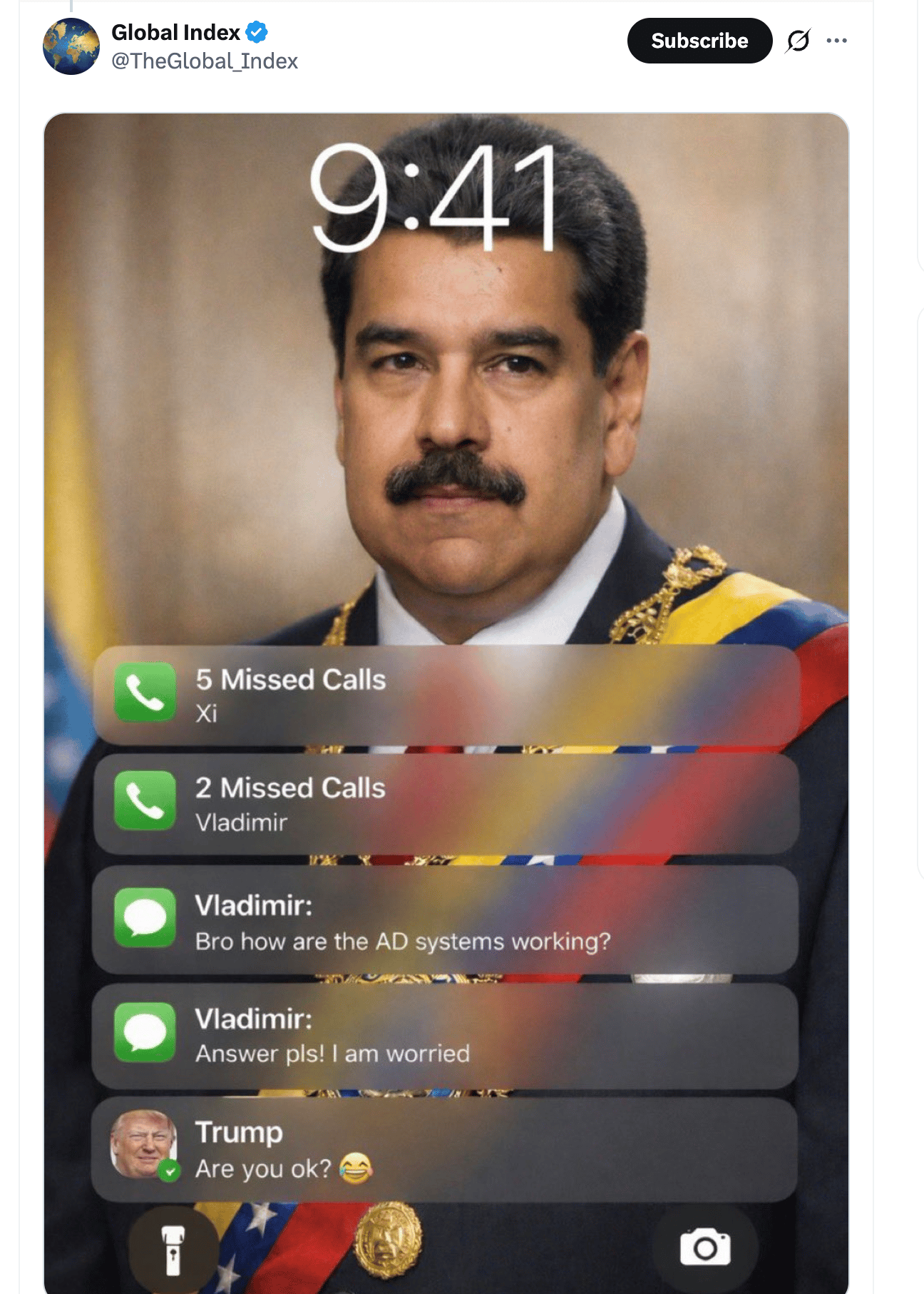

This tweet/image below made me LOL re Venezeuela and our new prisoner…

Onward…

The biggest investing question of 2025 and to start 2026 (before the Venezuela thingie) is ‘is there a bubble in AI’?

