Despair Is Priced In. Hope Isn't. 😐️

OVERVIEW

Despair Is Priced In. Hope Isn’t. 😐️

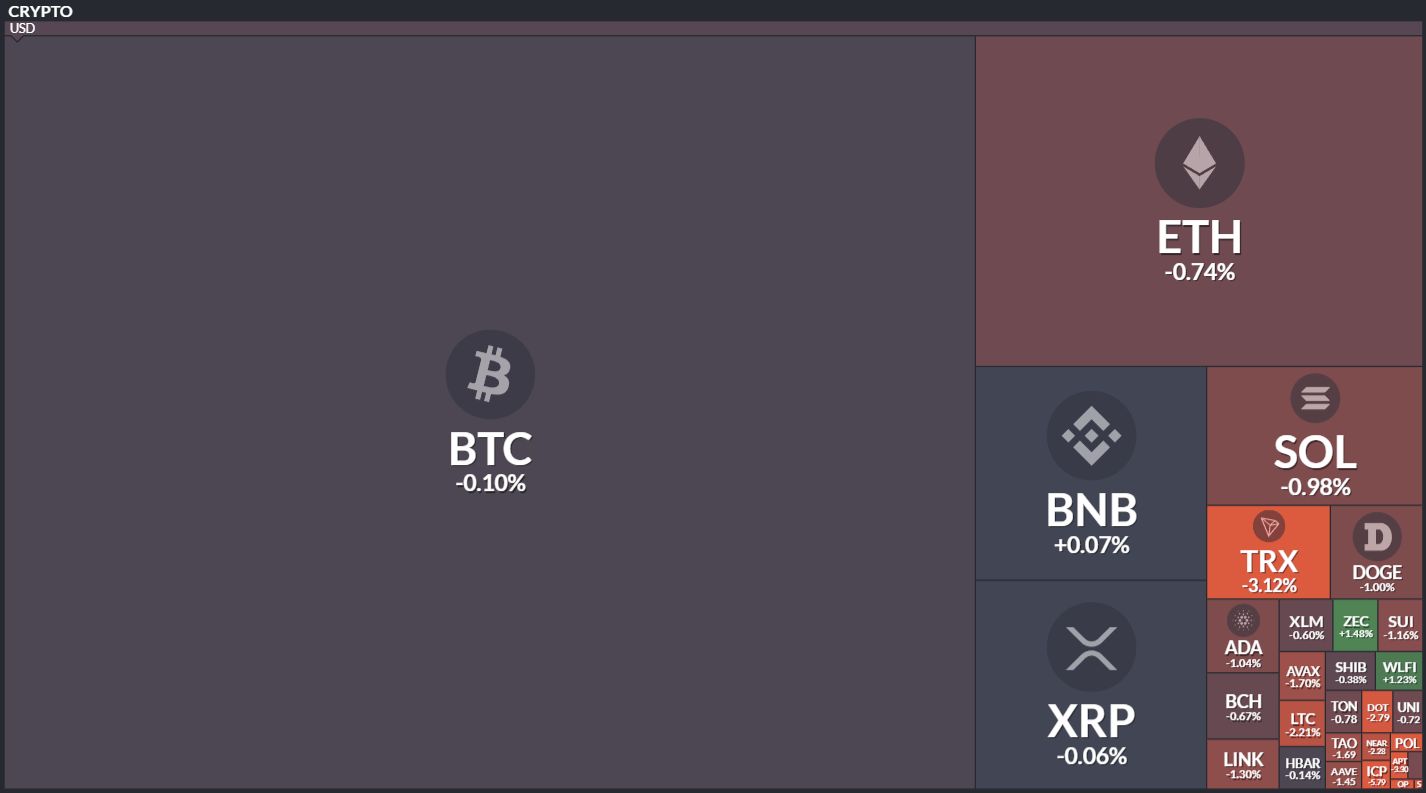

Before we dive in, here’s today’s crypto market heatmap:

