Investors Sideline a Defiant Dollar

From the Desk of Ian Culley @IanCulley

May showers and meme stocks are rolling through.

Roaring Kitty is back, leaning into his detractors with his trademark flair.

AMC and GameStop $GME are ripping. Gold mining stocks are picking up the pace. And the US dollar…

Surprisingly, it’s still holding above former support.

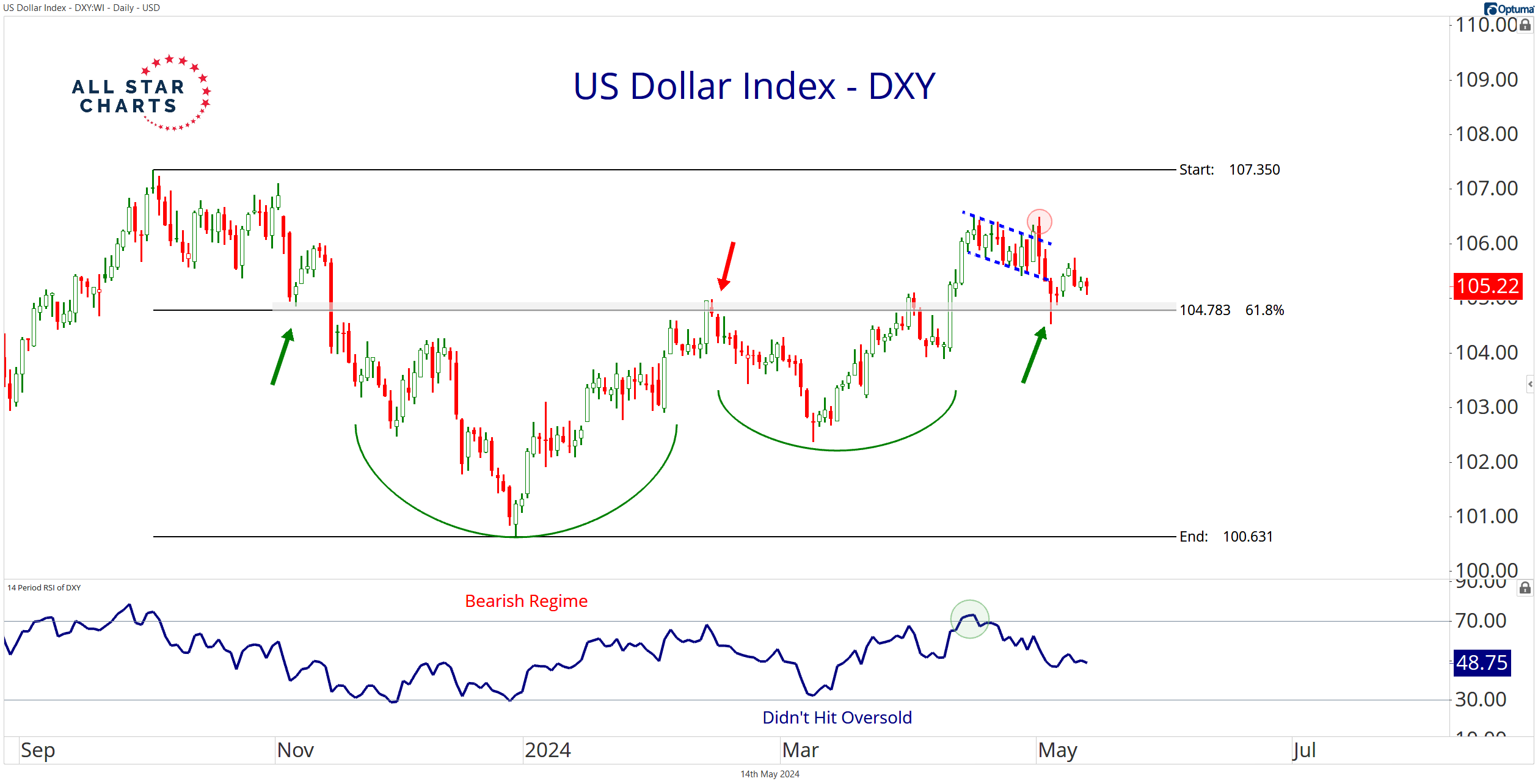

The 105 – 104.75 area marks the spot for the US Dollar Index $DXY:

A decisive close below that key polarity zone places the dollar back in the box, giving stock market bulls free rein.

Yet investors don’t seem to care about the greenback.

Despite DXY’s sticky former highs, risk assets continue to crank.

