Chart of the Day – Monday, August 5, 2024

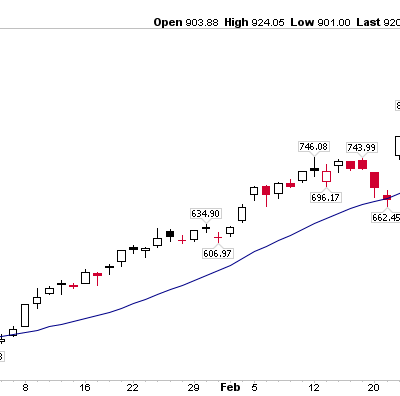

$Vix printed 3rd highest level today since 1990. The Great Financial Crisis in 2008 and the 2020 Covid Pandemic are the only 2 times higher in 34 years. This is indeed how bottoms form but as always bottoms are processes. pic.twitter.com/94EkfVUmXk

— Roy Mattox (@RoyLMattox) August 5, 2024

Today’s Chart of the Day was shared by Roy Mattox (@RoyLMattox).

Today’s Chart of the Day was shared by Roy Mattox (@RoyLMattox).

- The Volatility Index ($VIX) had its second-biggest day in history today, surging +64.93%.

- Roy points out that it reached 65.73 today—its third-highest level ever. However, it pulled back 27 points or -41% from its intraday high to close at 38.56. The $VIX has never closed further below its intraday high.

- The $VIX has only been higher than today during the Great Financial Crisis and the Pandemic. Despite today’s historic move, the S&P 500 is less than -10% off a record high. This smells like capitulation, but as Roy notes, bottoms are usually more of a process than an event.

The Takeaway: The Volatility Index ($VIX) exploded to its third-highest reading in history today. However, it closed significantly off its intraday peak. The S&P 500 is probably nearing a short-term bottom, but turbulence is likely.

The post Chart of the Day – Monday, August 5, 2024 appeared first on The Chart Report.