Daily Chart Report 📈 Friday, May 24, 2024

Powered By:

Today’s Summary

Friday, May 24, 2024

Indices: Nasdaq -0.44% | S&P 500 -0.74% | Dow -1.53% | Russell 2000 -1.60%

Sectors: All 11 sectors closed lower. Tech led but still fell -0.81%. Real Estate lagged, dropping -2.12%.

Commodities: Crude Oil futures fell -0.90% to $76.87 per barrel. Gold futures dropped -2.33% to $2,337 per oz.

Currencies: The US Dollar Index rose +0.13% to $105.05.

Crypto: Bitcoin fell -1.70% to $67,945. Ethereum rose +1.22% to $3,782.

Volatility: The Volatility Index rose +3.90% to 12.78.

Interest Rates: The US 10-year Treasury yield rose to 4.477%.

Here are the best charts, articles, and ideas shared on the web today!

Chart of the Day

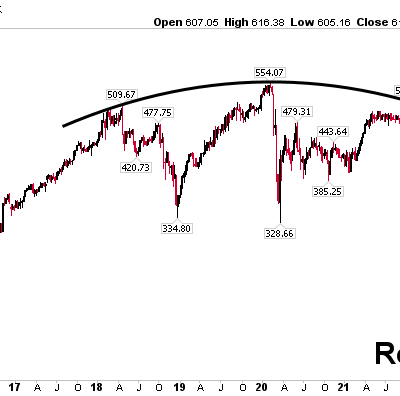

So many things looking good lately. Not so much for transports. $IYT in a dangerous spot. Something to watch pic.twitter.com/Pkqf7xIzlE

— Gregory Krupinski (@G_krupins) May 24, 2024

Today’s Chart of the Day was shared by Gregory Krupinski (@G_krupins).

Today’s Chart of the Day was shared by Gregory Krupinski (@G_krupins).

- The S&P 500 closed higher for the fifth consecutive week, although it was essentially unchanged (+0.03%). More importantly, it’s at all-time highs along with other key groups like Semis and Homebuilders.

- While many risk-on groups are leading, Greg points out that Transports have continued to lag. The Transportation ETF ($IYT) just had its worst week since October, dropping -3.42% to a fresh year-to-date low.

- $IYT is testing a pivotal level around $63. This level represents the January lows, the 200-day moving average, and the neckline of a potential Head & Shoulders pattern.

The takeaway: Transports ($IYT) are threatening to break down while other risk-on groups, like Semis and Homebuilders, are at all-time highs. Watch how $IYT behaves around $63 next week.

Quote of the Day

“Life is a tragedy when seen in close-up,

but a comedy in long-shot.”

– Charlie Chaplin

Top Links

NVIDIA Reigns Supreme While Majority of Stocks Decline on the Week – Trade Risk

Evan Medieros highlights some key takeaways from this week’s price action.

Semis – 20% in Five Weeks – Bespoke

Bespoke looks at the latest thrust in Semiconductor stocks.

Surge in TSLA and Strong AMZN Not Enough – StockCharts

Julius de Kempenaer examines recent sector rotation.

Are Cracks Starting to Appear as Stocks Fly Into the Holiday Weekend? – Ciovacco Capital Management

Chris Ciovacco analyzes the current market environment.

Top Tweets

$SPY negates that bearish daily candle yesterday, but a weekly doji pic.twitter.com/v354vll74V

— Mike Zaccardi, CFA, CMT

(@MikeZaccardi) May 24, 2024

Can’t help but notice a major league bearish divergence between $SPX $QQQ and most market breadth indicators… pic.twitter.com/7Si3e4fRAP

— David Keller, CMT (@DKellerCMT) May 24, 2024

Best week for Tech vs. S&P 500 since last November pic.twitter.com/HchVR88zzt

— Kevin Gordon (@KevRGordon) May 24, 2024

Communication Services testing the 2021 trend breakdown level — part deux$XLC pic.twitter.com/B2mj9xJ8bm

— Wall Street Wingman (@WallStWingman) May 24, 2024

What’s crazier? That semis are up over 20% in the last five weeks, or that it’s the second time this year that the sector has rallied this much in five weeks? $SMH $SOX $NVDA pic.twitter.com/6TvhYX7pQX

— Bespoke (@bespokeinvest) May 24, 2024

June and August are up 1.3% in election years.

Those months usually aren’t that great in most years. Summer rally is still likely. pic.twitter.com/LX6FTKJOrf

— Ryan Detrick, CMT (@RyanDetrick) May 24, 2024

$IWM Monthly. “You are here.”

Reminder of the big picture. Stop getting worked up about the daily noise. pic.twitter.com/uajnxXApwE

— Brian G (@alphacharts) May 24, 2024

Great chart showing how all of S&P 500’s new highs come when $SPY volume is low, which totally validates our use of SPY as the “Peoples’ Fear Gauge” If ppl happy no need to touch SPY but when storm comes it is used heavily to tweak/position portfolios via @psarofagis pic.twitter.com/3u0uZCnDoI

— Eric Balchunas (@EricBalchunas) May 24, 2024

Finally what every precious metals investor wants to see.

A Silver/Gold ratio breakout on the weekly timeframe.

This is usually a very bullish signal for PM markets.

Got #silver and #gold? pic.twitter.com/3NStQBhdVB

— Brandon Beylo (@marketplunger1) May 24, 2024

My key question for next week:

Is this week a short-term bearish flag pattern in the US Dollar Index $DXY or the resumption of the 2024 bull market?

I can see a case for either, but leaning toward a potential break down – time will tell! pic.twitter.com/jNSdfuBtkL

— Matt Weller CFA, CMT (@MWellerFX) May 24, 2024

Three day weekend = Time for the crypto bros to shine

$BTC pic.twitter.com/fC0Z8ws0Aj

— TrendSpider (@TrendSpider) May 24, 2024

You’re all caught up now. Thanks for reading!

The post Daily Chart Report 📈 Friday, May 24, 2024 appeared first on The Chart Report.