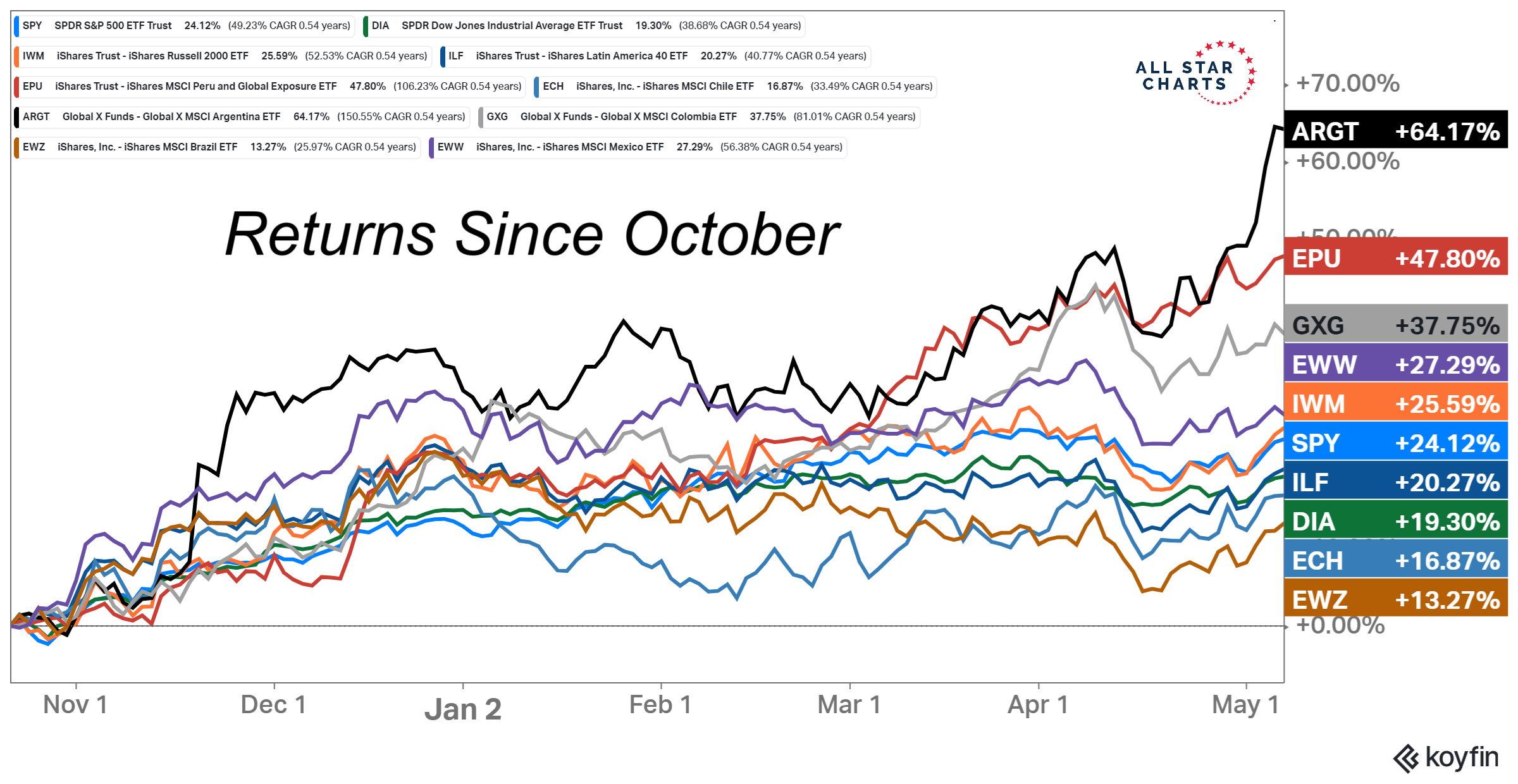

Here are the returns of a series of country ETFs since October.

Notice how the ones from the U.S. are further down the list than you might expect.

At the top you’ve got Argentina, Peru, Colombia and Mexico:

And if you zoom out even further, you’ll see a similar theme: Many countries in Latin America outpacing the U.S.

Here are the returns for these ETFs going back to the beginning of 2023.

We’ve talked about Argentina a ton and discussed its largest weighting Mercado Libre $MELI.

