Crypto's New Class System: Bitcoin Aristocracy, Ethereum Gentry, Altcoin Peasantry 👑

OVERVIEW

Crypto’s New Class System: Bitcoin Aristocracy, Ethereum Gentry, Altcoin Peasantry 👑

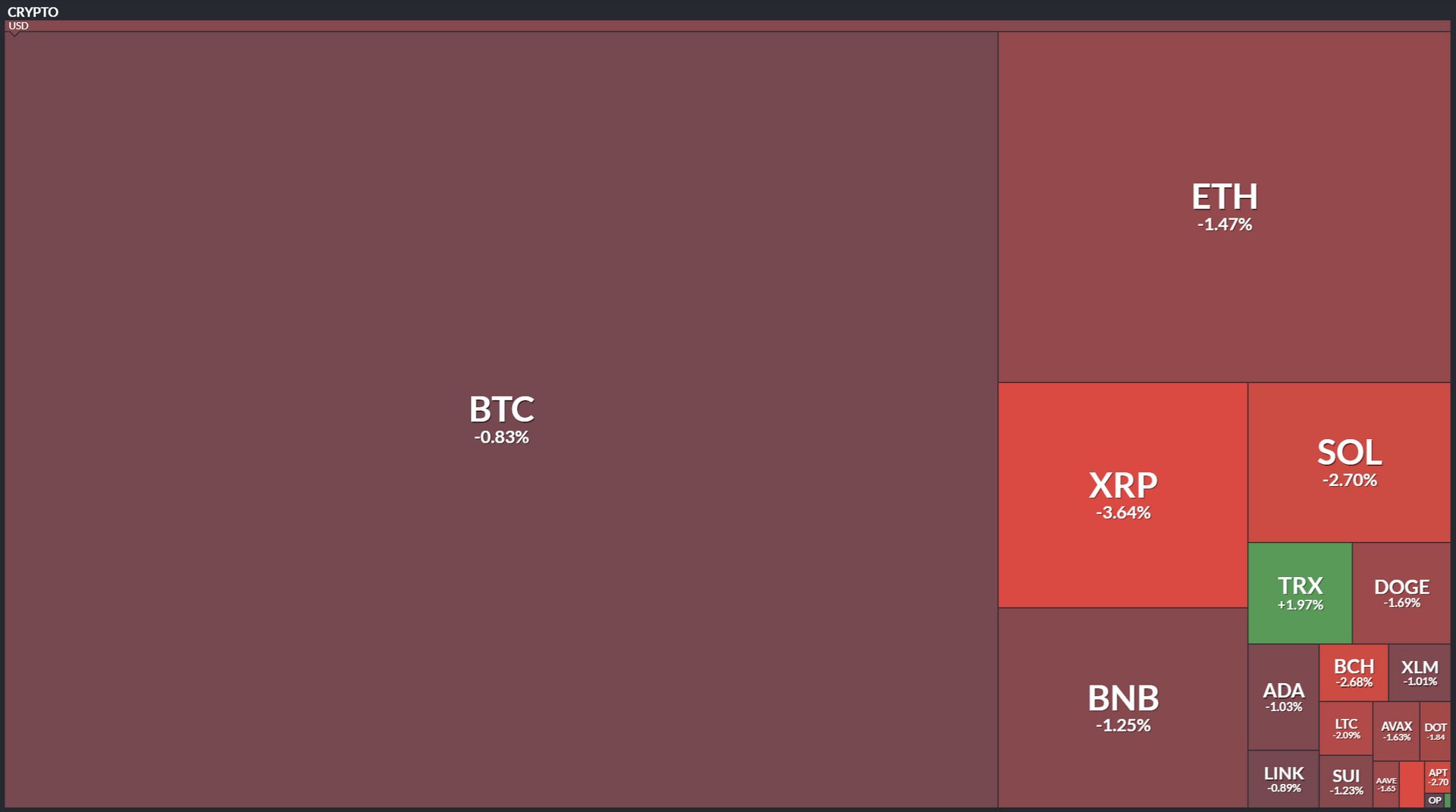

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

ON-CHAIN ANALYSIS

MVRV Analysis Reveals Summer 2025 Buyers Are Still In Therapy, November Buyers Doing Fine 🧠

