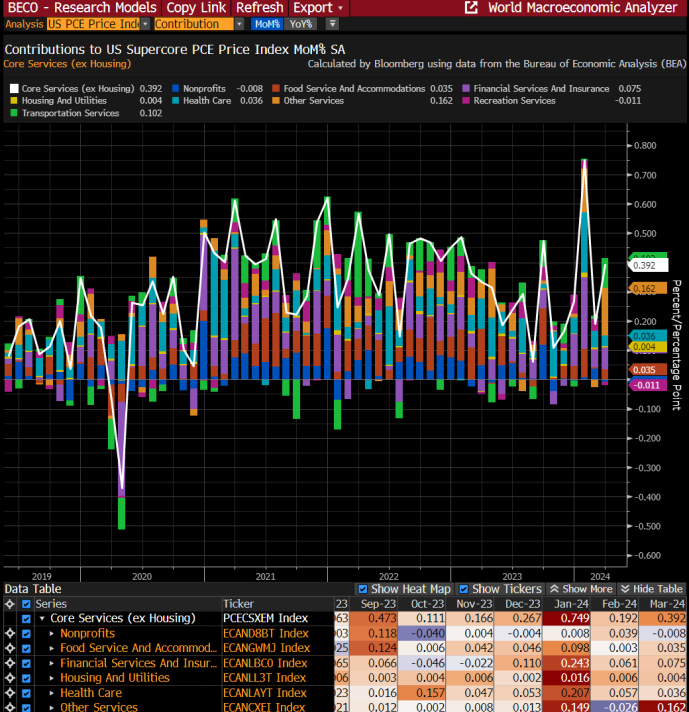

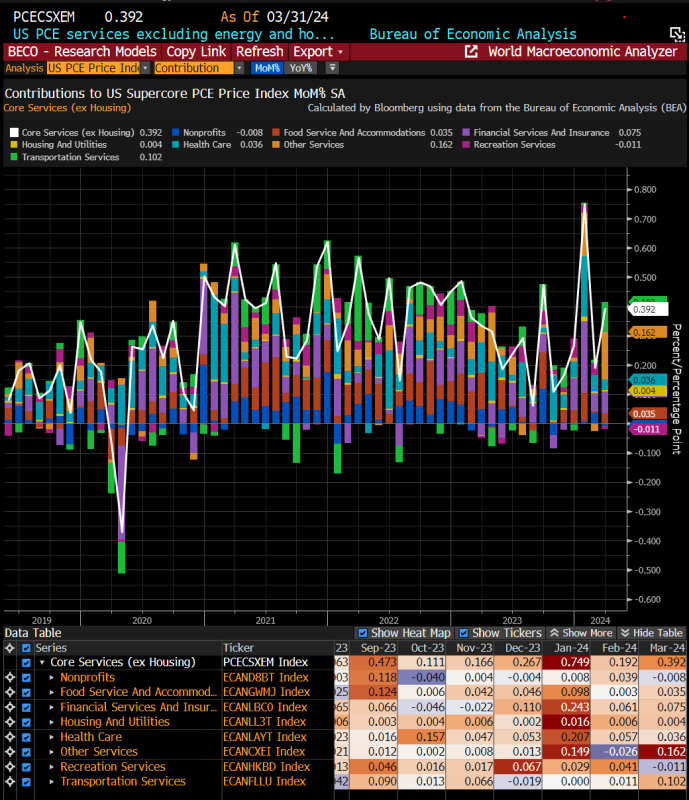

Chart of the Day – US Super-Core Inflation is Too Damn High

Source: Bloomberg

Supercore inflation up 0.392% mom with 3m annualized up to 5.5%. These readings are consistently above a rate of inflation consistent with returning overall inflation to 2%.

The Fed and Treasury together swung for the fences last October/November, believing in the immaculate disinflation and “golden path.” They thought they could engineer a soft landing and return of inflation to 2% without pain. They were wrong.

They didn’t realize that the significant loosening of financial conditions they created by embracing an easing bias would lead to a resurgence of animal spirits, inflation expectations moving back higher again and actual wealth effect gains driving actual inflation further away from target.

Inflation is re-accelerating and the Fed needs to introduce dual sided risk to their next move being a hike or a cut in order to dampen animal spirits, raise term premiums, introduce volatility in rates market, re-anchored inflation expectations and bring inflation back down so this is not an election issue. This is the way.