[Options] A New Twist On Our Uncle Warren Trade

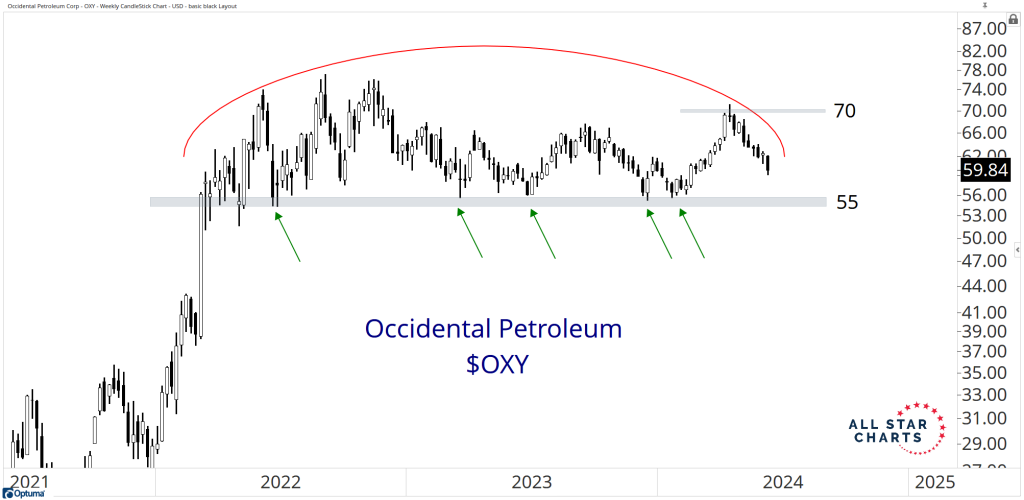

In what has become pretty well documented over the past two years or so, our Uncle Warren Buffett has been accumulating a very large position in Occidental Petroleum $OXY. He’s been making his buys in the neighborhood of $55-60 per share. Like clockwork, every time $OXY has traded below $60 per share, we see new Form-4 filings disclosing another large purchase by Berkshire Hathaway.

We at All Star Charts were a little ahead of the crowd on this trade, having sold puts numerous times in $OXY over the past two years at these levels to take advantage of elevated options premiums and the “Buffett Support Zone.”

But it is no longer a secret. And there are many more people than us who are aware of this trade — which, to me, makes it vulnerable.

If Buffet’s buying can no longer support the stock price, or if/when he decides he’s got enough and stops his accumulating, we might experience a narrative shift that could result in a swift repricing of this stock to lower prices. This makes selling naked puts a riskier proposition. And right now, even worse, the premiums in $OXY puts are pretty cheap, meaning we’ll get paid even less to take the trade on, which further increases our risk.

I don’t like that trade.

But I do like THIS one:

Let’s take advantage of the cheap options premiums to define our downside risk, yet leave us exposed to the possibility that $OXY retraces (again) back up the $70 level and maybe even breaks out this time!

Here’s the Play:

I like buying $OXY September 65 calls for approximately $1.40 per contract. This premium I pay today represents the most I can lose in this trade, therefore I’ll size my position with this in mind.

As long as $OXY can stay above $59 per share, I like the position. But if we lose this level, I’m out. I’m either early or wrong, but the PnL will be heading in the wrong direction and I’ll cut my losses.

Additionally, even if the $59 level holds but we don’t see any upside follow thru, I’ll close my calls if I lose 50% of their value to protect what’s left of my capital in this trade.

On the winning side, if/when $OXY trades to $69 per share, I’ll sell half of my position to lock in some gains, while still leaving me with half a position on to see if $OXY can make a run to/through $75 per share. If that happens, we’ll be sitting pretty with an excellent position on.

If you haven’t already, watch the video above for more in-depth analysis into why we like this trade.

If you have any questions on this trade, please send them here.

If you missed my most recent ASO video Jam Session, you can catch a replay on Stock Market TV.

P.S. We do trades like this regularly. If you’d like to leverage Best-in-Class technical analysis into smarter directional options trades, try out All Star Options Risk Free! Or give us a call to learn more: 323-421-7910.

The post [Options] A New Twist On Our Uncle Warren Trade appeared first on All Star Charts.