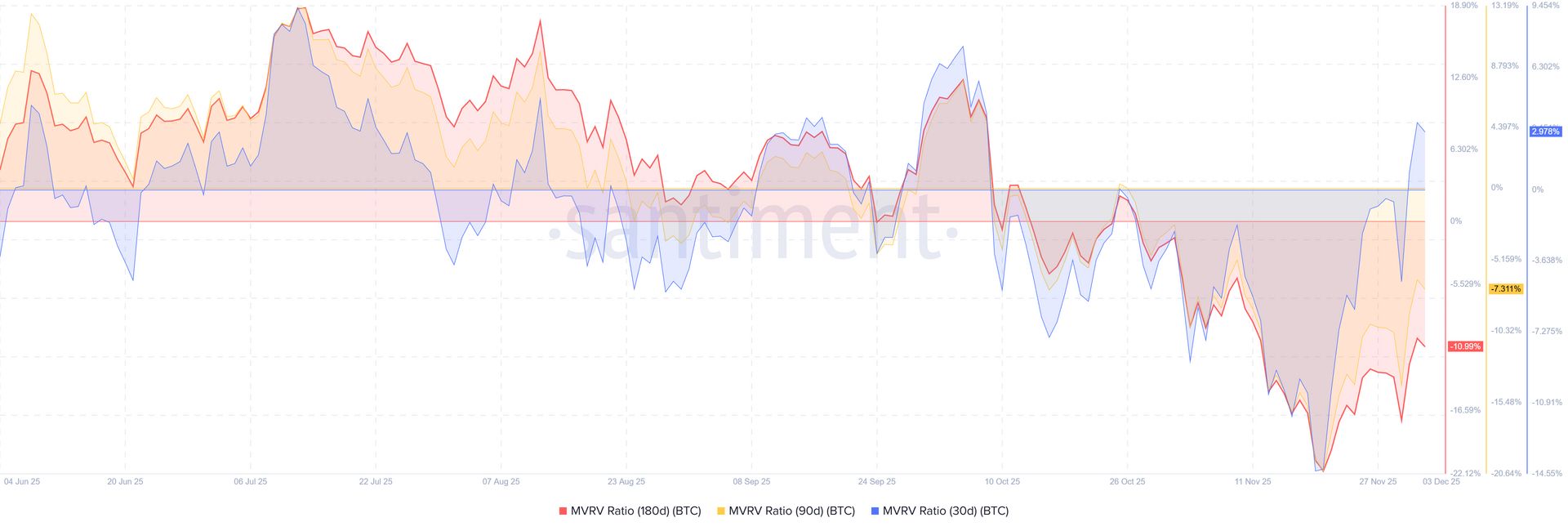

The Market Value to Realized Value (MVRV) ratio measures the difference between an asset’s current market price and its average acquisition cost across all holders.

In other words: it tells us whether the average holder is making or losing money at current prices. A positive MVRV means holders are in profit; negative means they’re underwater.

The ratio becomes particularly useful when examined across multiple timeframes (180-day, 90-day, 30-day) because the gradient reveals momentum – whether recent buyers are being rewarded or punished relative to longer-term holders.

$BTC.X ( ▼ 3.6% )

Verdict: BULLISH (textbook recovery)

Bitcoin is doing exactly what you’d expect it to do: steadily grinding higher across all timeframes.

The -11.0% on the 180-day tells us Summer wasn’t pretty, but the improvement to -7.3% at 90 days and the flip to positive territory at +3.0% on the 30-day is the MVRV equivalent of a perfect staircase.

