Investors Ice the Bond Market Rally

From the Desk of Ian Culley @IanCulley

G7 central banks are cutting rates – first Canada and now the European Union.

Will the Federal Reserve follow suit in the coming months?

Investors seem to think so…

US 30-year T-bond futures have posted positive returns six days in a row – their longest winning streak since April last year.

T-bonds also broke above a key polarity zone, triggering our buy signals from last month:

I’ve made clear my disdain for buying treasuries, so the long bond trade will likely be a winner. After all, the best trades are often the hardest to take.

But price is sliding back below our risk level following the May nonfarm payroll data. And a yearlong downtrend line continues to act as resistance. Until T-bond futures break through resistance, the downtrend remains intact, regardless of our buy signal.

Interestingly, the Nasdaq 100 and S&P 500 managed to print new all-time highs while bonds had the hot hand. They’re not the most convincing record highs, but record highs nonetheless.

Stocks and bonds have trended together over the past two years. It’s not the classic intermarket relationship of previous decades. But to witness the positive correlation hold as both asset classes trend higher only strengthens our bullish outlook for risk assets.

Meanwhile, bonds are falling hard this morning as US jobs data proved much stronger than expected. Stocks, too.

Perhaps the Fed won’t cut by the September meeting. Who knows?

Either way, it appears investors are playing a good old-fashioned game of Kick the Can.

Can you hear it?

Better yet, can you see it on your screens?

–Ian

Countdown to FOMC

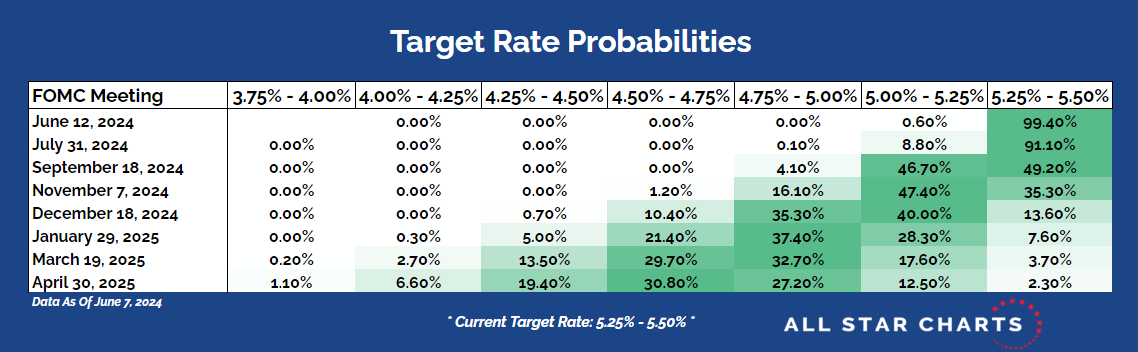

Following this morning’s release of the May Nonfarm Payrolls, the market is repricing the probability of the first 25-basis-point rate cut for the November meeting.

Here are the target rate probabilities based on fed funds futures:

Click the table to enlarge the view.

This data is from the CME FedWatch Tool as of June 7, 2024.

Thanks for reading.

And as always, be sure to download this week’s Bond Report!

Premium Members can log in to access our Bond Report. Please log in or start your risk-free 30-day trial today.

The post Investors Ice the Bond Market Rally appeared first on All Star Charts.