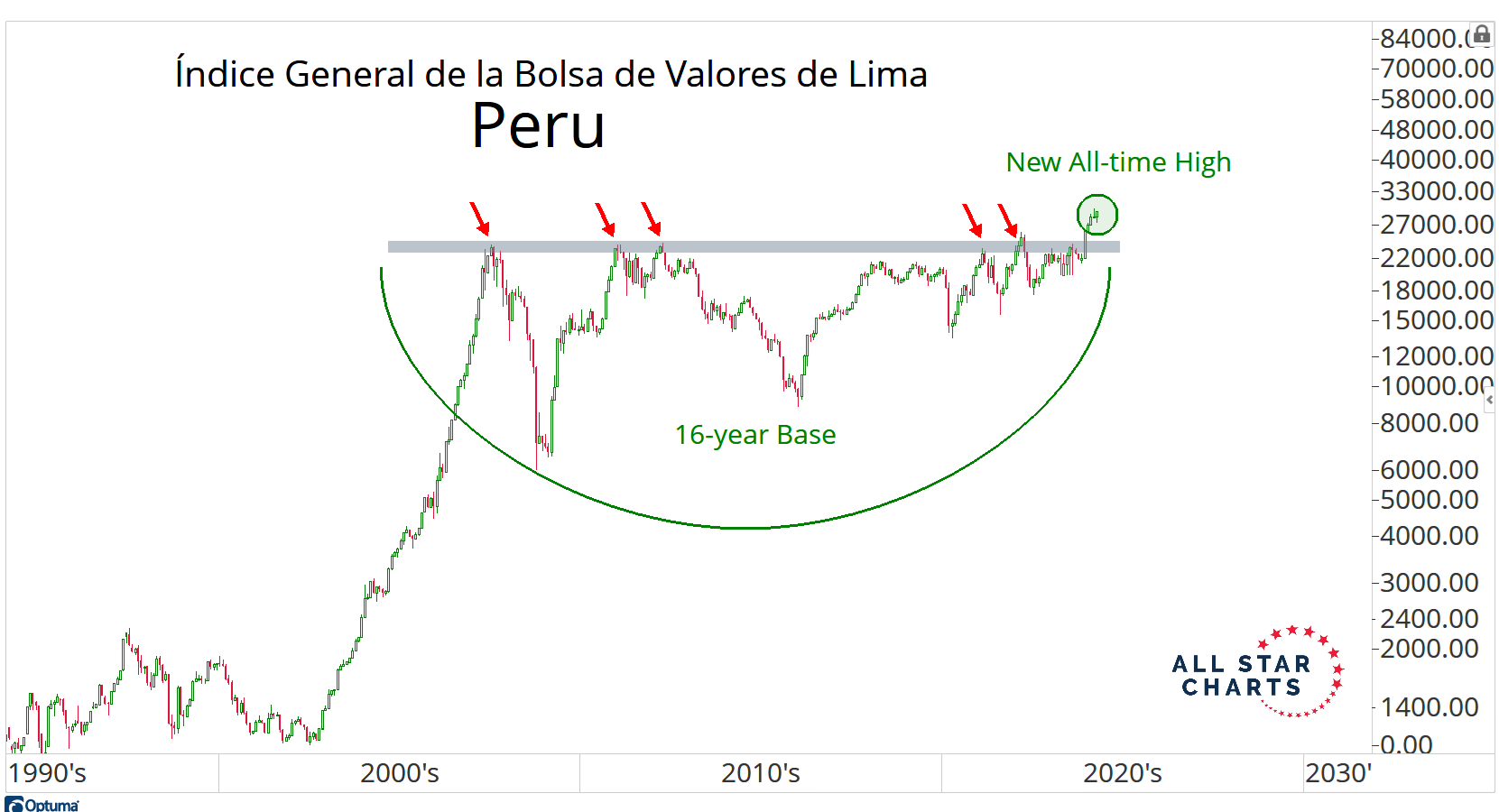

Today I want to focus on what’s happening in Peru more specifically.

