Fastenal Flies Higher

Happy Monday!

Fastenal delivered a quarter that speaks volumes about where industrial distribution is going.

The company’s Q2 revenue increased +8.6% YoY, eclipsing $2B.

But the real headline?

Digital transformation.

More than 61% of Fastenal’s sales flow through its FMI (FASTBin / FASTVend) and eBusiness platforms – a shift from legacy MRO distribution to a high-margin, high-automation model.

Management attributes the outperformance directly to “improved customer contract signings” and the stickiness of its digital experience. The typical Fastenal customer is spending more, more frequently, with less friction.

The result — elevated gross margins (45.3% vs. 45.1% YoY), further expansion of private-label sales, and a 21% operating margin.

Heavy manufacturing sites are up 11.5% YoY and high-volume contracts (>$10K/mo) are now 81.4% of revenue.

Fastenal’s automated, digital backbone isn’t just propping up margins – it’s powering a new era of industrial growth. In a sector where efficiency means survival, this quarter shows that mastering digital is no longer optional; it’s how you lead.

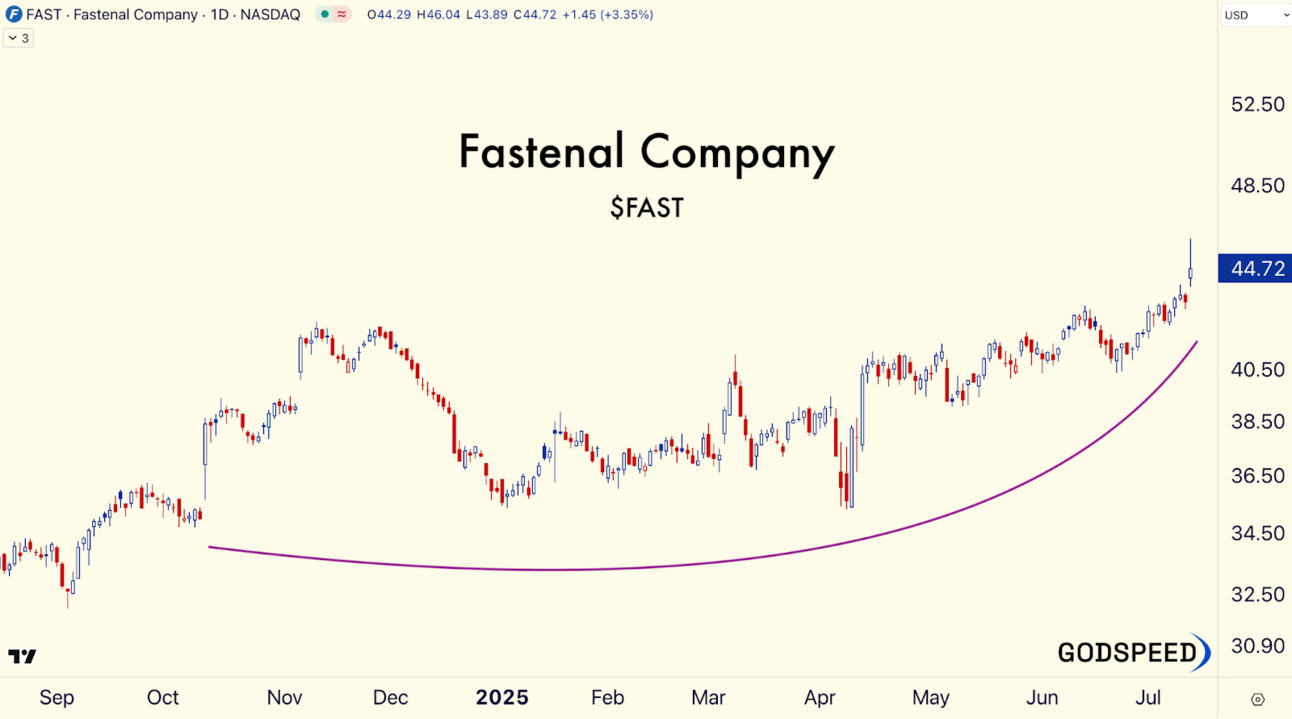

Let The Charts Speak

$FAST flew +3% following this morning’s earnings report as the stock gapped to an all-time high.

Here’s the daily chart.

If you enjoy this post, please share it with a friend.

Godspeed – Rosebee