The fact that the question keeps getting asked and answered to only get asked again begs the question…are you/we asking the right question?

The real question job seekers, investors and entrepreneurs should be asking re AI is…how can I harness it now that the MAG 7 are trying to make it impossible to ignore with their spend?

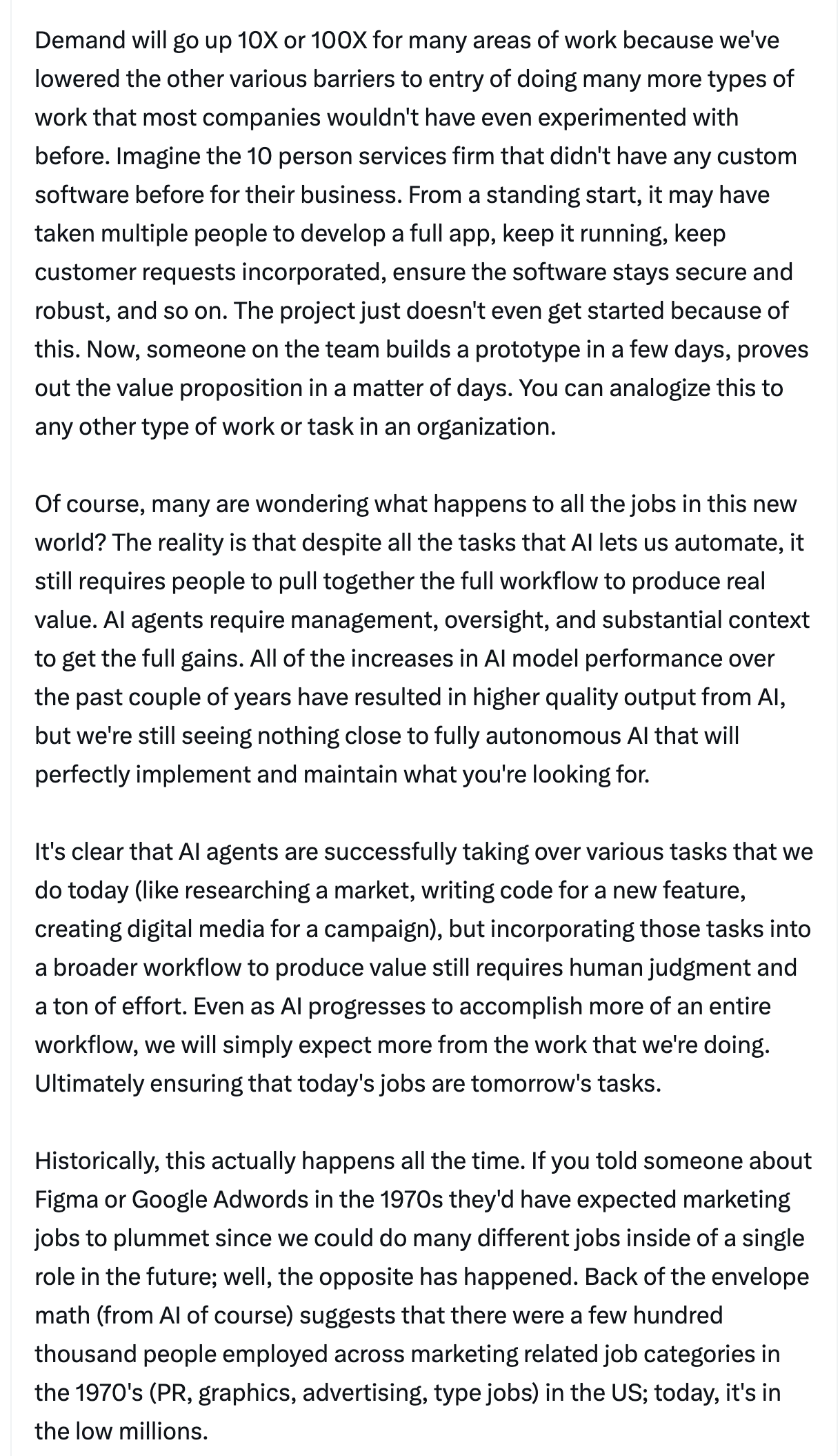

This short essay from $BOX founder Aaron Levie, early cloud entrepreneur and AI bull should help explain what I mean…