Recent buyers are in the green, three-month buyers are nursing manageable losses, and six-month holders are down but not destroyed. This is healthy price discovery with proper absorption of supply. No euphoria, no panic – just steady accumulation showing up in the data. 🤑

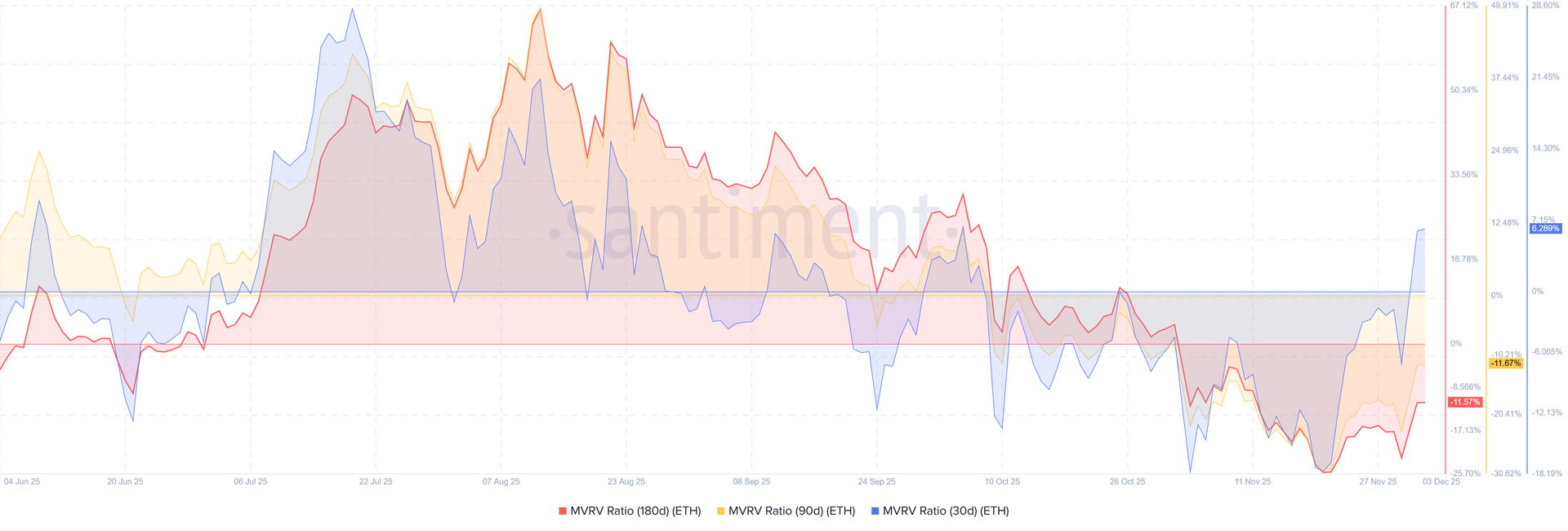

$ETH.X ( ▼ 2.22% )

Verdict: BULLISH (explosive recent momentum)

The nearly identical 180-day and 90-day readings (-11.6% vs -11.7%) tell you ETH spent most of Q3 in purgatory, chopping sideways without giving anyone relief. But that +6.3% on the 30-day? That’s the kind of sharp reversal that indicates something changed in November.

This is actually better recent performance than Bitcoin, which is worth noting given ETH’s chronic underperformance throughout 2024-2025.

The flat middle timeframes followed by the 30-day spike suggests buyers who showed up in November are being rewarded, while anyone who bought during the Summer/Fall malaise is still working through their cost basis. ➗

$XRP.X ( ▼ 6.26% )

Verdict: NEUTRAL (improvement without conviction)

XRP is doing the right things (consistently improving across all three timeframes) but it’s not doing them with authority. Even the 30-day holders are underwater at -5.0%, which means this asset still hasn’t built the kind of momentum needed to flip recent buyers into profit.

The progression from -16.3% to -10.2% to -5.0% is encouraging, but it’s the MVRV pattern of an asset that’s stabilizing rather than one that’s running. There’s no blood in the water anymore, but there’s no real participation either.