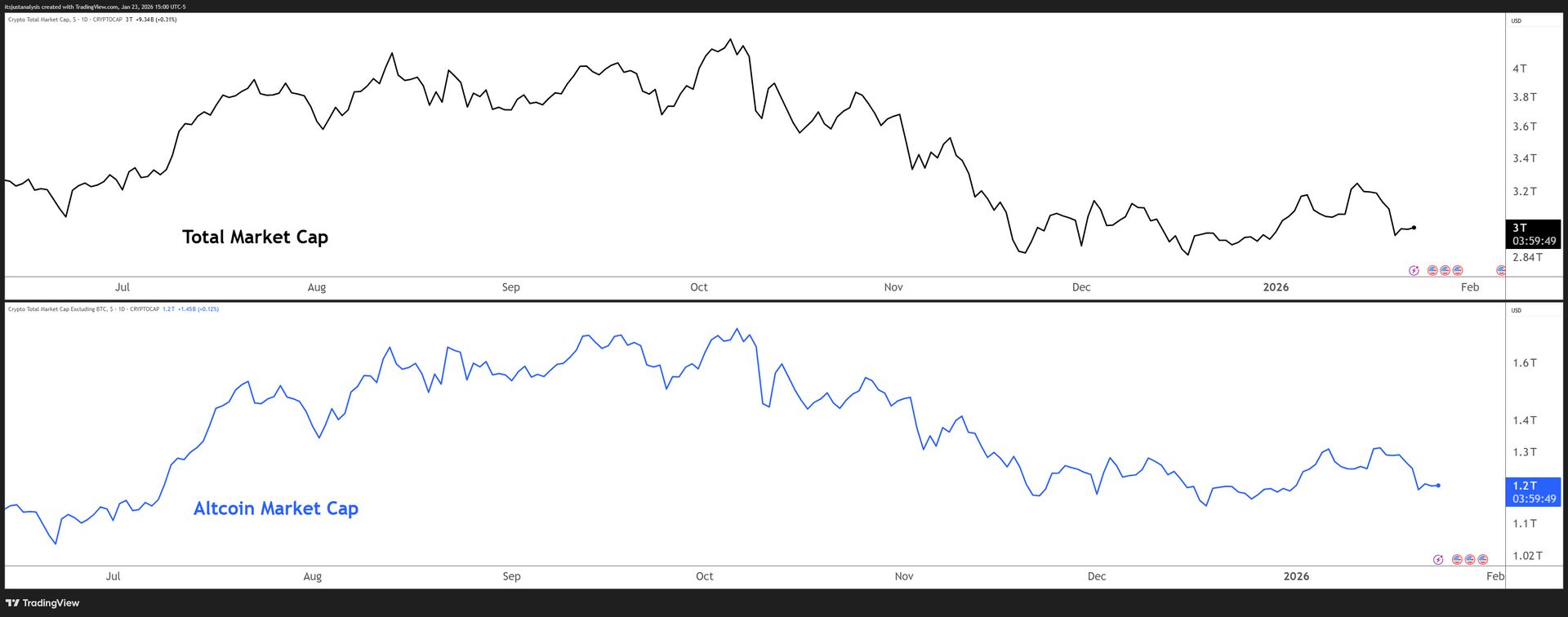

And here’s a look at crypto’s total market and altcoin market cap charts:

CRYPTOTWITS

New Cryptotwits Podcast Episode! 📺️

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

ON-CHAIN ANALYSIS

The Structural Conviction Index ⚖️

We last looked at the Structural Conviction Index (SCI) back in the January 6 edition of the Cryptotwits newsletter. 📰

Most on-chain metrics tell you what happened. I wanted something that tells me what’s happening – where conviction is migrating in real-time. That’s why I built the Structural Conviction Index.

What It Measures

The SCI tracks three migration channels and combines them into a single composite score from -100 (conviction collapsing) to +100 (conviction accelerating).

Age Migration looks at Mean Coin Age. When coins sit in wallets without moving, they get “older.” When they move, the average age drops. Rising age means holders are holding. Falling age means old coins are waking up – usually to be sold.

Custody Migration tracks exchange flows. Coins moving onto exchanges typically signals intent to sell. Coins leaving exchanges signals accumulation – people pulling assets into cold storage or staking, taking them off the market.

Concentration Migration measures where supply is moving between wallet cohorts. Are whales accumulating while retail distributes? Or is smart money handing bags to less sophisticated participants? This channel captures the flow of supply between strong and weak hands.

