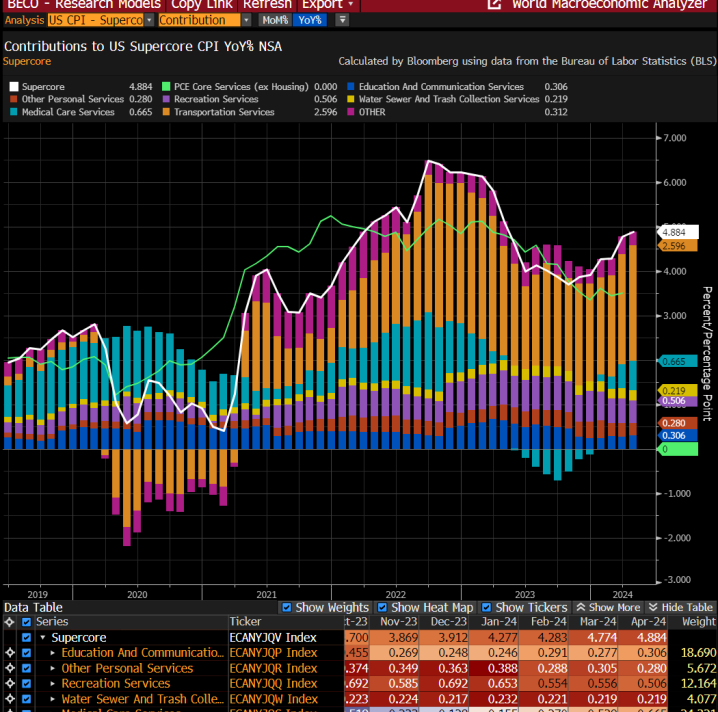

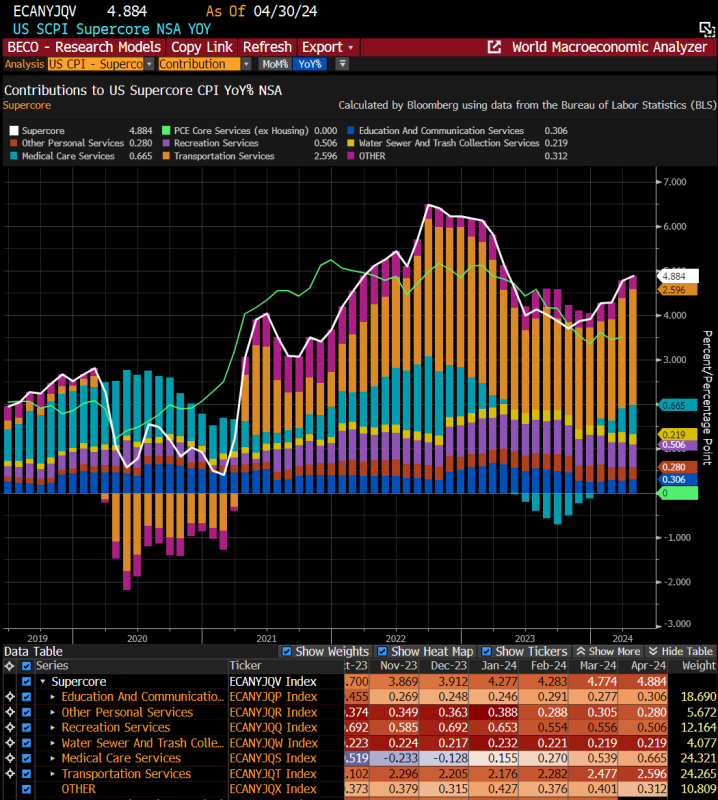

Chart of the Day – April Supercore CPI En Fuego

Source: Bloomberg, BLS

Supercore CPI inflation is core services ex-housing and is often seen as the third pillar of inflation that the Fed is trying to bring back down to target after goods inflation and housing inflation. They seem to be failing in their efforts. This basket, which is about 50% of the the total inflation basket, bottomed last fall and is making 1 year highs on a yoy basis. On a sequential mom basis, supercore inflation was up 0.422%, annualizing near 5% as well. On a 3m annualized basis, the indicator is up over 6% yoy.

The Fed needs to work harder to destroy demand in order to bring inflation back down to target. Just talking about keeping rates higher for longer is not getting the job done.