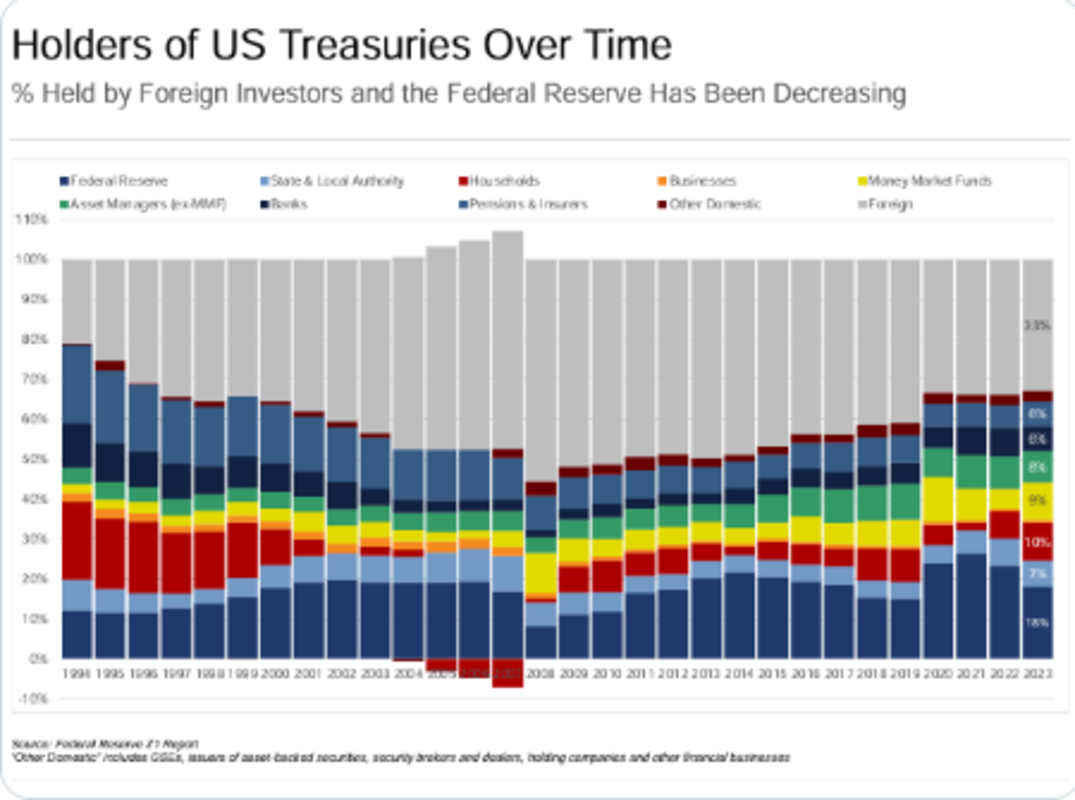

Chart of the Day – Foreign Holdings of USTs Continue to Fall

As we have been discussing for a while now, foreign demand for USTs continues to structurally decline over time as a % of total holdings of USTs.

Whether it is because foreign owners need to sell their USTs to raise US$ in order to pay back their US$ debts, whether it is because they need to raise $ to buy goods, or whether it is because they no longer want to hold USTs as a store of value given the way the US government is abusing its exorbitant privilege by running ridiculously high deficits into perpetuity, there are a variety of reasons why foreigners are selling.

When you add in the geopolitical component of expropriating UST reserves and sanctioning enemies out of the US$ based monetary order, less foreigners are going to want to store their excess reserves over time as well.

As foreigners continue to reduce their holdings of USTs, and the Fed remains on the sideline from adding to its holdings, the US Treasury has had to come up with new buyers that are more price sensitive than those other buyers, which is part of the reason why interest rates continue to move higher. Treasury is saying the quiet parts out loud. Less foreign demand for Treasuries is going to lead to higher borrowing costs for the US government over time.

Source: https://home.treasury.gov/policy-issues/financing-the-government/quarterly-refunding/most-recent-quarterly-refunding-documents