Each channel gets normalized to a -100 to +100 scale based on recent historical context, then averaged into the composite. 🔢

The Lucky Three

Today we’re going to look at Bitcoin, Ethereum, and Chainlink.

$BTC ( ▼ 0.35% ) is the benchmark. It’s where institutional capital lives and where the clearest signal tends to emerge.

$ETH ( ▼ 2.62% ) is the bellwether for the broader altcoin market. When ETH shows conviction, alts usually follow. When it doesn’t, they struggle.

$LINK ( ▼ 0.17% ) is he altcoin with arguably the greatest use and utility by traditional finance. It also tends to move differently than the majors, which makes it useful for spotting divergences.

Three assets. Three conviction profiles. Let’s see where the data says smart money is migrating. 🚶

ON-CHAIN ANALYSIS

Structural Conviction Index: Bitcoin 🪙

The Three Channels

Age Migration: +76.5

This one’s simple. When coins sit still for a long time, they get “older.” When they move, the average age drops. Right now, Bitcoin’s Mean Coin Age (90d) is climbing – up 10% over the past two weeks, sitting at 45.7 days.

Translation: Long-term holders aren’t selling. The diamond hands are diamond-handing.

Custody Migration: -100

This is the one flashing red. About 18,600 BTC moved onto exchanges over the past week. That includes a single-day bomb of 26,000 BTC on January 13th – the biggest daily inflow since mid-July.

When coins move to exchanges, it usually means someone’s getting ready to sell. So why isn’t this more concerning?

Because of the other two channels (Age and Concentration).

Concentration Migration: +100

Whale wallets – the 1,000 to 100,000 BTC cohort – now hold 32.43% of total supply. That number has been grinding higher. These aren’t retail gamblers. These are entities with conviction and time horizons measured in years, not days.

So whales are accumulating. Aggressively.

Putting It All Together

Weak hands are selling into strength.

The exchange inflows are real, but the coins moving aren’t coming from long-term holders (age is rising) or whales (concentration is rising). That means it’s the mid-curve – probably the 2024 ETF people who bought the hype and are now rotating out.

Someone’s buying what they’re selling. And that someone has bigger wallets and longer time preferences.

What To Watch

Age Migration turns negative. If Mean Coin Age starts falling, it means old coins are waking up and moving. That’s distribution from conviction holders.

Concentration velocity flips. If whales stop accumulating – or worse, start distributing to retail – the structural case falls apart.

Exchange inflows persist. One week of inflows during an uptrend is noise. Two weeks starts to look like intent.

None of those conditions exist right now. Until they do, the on-chain data says the adults are accumulating while the tourists panic-rotate.

Conviction is migrating toward stronger hands. That’s the only thing the SCI is designed to measure, and right now it’s pointing up.

What Does The Rest Of The Month Look Like?

SCI Composite: +25.5 – Leaning Bullish

Two of three channels aligned bullish. Current reading sits in the 69th percentile of all observations since July. The 30-day average is +29, well above the historical mean of +9.

We’re in accumulation territory, Patient accumulation – the kind that looks obvious only in hindsight. 👀

