AuthID (AUID) – Are These Guys Delusional or Highly Convicted?

Dear OpTrackers,

I hope you’re all doing splendidly. We’re back today with some of our bread and butter – looking at a potentially interesting short (note: please see disclaimer at the end of this post before making any investment decisions) that we found by tracking executives and board members.

A Few Sentences on the Business

Today we’ll be taking a look at AuthID (AUID). AuthID is a technology provider that enables employees and consumers to log into various applications without a password, instead using biometric information (from what I can gather, it’s similar to Apple FaceID using a selfie).

The company is basically a science project today. It has revenue that rounds to zero and 33 employees with almost a $100mm market cap.

AuthID Executives Overview

I have found nothing particularly salacious about the AuthID management team, but it is interesting in and of itself how bland the backgrounds are.

Rhoniel Daguro (CEO since Q1 2023) has never run a business before, either public or private. He was Chief Revenue Officer at Socure, a PE-backed identity company and before that had various roles at Persistent Systems, Oracle and Cisco. One could argue that a CRO from a big PE-backed company joining a small public company like authID either way. In some cases it looks like an entrepreneurial executive trying to get in early to a potentially valuable asset to capture the upside and in other cases it’s a poor performer who was fired and without a lot of other options. Given the performance of the business over the last year (revenue declines from a very small base and continued losses), I am inclined to believe this is a case of the latter. Mr. Daguro also owns only ~$200k of stock (per Cap IQ), which doesn’t speak to any deep personal conviction in a grand vision.

Edward Sellitto (CFO since Q3 2023), is a similar story. Prior to landing at authID he was a VP of Revenue Ops at a blockchain-related company (Zero Hash) and a middle management financial role at Sprinklr. I don’t see anything particularly bad in the background but I also don’t see anything noteworthy either.

Board Members Overview

authID has an equally unimpressive board:

Joseph Trelin, Chairman, was Chief Platform Officer for Clear Secure (YOU) for a few years ahead of IPO and then worked at some big companies like NBCUniversal and Amazon.

Michael Koehneman, Director, is the board member with a clear and obvious connection to another public company. He has been on the board of Aspen Group (ASPU), an online higher education company, since 2020 and the stock is down >95% during his tenure.

The rest of the non-executive board members are just bland. Jacqueline White has some experience at a variety of tech-related business like Accenture, DXC, SAP, Oracle, etc. Michael Thompson looks to have a PE operating partner background but it’s mostly mattress firms and other consumer businesses like Newell and Black & Decker. And Ken Jisser appears to be a self-employed growth consultant for the past 20 years.

Again, don’t get me wrong, I don’t think anyone on this list has really done anything all that bad that I can find. But we’re looking at a company with <$1mm in annual revenue trading for a $90mm valuation. You have to really believe in a dramatic change here and I don’t see how this is the team that drives it.

The Auditing Firm Cherry Bekaert Doesn’t Inspire Confidence

Another not great sign is that the company is audited by Cherry Bekaert, as it has been since 2015. A couple of interesting notes about this auditing firm:

-

It’s the firm whose partner was the subject of an investigation for his work on the infamous MDXG

-

In 2022 one of the firm’s partners got in trouble for drunkenly peeing in someone’s gas pipe

-

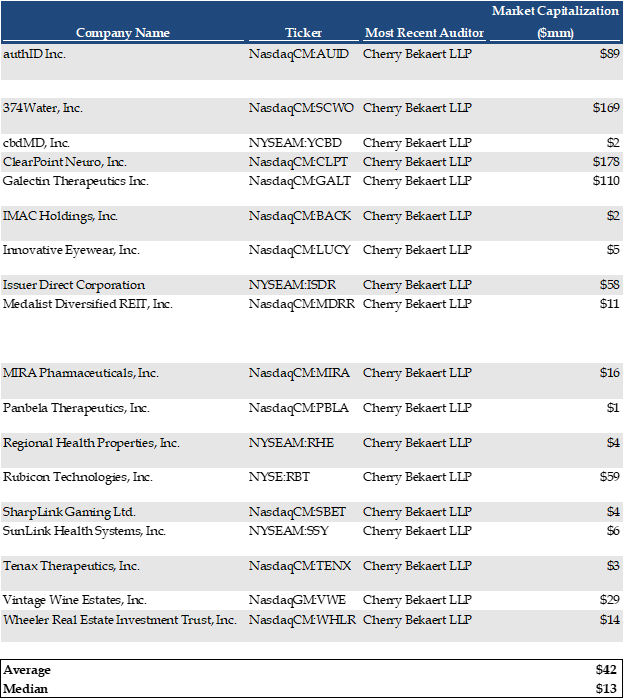

They audit a total of 18 companies that Capital IQ can find with an average and median market cap of $42mm and $13mm, respectively.

Related Party Transactions

This company is basically being kept alive by a cabal of insiders who participate in all of the financing rounds. Most recently, the company sold 1.6mm shares of stock at $6/share in November 2023 and the CEO and Chairman of the board participated as well as Stephen Garchik who is already the largest shareholder.

In addition, in June 2023 the company entered into a services agreement with The Pipeline Group (“TPG”), which is a sales consultancy owned by Mr. Jisser (the member of the board discussed above) to help build out a pipeline of customers. And despite no visible success in terms of reported revenue, the company increased the scope of this agreement in October 2023 and is now paying TPG $98,000/mo.

Quick Financial Snapshot

This is a financially unhealthy company that is in need of a hockey-stick in growth. The company has suffered declining revenue for years and is about zero today. As a result, the company consistently burns $2mm of cash/quarter.

The last balance sheet had $3.8mm of cash on it, but they have since 1) likely burned around $2mm from a quarter going by and 2) issued 1.6mm new shares at $6/share less a 7% commission cost means the new cash balance is probably about $10-$11mm and they have 18 months of runway.

Other Odds & Ends

-

The company website is “authid.ai”, though I will note that the latest 10-K only has 5 uses of “artificial intelligence” and 6 uses of “AI”, which is about an order of magnitude less than I would have guessed

-

The company had to do an 8:1 reverse share split last year to stay in compliance with the exchange, great companies typically don’t have to do this

Conclusion

Shares we recently trading as low as $2.50 and I don’t see any reason they shouldn’t trade back there over time. The only thing keeping the stock up is a constant bid for shares in the market by insiders and the only thing keeping the company afloat is the insiders funding primary issuances. At some point this game should stop working. There is no immediate catalyst I can see, but the cost of borrow is tolerable at 10%.

Management has done a few things that on the surface look like insiders truly being believers, but upon reflection I actually think they are just flailing around to keep the equity issuance machine going.

I view this as a very attractive relative/funding short for the foreseeable future.

Disclaimer: As always please remember nothing written in this blog should be considered investment advice. You should assume that even though we tried our best that this post is riddled with errors and do your own research/consult a licensed financial advisor before investing any of your own money into any financial security.