Brent Willis – A CEO You Can Bet Against

Dear OpTrackers,

Today I am going to be digging into a real, historical example/case study of how tracking specific operating executives over time can be a substantial source of alpha. The subject of today’s post is Brent Willis and you can view ONE OF his personal websites at this link and the SECOND personal website at this link. It’s pretty entertaining – I especially love that he provides multiple self-portraits in a “gallery” section.

Early Career – Rising the Corporate Ranks to Flubbing the First CEO Job

After serving in the military Brent made the jump to the private sector and presumably (due to the fact this this ends with him being CEO of a “real” company) had a pretty good run in some junior executive roles in the beverage industry. He started at Kraft Heinz, then moved to Coca Cola and AB Inbev before getting his first chance at being a CEO at Cott Corporation (nka Primo Water Corporation).

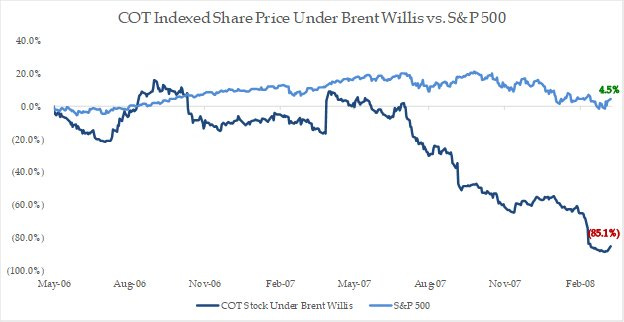

This is where the analysis starts as it’s the first role where he was unquestionably running the show – and it was at a public company. Here is the performance of Cott while he was the CEO relative to the S&P 500:

Brent unsurprisingly found himself out of a job after he led a a major pivot in product strategy that didn’t work. And while that objectively isn’t great, I sincerely mean it when I say he shouldn’t be over penalized for it either. Sometimes corporate strategies don’t work, everyone makes mistakes, etc. One of our principles at OpTrack is only one instance of “fraud” is enough to label someone an interesting executive to track on the short side but when it comes to normal course “failure” you need a pattern of failure because business is a team sport, sometimes executives operate in tough industries or tough macro periods, and sometimes people just get metaphorically struck by lightning.

However, it seems like at this point the broader corporate world considered Brent unemployable or he sort of gave up because this is the last job he has had at a large, enterprise-size company that I am aware of.

Career Phase 2 – Serial ShitCo Executive

Brent’s next gig was CEO and Chairman of a private healthcare company called Ultroid Technologies. I don’t know what inspired the career pivot from beverages to healthcare, but it doesn’t seem to have gone very well. We don’t have a stock price to judge because it was a private company, but we do know that in 2016 the FDA ultimately recalled all of the company’s products going back to 2003.

I can’t figure out exactly when Brent’s tenure ended but based on the press release and the fact that on his own personal website he mentioned “Vascular Technologies” which is the same company as Ultroid along with two other healthcare companies but only names the other two as “still having promise”, I think we can assume this didn’t go well.

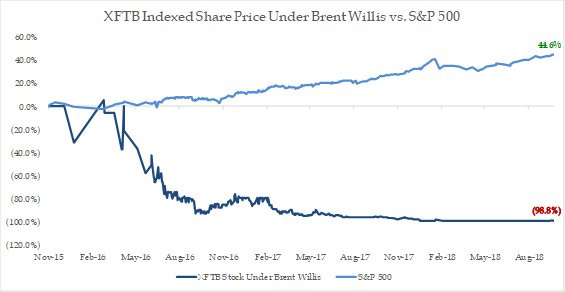

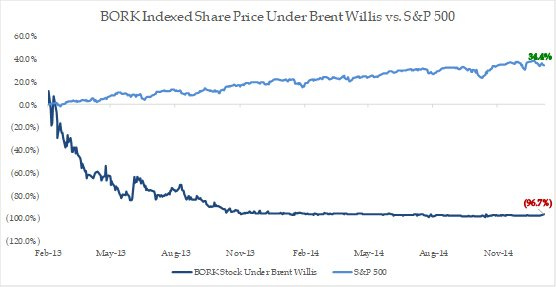

Around the same time he was involved in several other companies that found their way to the public markets and as best as I can piece together the timeframes for which he was associated with each company (I think I am right but could have some of these dates a bit wrong) had performance that looked like this:

So, at THIS point I think reasonable people could agree there is enough of a pattern to say that Brent Willis is either a really unlucky guy or just not very good at generating shareholder returns. Looking at the totality of the information above, the operative question is: By March of 2016 (or earlier) do you think you could have reasonably concluded that Brent Willis is a CEO you don’t mind betting against either in absolute terms or relative to the S&P500?

If the answer is yes and you had a way of tracking operators like Brent, you’d have be in luck because March of 2016 is when Brent joined NewAge, Inc. (a cannabis-related beverage company). And here is a chart of NewAge’s stock price from the month Brent joined as CEO to the end of its life as a public company (at the peak, it was >$500mm of market cap, so not some untradeable pico-cap):

I believe there are two instructive lessons from this result and the totality of Brent Willis’ story:

-

Knowing nothing about the business other than it was a small-cap company focused on a hype-y industry with Brent Willis as its CEO, it was knowable in advance that the stock was likely to eventually end up at or around $0.00.

-

That said, knowing that was true, the path companies can take to zero can be wildly volatile and the real nirvana moments happen when you are able to track folks like Brent over time and get involved when the market ascribes a lot of future value creation potential to someone who has actively demonstrated no ability to actually create value.

-

Please note: this is not meant to be actual financial advice. I am not a financial advisor, I could be dead wrong, and please consult a licensed financial advisor before making any investments in any financial securities.

-

-

Just to round out this story, Brent was eventually charged with fraud by the SEC for his activities while at NewAge.

So let me know: are you convinced? Does this help explain why and how tracking operating executives can lead to interesting investment opportunities? Be sure to click the subscribe button below if so in order to get the next opportunity we find. And jam that share button if you think others might appreciate it as well.

Please also feel free to reach out if you’d like to discuss bespoke ways we can assist in implementing operating executive tracking in your investment process more formally.

P.S.

Unfortunately, this isn’t super useful information today. Brent went on to become CEO of another private company called Vaya Space but when the SEC charged him as mentioned above he was fire. Now he’s COO of an AI-related company (of course) that he apparently co-founded. We can only hope he finds his way back to the public markets eventually…

Until next time!