STOCKTWITS

They Made Me Post This 🤦

Silver hit $100. I am happy. Thrilled. So are many of you. 😃

ON-CHAIN ANALYSIS

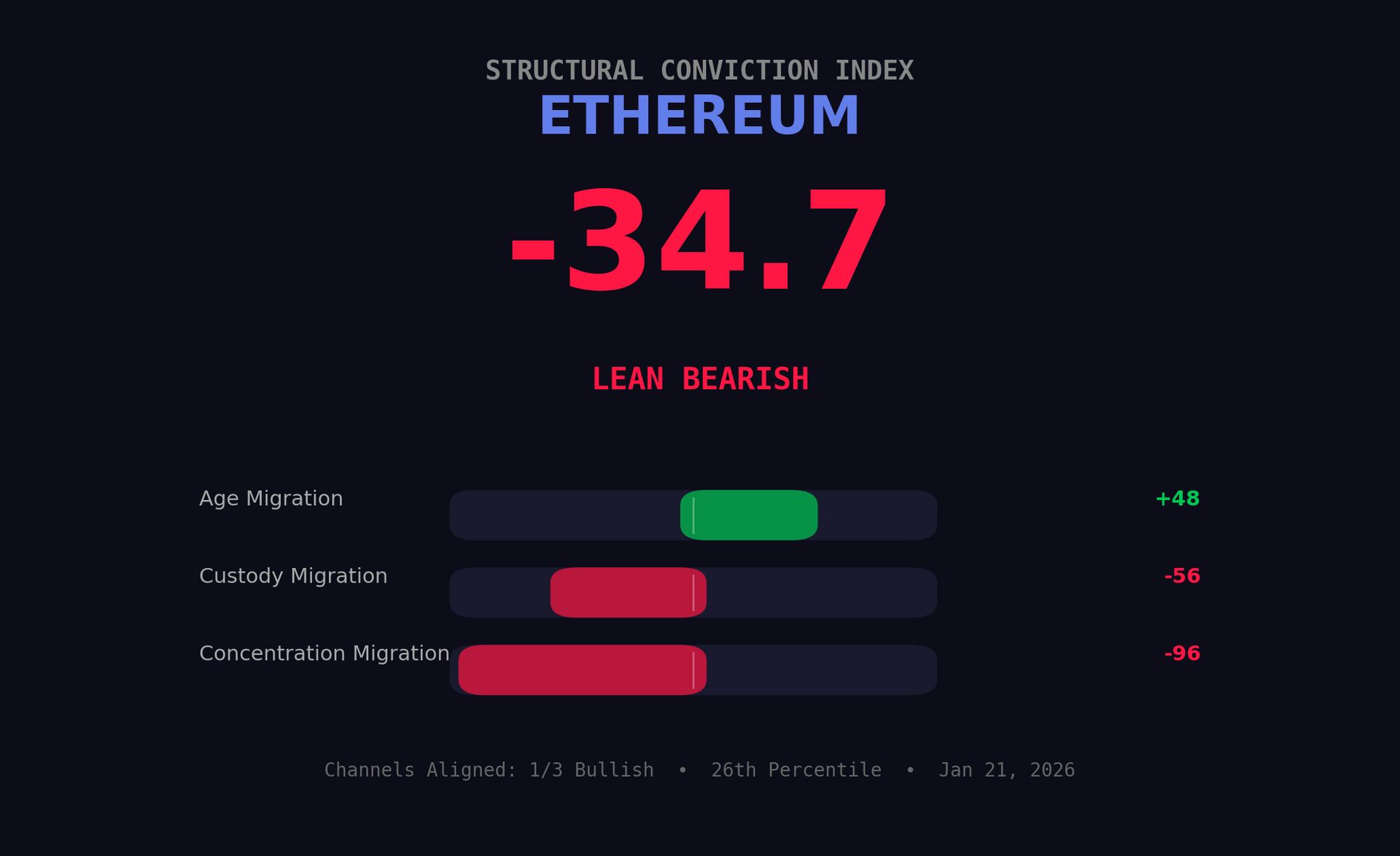

Structural Conviction Index: Ethereum 🥈

The Three Channels

Age Migration: +48.2

This is Ethereum’s one bright spot. Mean Coin Age (90d) is at 41.6 days and trending up – meaning some holders are still parking their coins and not touching them. Long-term conviction isn’t completely dead.

Custody Migration: -56.3

Here’s where it gets interesting. Ethereum actually saw net outflows from exchanges over the past week – about 89,000 ETH leaving. Normally that’s bullish. Coins leaving exchanges usually means accumulation.

So why is the score negative?

Because relative to recent history, this pace is weak. Back in late November, 1.28 million ETH left exchanges in a single day. The current trickle doesn’t signal aggressive accumulation. Nobody’s rushing to buy, but nobody’s panic-selling either. It’s the on-chain equivalent of a shrug.

Concentration Migration: -96.1

This is the ugly one.

The whale cohort (10K to 1M ETH holders) has been steadily bleeding supply while retail absorbs it. When whales distribute to retail, that’s textbook late-cycle behavior. Smart money handing bags to less sophisticated participants.

This channel is nearly maxed bearish, and it’s been that way for weeks.

