Research links: limited capacity

6 months ago

1 MIN READ

Quant stuff

- A round-up of recent academic research including ‘Global News Networks and Return Predictability.’ (alphainacademia.substack.com)

- The head the Bureau of Labor Statistics should be able to do economics. (keubiko.substack.com)

- The Wharton School is going to start a master’s program in quantitative finance. (bloomberg.com)

Rates

- When the Taylor Rule fit what the Fed was doing, and when it didn’t. (papers.ssrn.com)

- Are TIPS a good measure of R-star? (libertystreeteconomics.newyorkfed.org)

Concentration

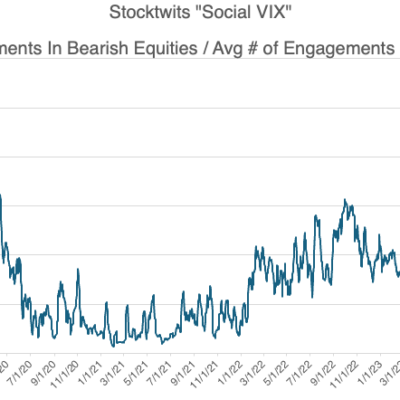

- Can we measure crowdedness in equity markets? (morningstar.com)

- The case against concentrated portfolios. (mailchi.mp)

Research

- “Holding the market” is not as straightforward as it seems. (acadian-asset.com)

- How equity investors view inflationary shocks. (papers.ssrn.com)

- The case for high volatility trend following strategies. (rcmalternatives.com)

- Does overnight news explain overnight returns? (papers.ssrn.com)

- Why you need to be careful assessing the performance of secondary PE fund returns. (morningstar.com)

- How geopolitical risk affects consumers. (papers.ssrn.com)

- The stock-split effect isn’t dead. (papers.ssrn.com)

- Can AI write an analyst report yet? (ft.com)

Terms and Conditions

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

Please see disclosures here.