In yesterday’s note we talked about the lack of progress in most U.S. Stocks and Indexes over the past several months.

It’s been a frustrating market for some traders.

That’s why we’ve been doing this instead.

Look at the Median stock right now, stuck at the exact same price it was way back in December.

We’re now in May:

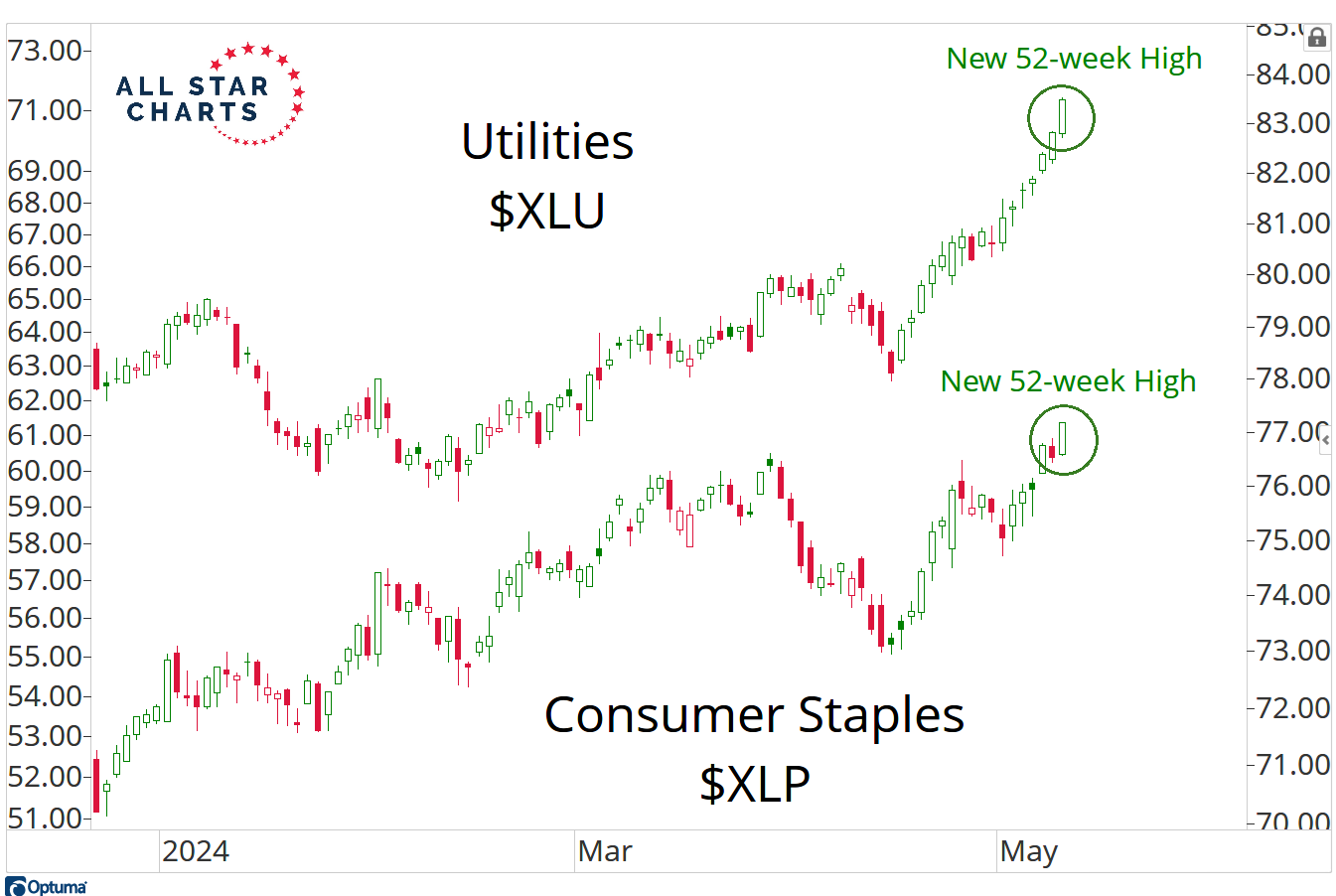

It’s the type of environment where Utilities and Consumer Staples are making new 52-week highs.

In fact, these are the only 2 sectors in the S&P500 that are making new 52-week highs.

At the industry group level, however, there are other more “defensive” areas that are shining in this environment.

Look at the Gold Miners Index hitting new 52-week highs, along with one of the leaders in the space Wesdome Gold Mines:

Is this the type of market where it’s best to do all those things that worked so well for us last year?

Or is this quite obviously a very different market where different types of strategies are much better?

I encourage you to Join us at 2PM ET today for our Options Execution Lab for Premium Members of ASC Options.

If you’re already a Member of ASC Options, then check your email for the invite link and we’ll see you today @ 2.

For everyone else, today’s Options Execution Lab will include a walk through of entering our Income Generating Trades in the open market.

It is only 1 simple strategy. But it could have potentially up to 3 steps.

We’ll go through each one today @ 2PM ET.

Click here to join us.

See you in there!

JC

The post Gold Miners hit New 52-week High appeared first on All Star Charts.