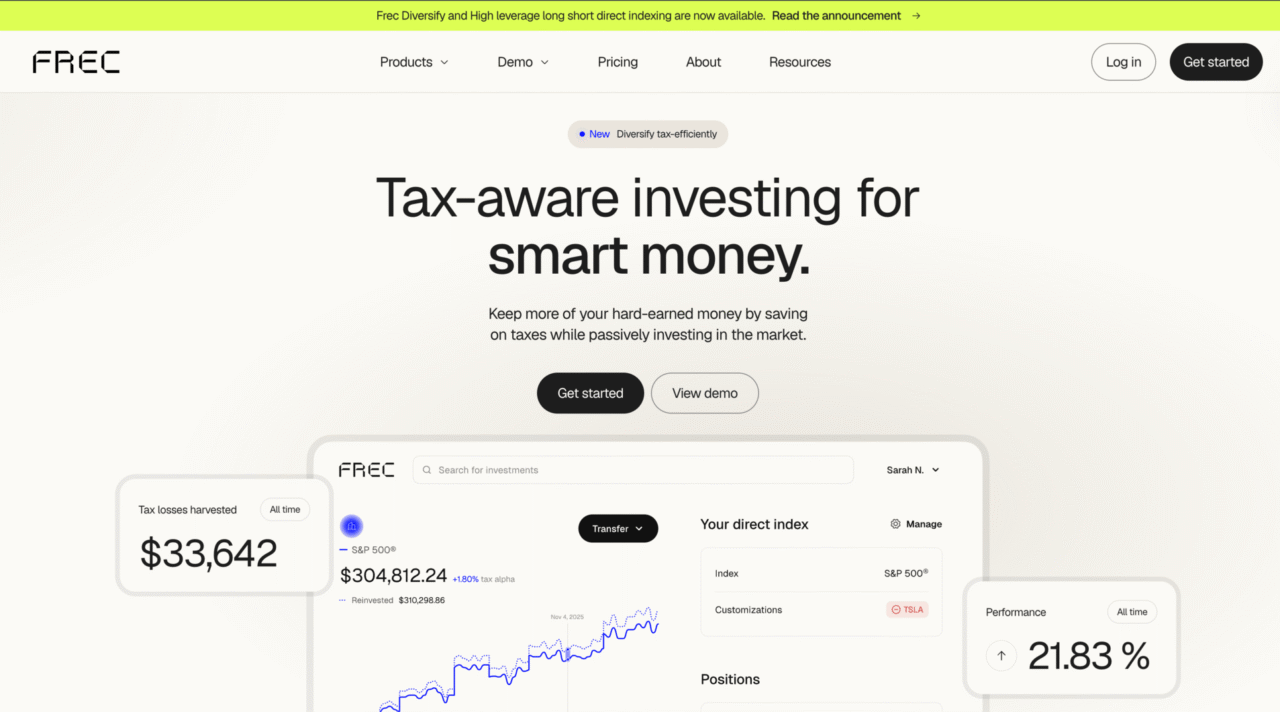

Direct Indexing From FREC – Next Stop $1 Billion Under Management with New Products

Good morning…

We have one more portfolio company of ours is in the news this week.

Frec surpassed $600 million in assets under management with their direct indexing products. I had Mo on my podcast last year to explain direct indexing and introduce the company. You can have a listen here.

The company also launched two new products this week:

Diversify…Bring your concentrated stocks and we’ll transition them into a diversified index for you with minimal tax impact.

and…

Long/Short Direct Indexing…High leverage options for Frec Long Short Direct Indexing

Since launching the 140/40 long short direct index, one of the most frequent requests has been greater leverage flexibility to further amplify market returns and tax savings. Now, investors can choose from:

-

140/40 with a value, quality, or growth tilt

-

200/100 with a quality or growth tilt

-

250/150 with a quality or growth tilt

These new options enable investors to increase return potential while significantly expanding tax-loss harvesting capacity. According to historical simulations, a 250/150 direct index tilted towards quality can produce 8.49% in after-tax excess return, and harvest up to 337% of the initial investment over 10 years2 .

Minimum investment for 200/100 and 250/150 long short strategies is $500k, and annual fees range from 1.00%-1.30%, plus 0.57%-0.86% in post-tax financing costs3 .