This is “less bad” rather than “actually good.” If you’re already holding XRP, fine, but this isn’t the MVRV structure that screams “add here.” 😶

$LINK.X ( ▼ 6.46% )

Verdict: BULLISH (only legitimate altcoin winner here)

Finally, an asset that remembered how to do basic math. LINK is the only altcoin in this cohort with a positive 30-day MVRV, meaning recent buyers are actually, brace yourself, making money.

The progression from -17.9% (180d) to -15.3% (90d) to +3.1% (30d) is exactly what you want to see: consistent improvement across all timeframes without the whiplash volatility plaguing the others.

This doesn’t mean LINK is going to the moon, but it does mean the asset is absorbing buying pressure efficiently and rewarding participants who didn’t panic-buy the top six months ago.

If I had to pick a winner out of seven tickers we’re looking at based purely on MVRV structure, this is the obvious choice. 🥇

$ADA.X ( ▼ 5.36% )

Verdict: NEUTRAL (leaning cautiously optimistic)

This is the on-chain definition of “less bad.”

Anyone who bought ADA in the last six months is underwater. But the progression from deeply negative to barely negative tells you something: recent buyers aren’t getting annihilated, which is more than I can say for Q2/Q3 entrants.

The 30-day sitting at -1.7% means last month’s buyers are essentially at breakeven, while the 180-day crew is still licking wounds from what was clearly a summer disaster. This isn’t bullish, it’s just stopped being aggressively bearish. 🤷

$CRO.X ( ▼ 4.25% )

Verdict: NEUTRAL (surgical recovery pattern)

CRO hodlers from June are currently sitting on a -41% realized loss, which is the kind of number that makes you question your life choices.

But here’s what matters: the 90-day improved to -27.9%, and the 30-day is nearly flat at -1.7%. The gradient matters more than the absolute values here – someone who bought last week is fine, someone who bought last summer is contemplating career changes.