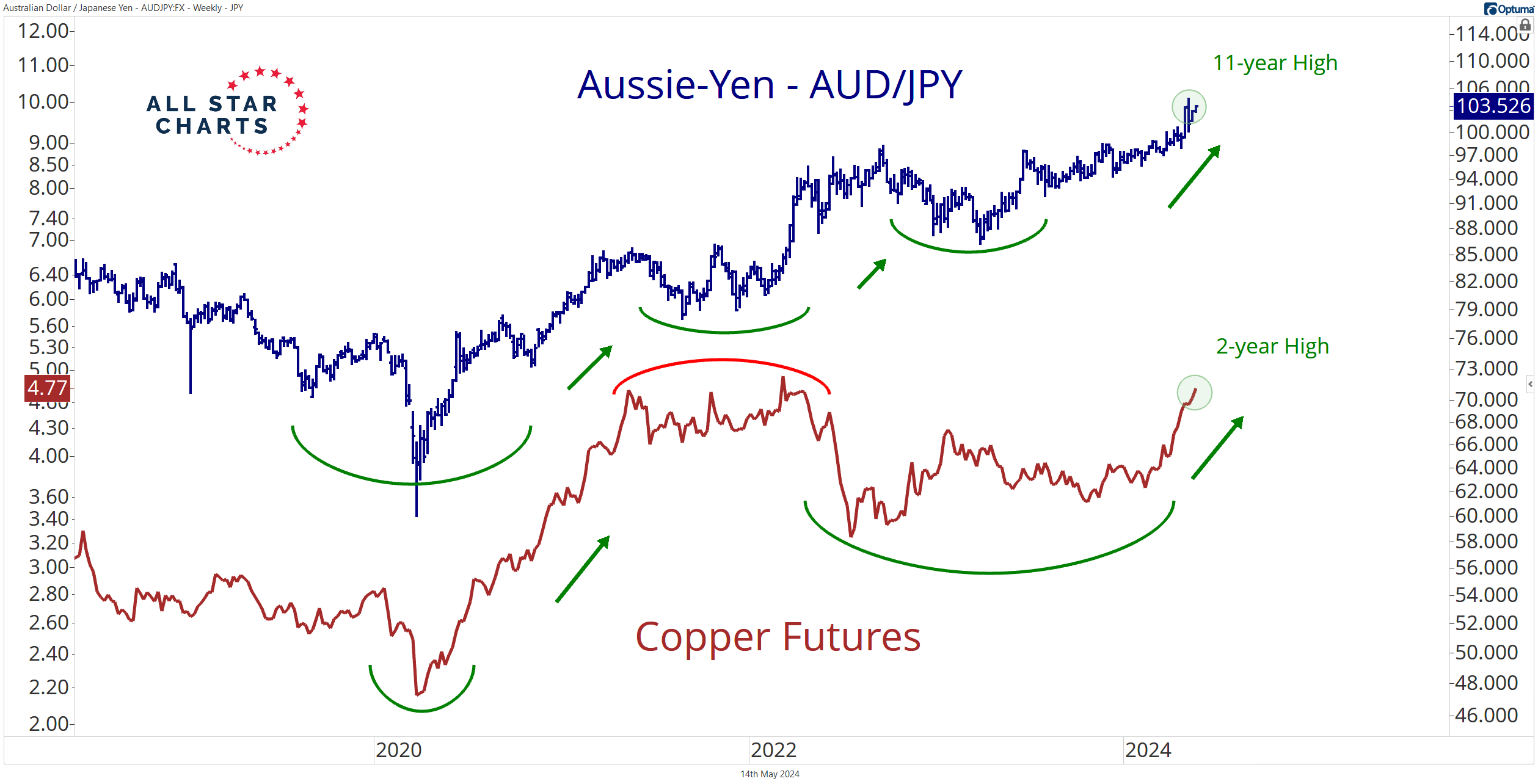

Check out Dr. Copper and the aussie-yen posting fresh multi-year highs:

Both represent critical risk-on-market gauges. Demand for copper measures economic health, while an aussie-yen bid accompanies a low-volatility environment.

These multi-year highs are exposing a risk-seeking behavior that’s sidelining the buck.

Let’s face it – no one is running for safety while GME is up almost 200% in two days.

On the flip side, the good times entice investors to collect the USD-associated carry. It’s evident in the buoyant USD/JPY.

Nevertheless, I still believe the yen bounces back (dollar-yen rolls).

Our bullish euro and British pound trades are working. Plus, the Australian, Canadian, and New Zealand dollars are tracking toward their respective breakout levels.

If all six trades I outlined last week are within range, the dollar is skidding lower. It’s simple mathematics.

So far, we can count two (the EUR/USD and the GBP/USD).

The list will likely grow later this week. But apparently, Dr. Copper and meme stock season aren’t waiting for confirmation.

Stay tuned.

–Ian

Thanks for reading.

Be sure to download this week’s Currency Report!

Premium Members can log in to access our Weekly Currency Report. Please log in or start your risk-free 30-day trial today.

The post Investors Sideline a Defiant Dollar appeared first on All Star Charts.