It's a Simple Stock Market Right Now

It’s a simple Market Right Now

Believe it or not, this is a simple market.

It only feels complicated because people are trying to make it complicated.

Think about it, if you can make it complicated (a problem) many will have more success pretend to have a solution (their discord channel).

My goal is to keep this as simple as possible, but no simpler.

When the market requires nuance and complexity I won’t avoid it.

Right now, there are two trades.

Trade #1: Everything That Isn’t Tech

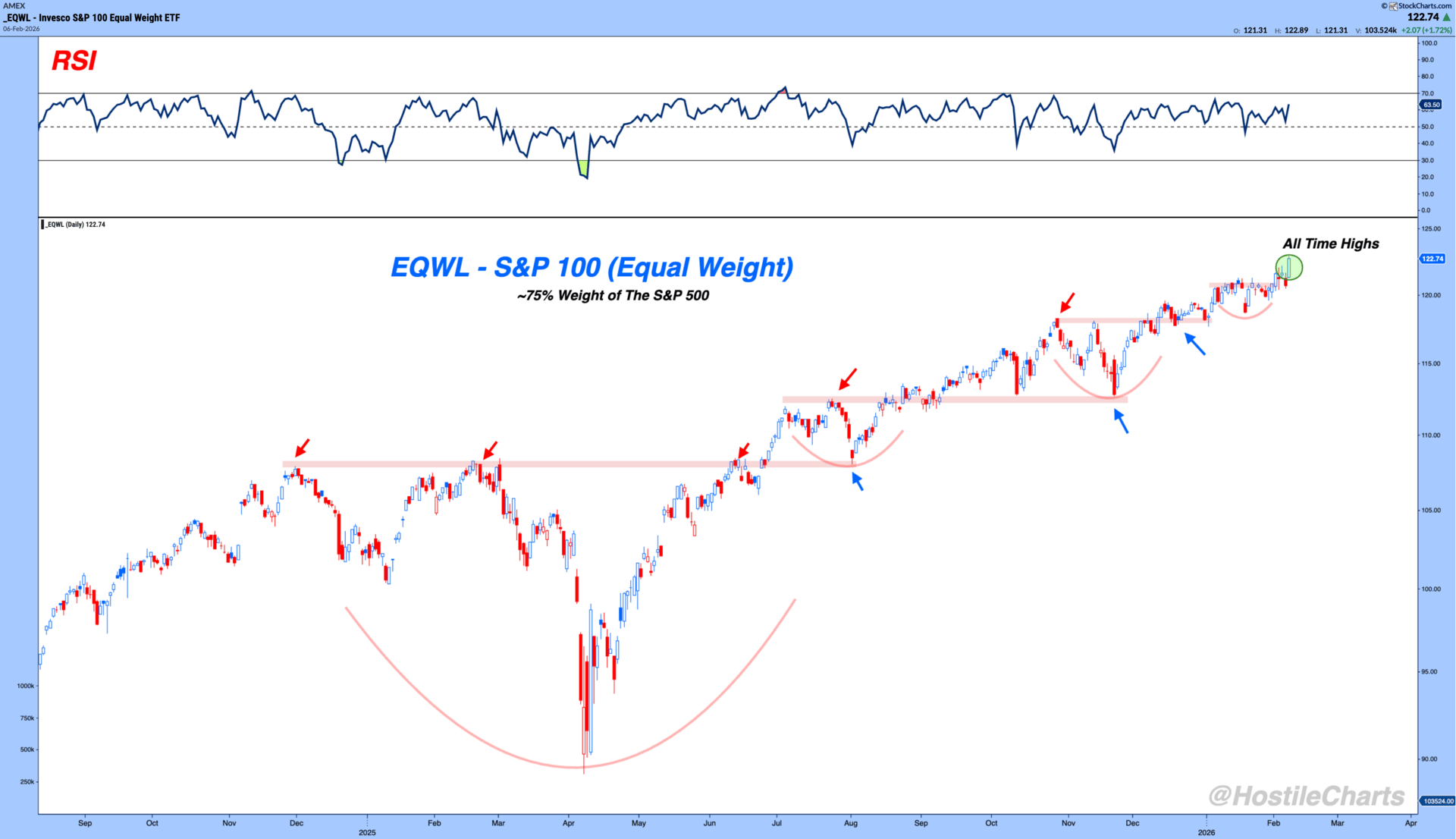

If you want to understand what the market is actually doing, stop staring at cap weighted indexes and look at equal weight ETFs.

Equal weight is the closest thing we have to market democracy.

Every stock gets one vote. No special treatment. No outsized influence.

The message right now it simple…..UP.

RSP, S&P 500 Equal Weight, all time highs

EQWL, S&P 100 Equal Weight, all time highs

EQAL, Russell 1000 Equal Weight, all time highs

The 1000 largest stocks in the United States, representing over 90 percent of total market capitalization, are collectively in uptrends once you strip out weighting distortions.

That trade is simple. It’s up.

S&P 1500 % Above a 200 Day Moving Average

To beat it into your head a little bit more, let’s look at the S&P 1500 percent of stocks above their 200-day moving average.

The 200-day moving average isn’t anything special.

But it does a decent job giving us a clue about the longer-term trend of a stock.

Small caps (S&P 600), mid caps (S&P 400), and large caps (S&P 500) are all basically sitting at 52-week highs in this metric.

All higher than anything we saw in 2025, hovering right around 70 percent.

So think about it like this.

If you threw a rock at the market of stocks, you’d have a pretty high likelihood of hitting an uptrend.

It’s not more complicated than that.

Yes, are these areas of the market “boring”?