Still all negative, still all underwater, but the trajectory is unmistakable. 😐️

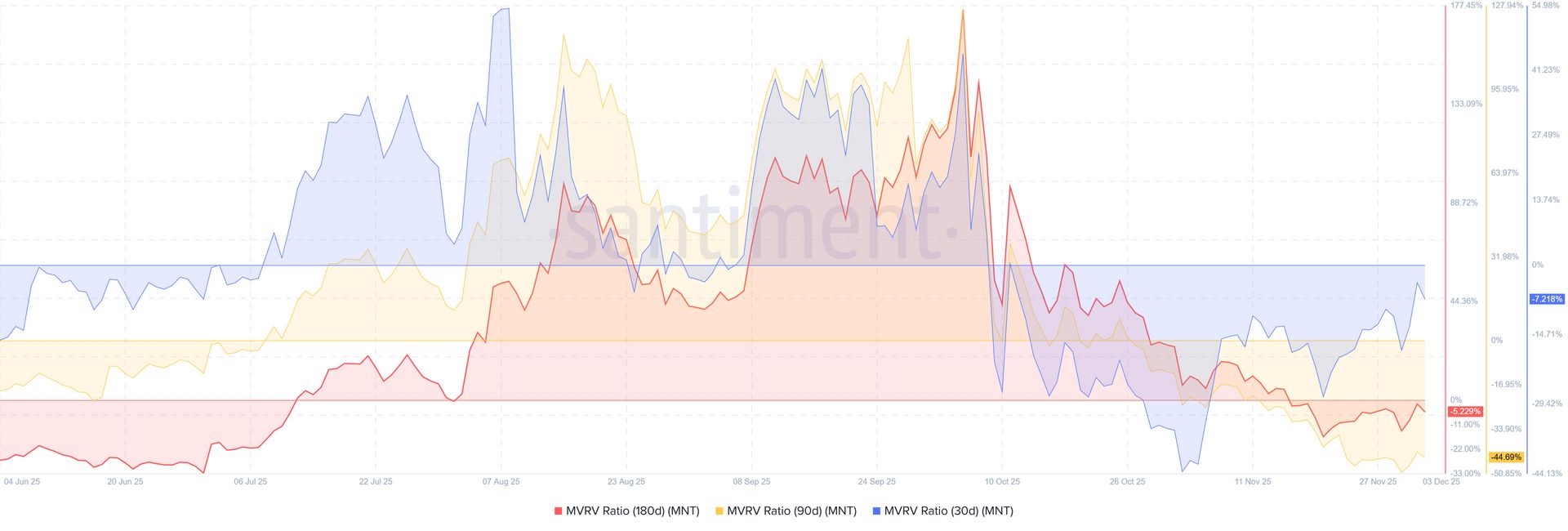

$MNT.X ( ▼ 2.02% )

Verdict: BEARISH (damaged goods)

This MVRV pattern is fascinating in the worst way possible.

The 180-day being only -5.2% while the 90-day sits at -44.7% tells you exactly what happened: MNT experienced a concentrated implosion somewhere in the August-October window, and while it’s started recovering (30-day at -7.2%), it’s nowhere near healed.

This is the MVRV signature of a “flash crash followed by zombie bounce.” Anyone who bought during the September/October carnage is still deep in the red, and the weak 30-day recovery suggests there’s no real conviction in the bounce. This one needs more time in the hospital. 🏥

NEWS

CFTC Approves First Regulated Spot Crypto Trading. Actually a Big Deal.

Bitnomial goes live with federally supervised spot crypto. The regulatory ice age might finally be thawing.

Bitnomial became the first CFTC-registered exchange authorized to offer spot cryptocurrency trading under federal supervision, with authorization effective December 1st and launch scheduled for the week of December 8th.

US retail traders can now buy and sell digital assets on a fully regulated commodities exchange for the first time. Not through offshore platforms, not through unregistered exchanges operating in regulatory gray zones, but through a federally supervised DCM with clearinghouse settlement.

TBitnomial operates both a Designated Contract Market (Bitnomial Exchange) and a Derivatives Clearing Organization (Bitnomial Clearinghouse), enabling portfolio margining across spot, perpetuals, futures, and options – all on one exchange.

That means traders can offset risk across product types instead of maintaining separate, fully-collateralized positions on multiple venues. No redundant margin requirements. Net settlement eliminates counterparty risk.

But the precedent is the bigger story. Coinbase, wagering/betting platforms, and other DCMs now have a roadmap. The CFTC just signaled it’s willing to recognize spot digital assets within existing commodities-exchange frameworks.

It’s about time. ⌚️

NEWS

UK Government Considers Banning Crypto Donations After Record £9M Gift to Reform

Nothing says “my argument sucks” like trying to ban how people donate to your opponents. 🤦

Christopher Harborne, a British crypto investor living in Thailand, just donated £9 million ($12M) to Reform UK – the largest single political donation ever made by a living person to a UK political party.

It broke the previous record of £8 million set in 2019.

The donation pushed Reform UK’s Q3 fundraising to £10.2 million, more than double the Conservatives’ £4.6 million and dwarfing Labour’s £2.1 million. It’s the first full quarter since the 2024 general election where Reform outpaced the Conservatives in fundraising.

Naturally, the UK government is now discussing whether to ban cryptocurrency donations entirely.

Now that Reform is polling at the top nationally and outfundraising the establishment parties, suddenly crypto donations are a “national security risk.” The Ministry of Housing, Communities and Local Government warns that “existing rules leave the political system exposed to covert foreign influence.”

You know what actually enables covert foreign influence? Shell companies. Offshore structures. Layered intermediaries. All of which remain perfectly legal for political donations in the UK.

The irony is spectacular: ban the transparent, traceable donation method while leaving the opaque ones untouched. SMH. 😶

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

💵 Native USDC Lands on Starknet And Immediately Fixes Half of DeFi’s Annoyances

Native USDC on Starknet means no more wrapped-token chaos, fragmented liquidity, or anxiety-inducing bridges – Circle mints and burns directly, and CCTP does the heavy lifting. Apps, wallets, and Bitcoin DeFi now get clean dollar rails with real liquidity and predictable pricing. Starknet.