Putting It All Together

Ethereum has a whale problem. Not the “too many whales” kind – the “whales are leaving” kind.

The supply distribution data is clear: large holders are reducing exposure. The ETH they’re selling isn’t all going to exchanges – some of it is being sold directly to smaller wallets. Retail is absorbing the supply, which historically doesn’t end well for retail.

The one saving grace is Age Migration staying positive. Whatever ETH isn’t being sold is getting older, meaning some conviction holders are still in diamond-hand mode. But it’s not enough to offset the distribution pattern.

What To Watch

Concentration velocity flips. Whales need to stop distributing. If the 10K-1M ETH cohort stabilizes or starts accumulating again, this changes the picture completely.

Custody Migration turns strongly positive. Not mild outflows – sustained 100K+ ETH daily outflows for a week or more. That would signal real accumulation, not just apathy.

Age Migration accelerates. A move from +48 toward +80 would tell me conviction holders are truly committed through this distribution phase.

None of those conditions exist right now.

Look – ETH isn’t going to zero. It’s still the second-largest crypto asset by market cap, it has a real ecosystem, and the staking mechanism provides some structural demand. But structural conviction? Right now, it’s migrating elsewhere.

Sometimes the data tells you what you don’t want to hear. This is one of those times.

What Does The Rest Of The Month Look Like?

SCI Composite: -34.7 – Leaning Bearish

One of three channels aligned bullish. Current reading sits in the 26th percentile of all observations since July. The 30-day average is -37, well below the historical mean.

The divergence between BTC and ETH is, well, I’m not sure if there is a good comparison. Let’s just say wildly different.. Bitcoin’s SCI is +25.5 (69th percentile). Ethereum’s is -34.7 (26th percentile).

For end of January, the lean is bearish. Not “sell everything” bearish – more like “don’t expect ETH to lead any rallies” bearish. 🐻