I am a customer of FREC and Social Leverage is an investor (fund 4).

Mo, the founder, is building the products and company for people/investors like himself. He sold his last company to Twitter. His mission and vision:

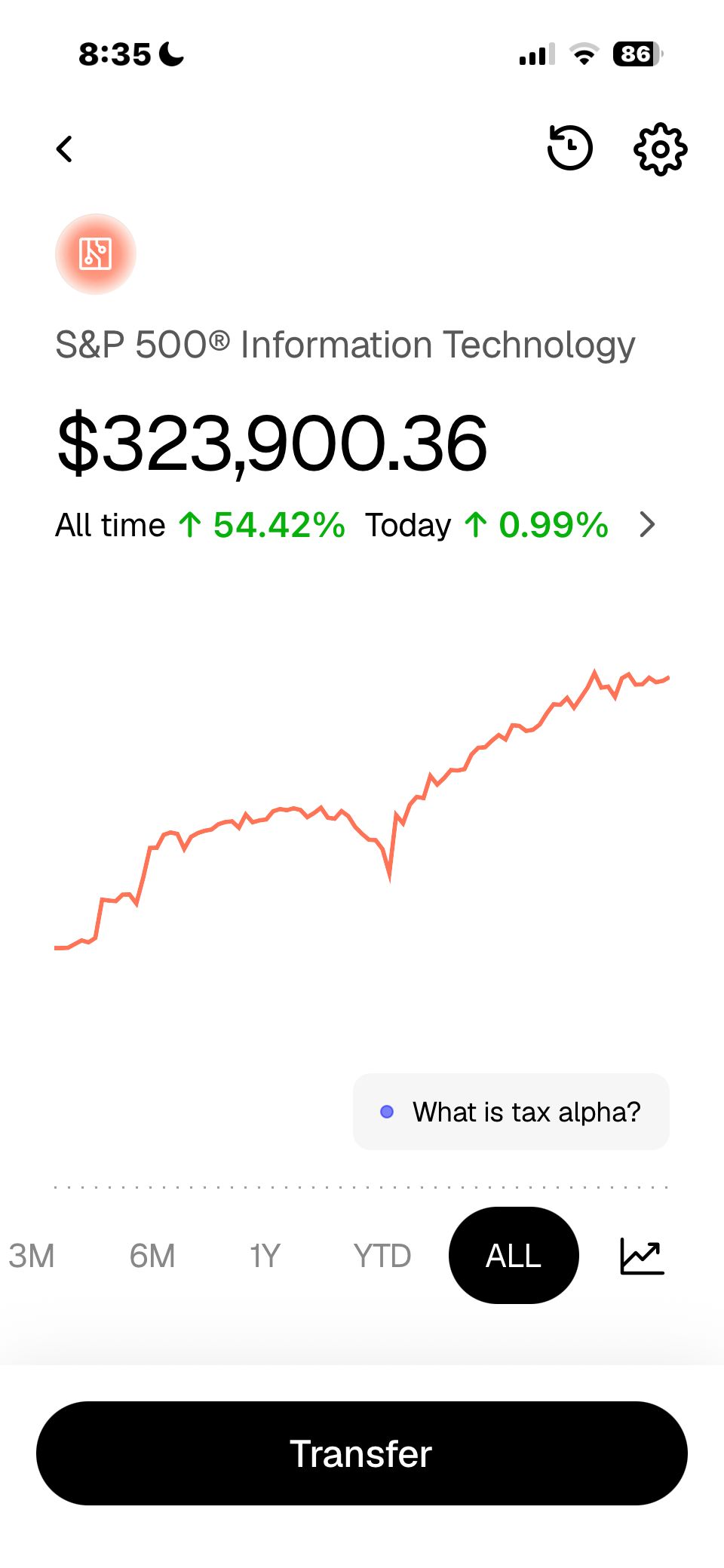

It is so easy to get started and the website and app are simple, elegant and easy to use. Here are screenshots from one of our family accounts that I hold S&P Information Technology ETF ( $XLK ( ▲ 1.62% ) – I added Google to this index because FREC allows you to personalize the index if you like by adding and removing stocks and change weightings) and the Van Eck Semiconductor Index ( $SMH – I have slowly lowered $NVDA percentage).

Hit me up if you have questions or want an intro to the team to get started investing yourself.