Chart of the Day – Wednesday, July 17, 2024

1 year ago

1 MIN READ

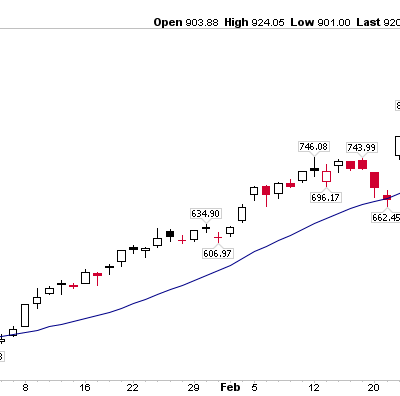

1.618 Fib extension of the 2021-2022 bear market has been achieved…$SPX $SPY $ES_F pic.twitter.com/iAzO5fTDQ5

— Ian McMillan, CMT (@the_chart_life) July 17, 2024

Today’s Chart of the Day was shared by Ian McMillan (@the_chart_life).

Today’s Chart of the Day was shared by Ian McMillan (@the_chart_life).

- The S&P 500 dropped -1.39% from a record high today, marking its first -1% decline since April 30th. Ian points out that the S&P 500 has reached the 161.8% Fibonacci extension of the bear market drawdown.

- This natural resistance level is around 5,600. Within the past week, the Nasdaq and Semiconductors have also reached their Fibonacci targets.

- This is really the first significant resistance level the index has encountered since breaking out seven months ago. This doesn’t mean the bull market is over, but after rallying +14% in just three months, this would be a logical place for a pause, pullback, consolidation, or correction.

The Takeaway: The S&P 500 has arrived at the 161.8% Fibonacci extension of the bear market decline, around 5,600. This is a natural spot for Large Caps to digest their recent gains.

The post Chart of the Day – Wednesday, July 17, 2024 appeared first on The Chart Report.