🛡️ Holochain 0.6 Ships a Real Immune System So Bad Actors Get Bitch Slapped Automatically

Holochain’s latest release finally adds network-level blocking for agents whose data fails validation, complete with warrants that follow bad keys around like a digital restraining order. The immune system isn’t perfect yet, but the groundwork is finally in place for validating, throttling, and isolating malicious actors on autopilot. Builders are encouraged to upgrade now and break things early. Holochain.

🤖 SKALE on Base Becomes the Dark Forest for AI Agents — Private, Gasless, and Blazing Fast

SKALE’s Base deployment gives AI agents a secluded execution zone where their strategies stay encrypted, their transactions stay gasless, and their loops finalize in under a second. It’s everything agents need: privacy, consistency, and zero-fee microtransactions to make x402 payments actually feasible. SKALE Network.

🕵️♂️ AgentFlux Brings Private, On-Device AI Agents to Onchain Finance Without Leaking Your Alpha

AgentFlux lets institutions run powerful AI agents locally (next to their keys, strategies, and client data) instead of piping secrets into the cloud. By splitting tool-calling into selection + argument-generation models, the framework hits near-cloud accuracy (why does that sound kind of iffy?) while preserving full privacy. Axelar.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🎤 Gala Music Kicks Off Artist Token Wars With FIMCOIN

Gala opened creator-launched tokens, and FIMCOIN became the first to rocket out, hitting launch and graduation in under an hour. Artists can now mint their own coins, rally fans, and plug into Gala’s ecosystem instead of begging algorithms for mercy. It’s crypto’s version of “support independent artists,” except now fans get to speculate on your career arc in real time. Gala Games.

🧾 NFT SUB Brings Web2 Subscriptions to Web3 Without the Pain or the Paperwork

NFT SUB transforms subscriptions into ERC-1155s with on-chain renewals, Reactive-powered automation, and zero dependency on centralized billing. Merchants define terms, users mint subscription NFTs, and Reactive Contracts handle charging, expiry, and renewals like clockwork. This could be one of the first subscription models that doesn’t rely on duct-taped cron jobs or off-chain databases praying not to crash. Reactive Network.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🔥 Firelight Unlocks XRP Staking and Builds the Missing Yield Layer for XRPFi

Firelight finally gives XRP holders a real staking and liquid staking system, minting stXRP that plugs straight into Flare’s DeFi stack. Phase 2 adds DeFi cover markets, letting stakers earn yield by backing protections against hacks and oracle failures; something the ecosystem desperately needs. Flare Network.

🔥 PancakeSwap Burns Another 4.47M CAKE And Continues Its Ultrasound Crusade

CAKE supply dropped again in November – the 27th straight month of reductions – thanks to aggressive burning outpacing emissions by over 3.8 million tokens. Trading, predictions, and ecosystem fees are doing the heavy lifting as PancakeSwap grinds toward long-term deflation. PancakeSwap.

NEWS IN THREE SENTENCES

Protocol News 🏦

🌉 IOTA Integrates LayerZero + Stargate And Goes Full Omnichain Across 150+ Networks

IOTA’s LayerZero integration connects it to Ethereum, Solana, Base, BNB Chain and basically the whole multichain internet in one shot. Real-world asset flows, stablecoin mobility, and supply-chain finance all get native connectivity backed by OFT standards instead of bridge duct tape. It’s a massive step that turns IOTA into real infrastructure rather than a siloed ecosystem yelling about data flow. IOTA.

LINKS

Links That Don’t Suck 🔗

😆 Binance’s CZ roasts Peter Schiff in Bitcoin debate, calls tokenized gold a ‘trust‑me-bro’ scam

🦄 Ledger Unlocks Secure, Onchain Swaps with the Uniswap Trading API

🤯 MetaMask Teams Up with Polymarket for Prediction Markets

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