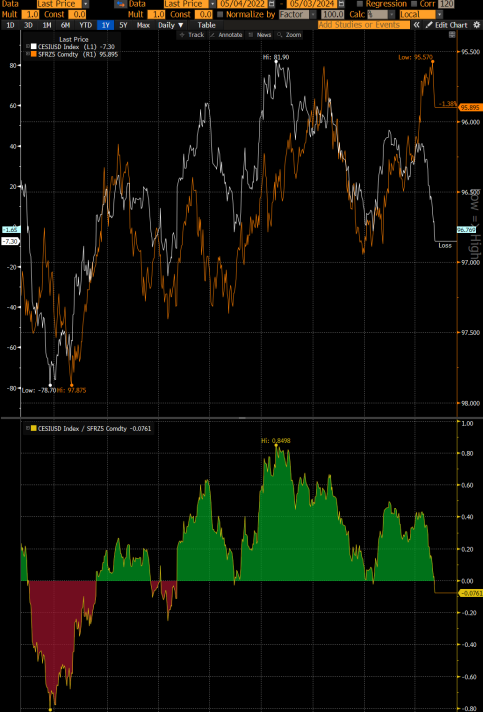

Chart of the Day – SFRZ5 vs US Citi Surprise Index

Source: Bloomberg

There is a pretty reasonable correlation between the outlook for short term interest rates 12-18 months out (as measured by December SOFR Futures – price inverted on chart) and the Citi Economic Surprise Index.

We can see that in recent months, the data has continued to negatively disappoint expectations but so far, expected interest rates in December 2025 have only begun to start falling again (SOFR price is inverted on chart equates to interest rates falling). There is a now a wide gap opened here which suggests that if the economic surprise index continues to fall, the market is going to start pricing in more aggressive interest rate cuts in the future.

I suspect the hesitancy for the market to react to this data disappointment vs. expectations so far has to do with the fact that inflation data remains sticky and elevated vs a target of returning to 2%. We are in a stagflationary-esque environment where growth data is starting to slow but overall inflation data has been re-accelerating over the last few months. This makes it more difficult for the Fed to begin an easing cycle to address the growth slowdown.

However, if the data continues to underwhelm from here, I think markets are going to start expecting that whenever the interest rate cutting cycle begins, it will necessitate even more interest rate cuts than are being priced in now.