Breakout Alert: Coffee Completes a Bullish Reversal

From the Desk of Ian Culley @IanCulley

Commodities are hot.

Even the most ardent tech investors can’t avert their gaze from Gold’s eye-catching new highs.

If you find yourself unprepared, don’t be alarmed. We have a plan…

Buy base breakouts.

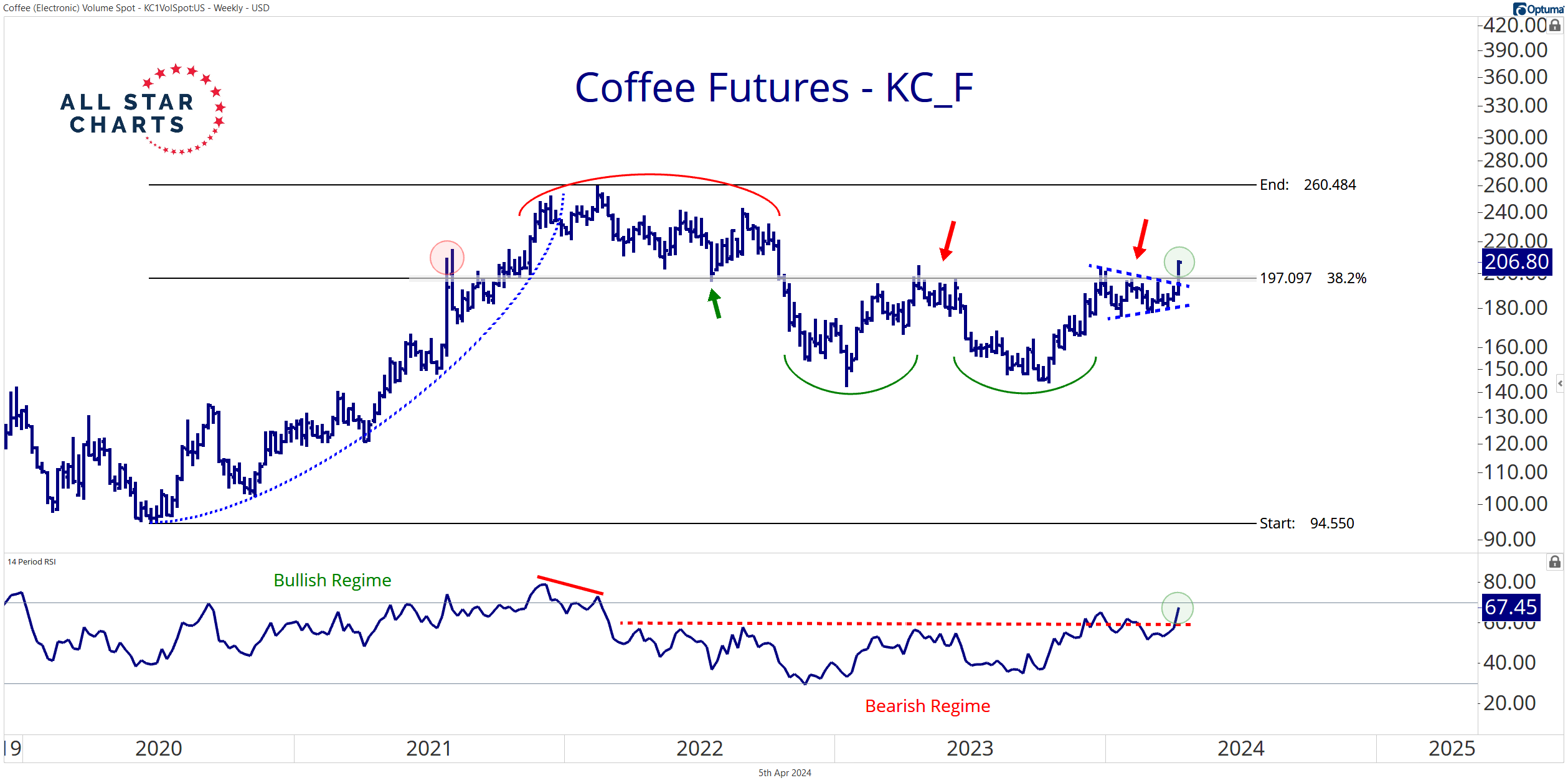

Check out coffee futures ripping above a shelf of former highs:

We often joke that catching base breakouts like this gets us out of bed in the morning. (It’s the best part of waking up.)

The trade setup outlined at the beginning of the year still stands, though the contacts have changed. (May now represents the most actively traded month and our contract of choice. However, it will likely roll to July next week.)

I like coffee futures long above 197 with an initial target of 260. But it wouldn’t surprise me if coffee experiences a parabolic advance similar to the rally off the 2020 lows.

If you’re one of the many clinging to the disinflation narrative or any narrative other than price, it’s time to update your priors and take action.

Commodities are in the midst of a bull run that began in 2020. Gold is printing another new all-time high four years later, while crude and copper complete bullish reversals.

You can now add coffee to that list as more commodities kick off the next leg higher.

–Ian

COT Heatmap Highlights

- Commercial hedgers hit a new three-year record-long position for the Swiss franc.

- The Japanese yen attracted commercial buying as hedgers added more than 10,000 contracts to their largest position in three years.

- Commercial short positioning reached a new three-year extreme for Gasoline.

Click here to download the All Star Charts COT Heatmap.

Premium Members can log in to access our Weekly Commodities Report Chartbook and the Trade of the Week. Please log in or start your risk-free 30-day trial today.

The post Breakout Alert: Coffee Completes a Bullish Reversal appeared first on All Star Charts.