STOCKTWITS

Stonk Market News 🗞️

ON-CHAIN ANALYSIS

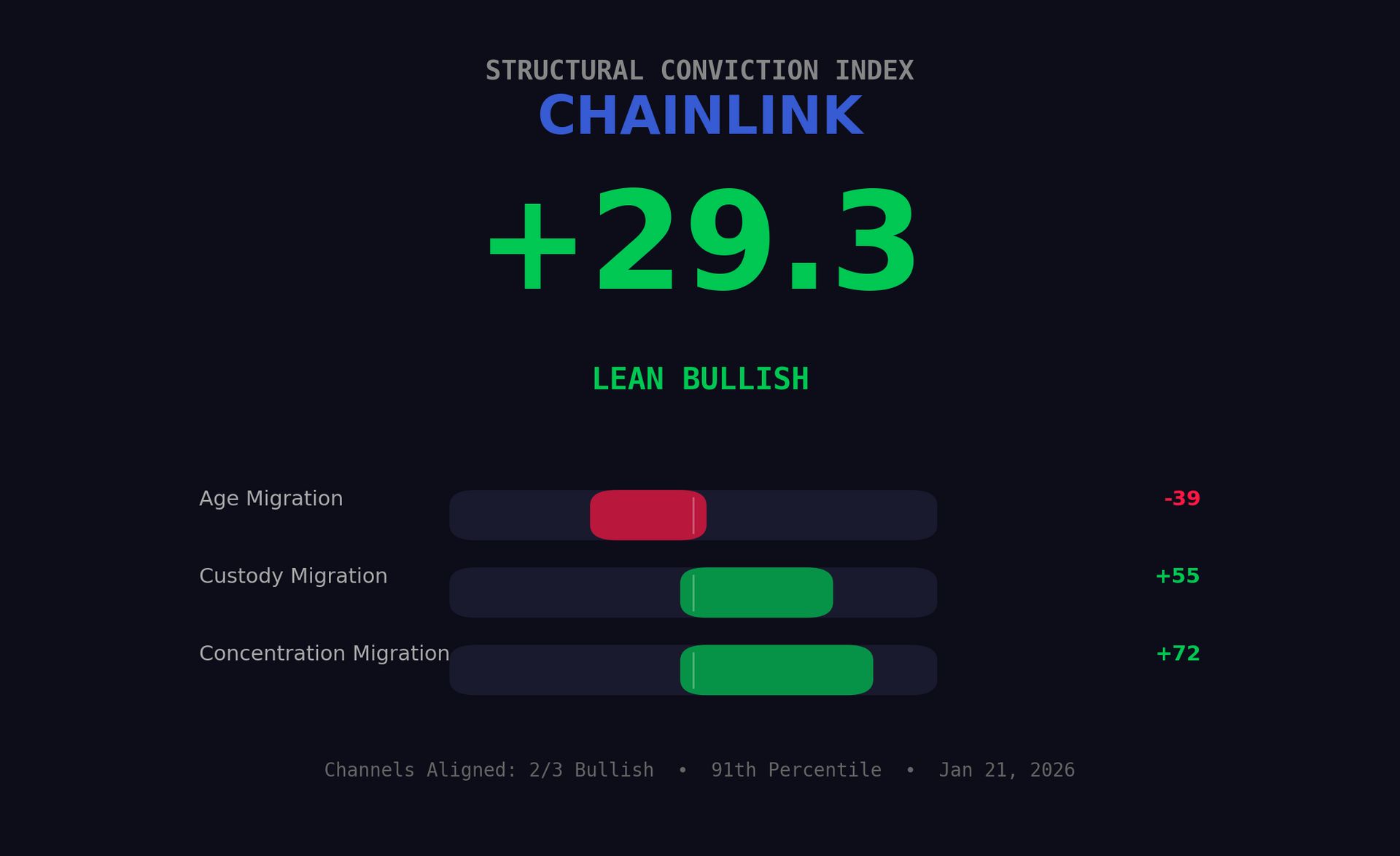

Structural Conviction Index: Chainlink ⛓️

The Three Channels

Age Migration: -39.1

This one’s slightly bearish. Mean Coin Age (90d) is at 54.2 days, and while it’s technically rising (+6.4% over the past two weeks), relative to historical norms this channel is flagging that some older coins are waking up and moving.

That usually means long-term holders are taking some profit. Not panic selling but more like selective trimming.

Custody Migration: +54.8

Here’s where it gets interesting.

Over the past seven days, 1.26 million LINK left exchanges. When coins move off exchanges, it typically means accumulation. People are pulling their LINK into cold storage or staking.

Concentration Migration: +72.2

The whale cohort – wallets holding between 100K and 10M LINK – now controls 44.64% of circulating supply. That concentration has been ticking higher while retail’s share continues to shrink.

Whales are buying.

Putting It All Together

In a nutshell, it looks like a text book case of accumulation. Coins are leaving exchanges. Whales are loading up. Some older supply is being sold into that demand. Net-net, the structure is bullish.

What makes LINK interesting right now is how different it looks from the other majors. Bitcoin has whales accumulating but coins flowing onto exchanges. Ethereum has whales distributing while custody flows are muted.

LINK has whales accumulating AND coins flowing off exchanges.

What To Watch

Custody Migration flips negative. If exchange inflows resume for 5+ consecutive days, the accumulation thesis falls apart. Right now coins are leaving exchanges. If that reverses, so does my outlook.

Concentration velocity stalls. Whales have been loading up. If they stop – or worse, start distributing – that +72 concentration score will collapse fast.

Age Migration deepens. A move from -39 toward -70 would signal that long-term holders are accelerating their exits, not just trimming. That would be concerning.

None of those conditions exist right now.

What Does The Rest Of The Month Look Like?

SCI Composite: +29.3 – Leaning Bullish

Two of three channels aligned bullish. Current reading sits in the 91st percentile of all observations since July – higher than it’s been almost all year.

LINK spent most of October through December in negative SCI territory, averaging -8.8 across the entire dataset. The current +29.3 reading isn’t a continuation of prior trends. Something shifted.

LINK is showing the strongest relative conviction of the three assets we’re looking at today. Stronger than Bitcoin (69th percentile). Much stronger than Ethereum (26th percentile).

That doesn’t mean LINK will outperform – price action is a different animal than conviction. But when you’re looking for assets where the structural foundation is firming rather than cracking, LINK belongs on the radar. 📻️

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