January 2024 Position Updates

Hello OpTrackers,

With the month of January wrapped-up, I wanted to provide an update on the numbers… and we’re still looking very good!

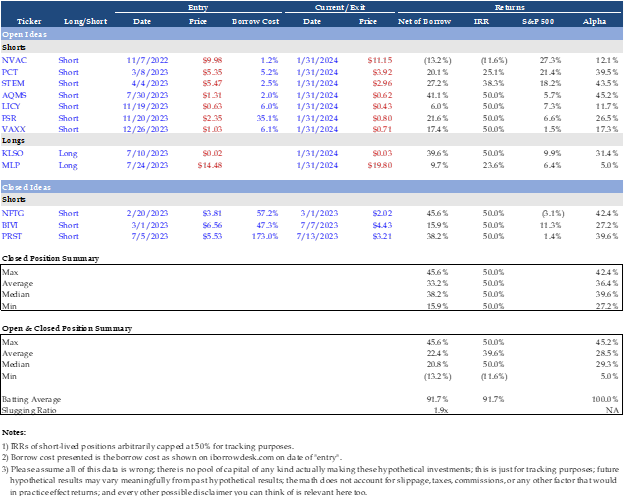

Here’s a quick summary of where we (illustratively) stand:

I remain very pleased with this. If we can maintain a 90%+ batting average net of borrow costs on absolute P&L and 100% on alpha, that would be absolutely insane. I do not expect this to continue, but I will give it my best effort. So far, these are encouraging results and I hope you’re getting value out of following along.

Note: the results above exclude AUID, which I published on yesterday because it hasn’t even been a full trading day since it was published. It will be included starting in the February results.

Speaking of which, if you can think of anyone else who would get value out of following along with these ideas it would mean the world to me if you could share it with them.

December Position Commentary/Updates

This was a very quiet month in terms of news for our positions. The only real headlines were about FSR, which had a recall on some of its vehicles and it made some press releases about its transition to selling through dealers, which I view primarily as a defensive move to try to pull forward cash flow at worse margins.

Everything else just continues on as it has been.

If there are any material updates in February, I will write them up in real time during February. Otherwise, I will send around another update at the end of the month!

Again, if you know anyone who might be interested in a new source of substantial alpha on the both the long and short side, please smash the share button below 🙂 I am still early days and every incremental subscriber means the world to us.

Until next time!

Please Note: I track these as a theoretical exercise and anything written on this blog should not be used as investment advice. Please consult a financial advisor before investing a dime of your own money. Additionally, these returns don’t perfectly capture borrow costs (or capture other potential offsets to returns at all) and realized returns may differ materially from the results shown here.