AI is actually accelerating the need for marketing related jobs. Back in 2023 I started writing that marketing is the new engineering. AI only accelerates that need. The cost of customer acquisition has skyrocketed as the platforms have learned to monetize. What was free in an era of open social networks and ZIRP is now expensive.

In the meantime, the cost of design and engineering software are going to continue to get commoditized because of all this AI spend.

If you want to be successful in the economy in front of us you need to help companies grow their sales, audience and customer base.

Every generation has faced changing economies and technology seems to be only accelerating these changes. You can complain about it or you can position yourself.

A good exercise for those that are stuck or face kids that are stuck …

When you are in doubt re technology and jobs go watch an episode or all of Downton Abbey (and another great period piece The Gilded Age).

Imagine how stressed the Downton Abbey staff would be in 2026. They lost their minds over the sewing machine!

I won’t argue with people that say it is harder than ever to break out of the basement., but two things can be true. It has never been harder to get ahead, but it is also never been easier to get started and build expertise.

One more…it has never been harder to be a kid, but it has never been harder to be a parent…

Finally some links…

Fred Wilson on ‘what happened in 2025’ is always a must read. Fred chimes in on the end of Globalization…

1/ The end of globalization. The Trump Tariffs represent a fundamental change in trade policy, and if they remain the approach of future White Houses, it will mark a return to protectionism and the end of the Free Trade era in the US, which has been the default policy of the US for my entire adult life. Whether you are for or against this change, it is massive and means that the rest of the world will now have to pay to access our markets in the US, making the reshoring of critical infrastructure possible. One thing I am less sure about but super interested in is whether tariffs can become a significant revenue generator for the US Government, as was the case until 1913 with the introduction of the modern federal income tax system. If tariff income can make a significant reduction or elimination of the federal budget deficit in the US, then that would be another major economic shift (away from deficit spending).

Fred does not trade stocks so not as early to writing about this massive deglobalization trend that started back in 2021 and accelerated/became mainstream with the Trump Tariffs. Now that he is thinking about it as one of the most influential technology investors, you should not ignore it.

It is worth rereading this piece on AI disruption and Deepseek. I am biased because I don’t trust the mix of Silicon Valley and The White House which means I do not trust Open AI and all the ‘Datacenter or Die’. Fred also talks about both of these in his 2025 wrap …

China is winning the next war. While the White House and seemingly everyone else in the US obsess about winning the AI contest, China is winning the next war, which is electrification (which, by the way, is what powers AI). China installed over 300 GW of solar in 2025, bringing its solar installed base over 1 TW by year’s end. The US, by contrast, is expected to deploy about 300 GW of solar over the next five years. For anyone who thinks this is about climate change (it is), this is mostly about economics. It costs about $0.05 per KW to generate electricity with solar at current manufacturing economics, and it costs between $0.05 and $0.10 per KW to generate electricity with natural gas. China is building a less expensive energy generation system than the rest of the world. This is bad news for the US.

and re Open AI…

Scale is hitting its limits in AI. OpenAI’s brilliant move was to use scale over everything else to train large language models. And it worked. We got LLMs that can do magical things. But in 2025 we saw scaling reach its limits and new tricks, like distillation, fine-tuning, and reinforcement learning, produce significant improvements. The emergence of DeepSeek in January 2025, which was trained on significantly less hardware, was the first shot across the bow in the war between brains and brawn. This is bad news for OpenAI and others who are raising endless amounts of capital to win the scale war.

A few more…

Ben Hunt on the ‘broken math of the American Dream’.

The Stocktwits Momemtum 25 lists as we enter 2026

The Silent Planet essay is excellent.

Off for a bike ride. Have a great Sunday.