Are they less fun to tell your friends you’re invested in?

Sure.

But the money you make from them spends the same.

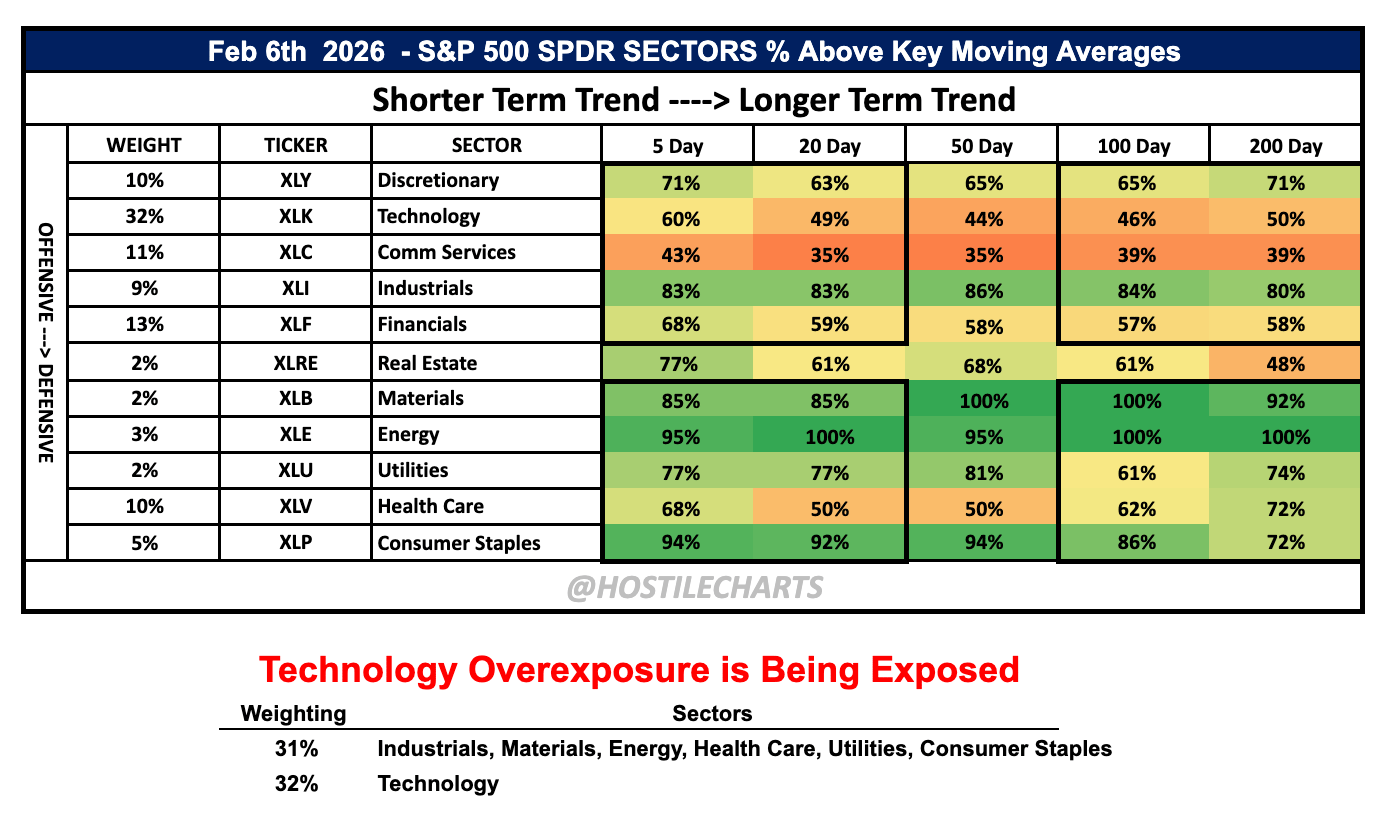

Trade #2: Anything Overweight Tech

Now ask a different question. What’s struggling?

Not small caps broadly.

Not large caps broadly.

Not the market of stocks.

The area getting the most airtime, the most retail attention, and the most emotional attachment is the area under pressure….Tech stocks.

So anything giving technology too big of a vote is meddling sideways.

And this is where the problem shows up.

The S&P 500 is loaded with tech.

Twitter tweet

It is the largest sector by a wide margin, which means it gets a louder vote.

And here’s the part most people still miss.

If you combine Industrials, Materials, Energy, Health Care, Utilities, and Consumer Staples, all of those sectors together still carry less weight in the S&P 500 than Technology alone.

Read that again.

Six sectors.

The parts of the market actually doing the heavy lifting right now.

Still get a smaller vote than tech.

That’s why the index feels stuck even while participation is strong.

That’s why rotation feels “confusing.”

And that’s why Technology overexposure is being exposed.

This isn’t a mystery. It’s math.

My Two Cents

The market does not care how innovative something is.

It does not care how exciting the story sounds.

We are not here to invest in what is cool. We are here for returns.

The market of stocks is doing its job. Participation is broad. Trends are intact.

Letting an interest in tech bog down portfolio performance is a choice, not a requirement.

Anyway, that’s my two cents.

My Weekly Show – Thompson’s Two Cents

🚀 Throw it on 1.5x speed and let it rip.

👍 Give it a like. It’s the easiest way to show me some love.

FREE – The Sunday Stalk List | Ep. 35

If you want clean charts, clear setups, and tactical insights — this one’s for you.

It hits inboxes every Sunday so you know exactly what to keep an eye on for the week ahead.

Cheers,

Larry Thompson, CMT CPA

Sign Up For Thompson’s Two Cents