Look at the Peruvian Stock Market coming out of this 16-year base and now making new all-time highs:

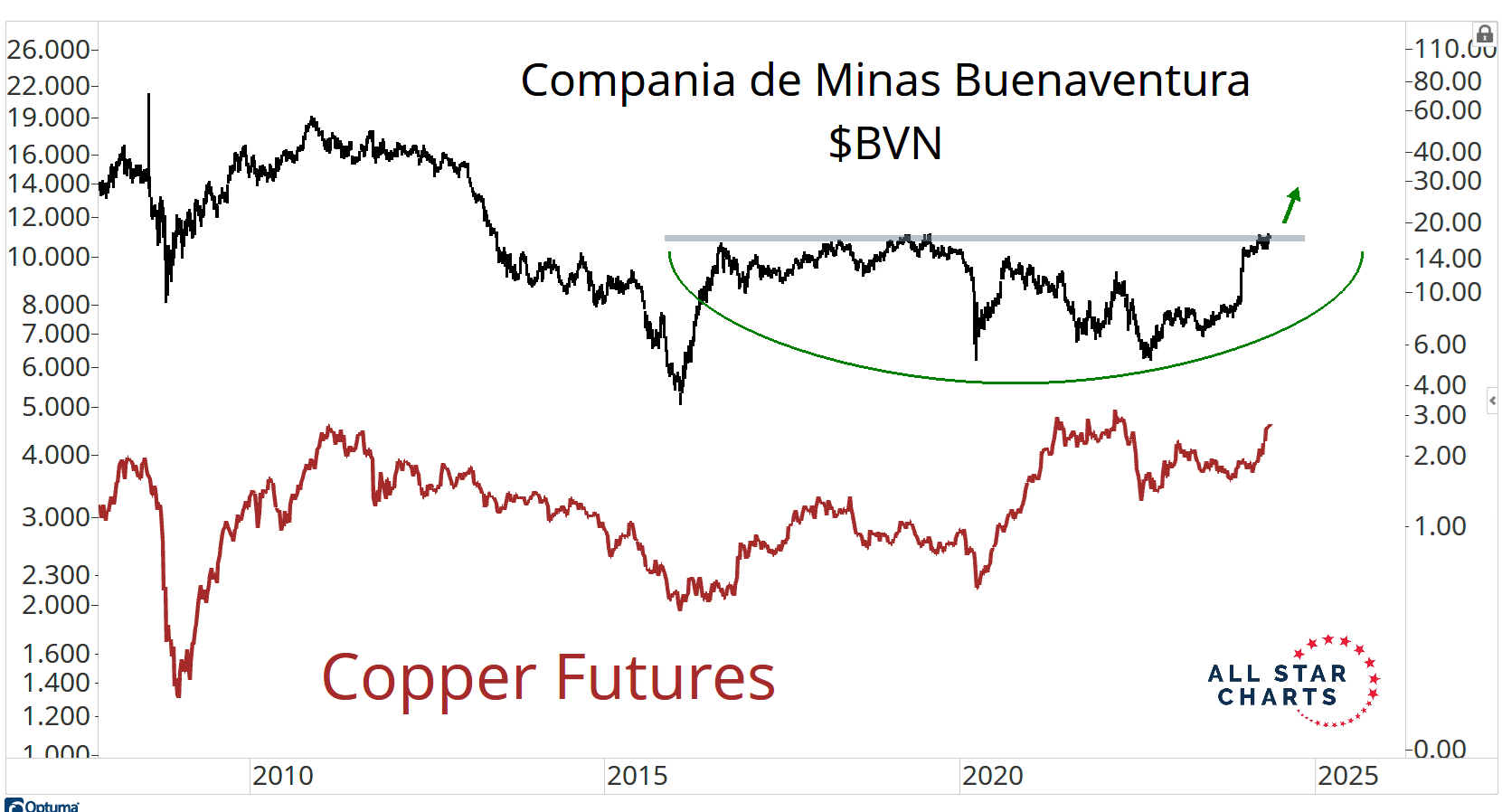

Within Peru and surrounding areas, we keep finding a lot of different opportunities.

But here’s one stock $BVN overlaid with the price of Copper Futures:

You think the prices of these 2 assets are related?

You bet they are!

All the price levels and targets are available from last week’s LIVE Monthly Charts Strategy Session.

Premium Members can catch the replay here and download all the slides.

I think it’s important to recognize which types of companies drive the indexes here in the U.S., in Latin America, Europe, Asia etc.

Not all markets are built the same way.

Peru is a good example of a market that is much different than the indexes we have in America.

But we can find stocks that are from Peru or have a ton of Peruvian exposure that trade on U.S. exchanges, that we can buy and sell the same way we’d trade McDonald’s or Apple.

Let me know what you think!

JC

The post Latin America: This Cycle’s Leader appeared first on All Star Charts.