Stocktwits Top 25 Week 41

Presented by

OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

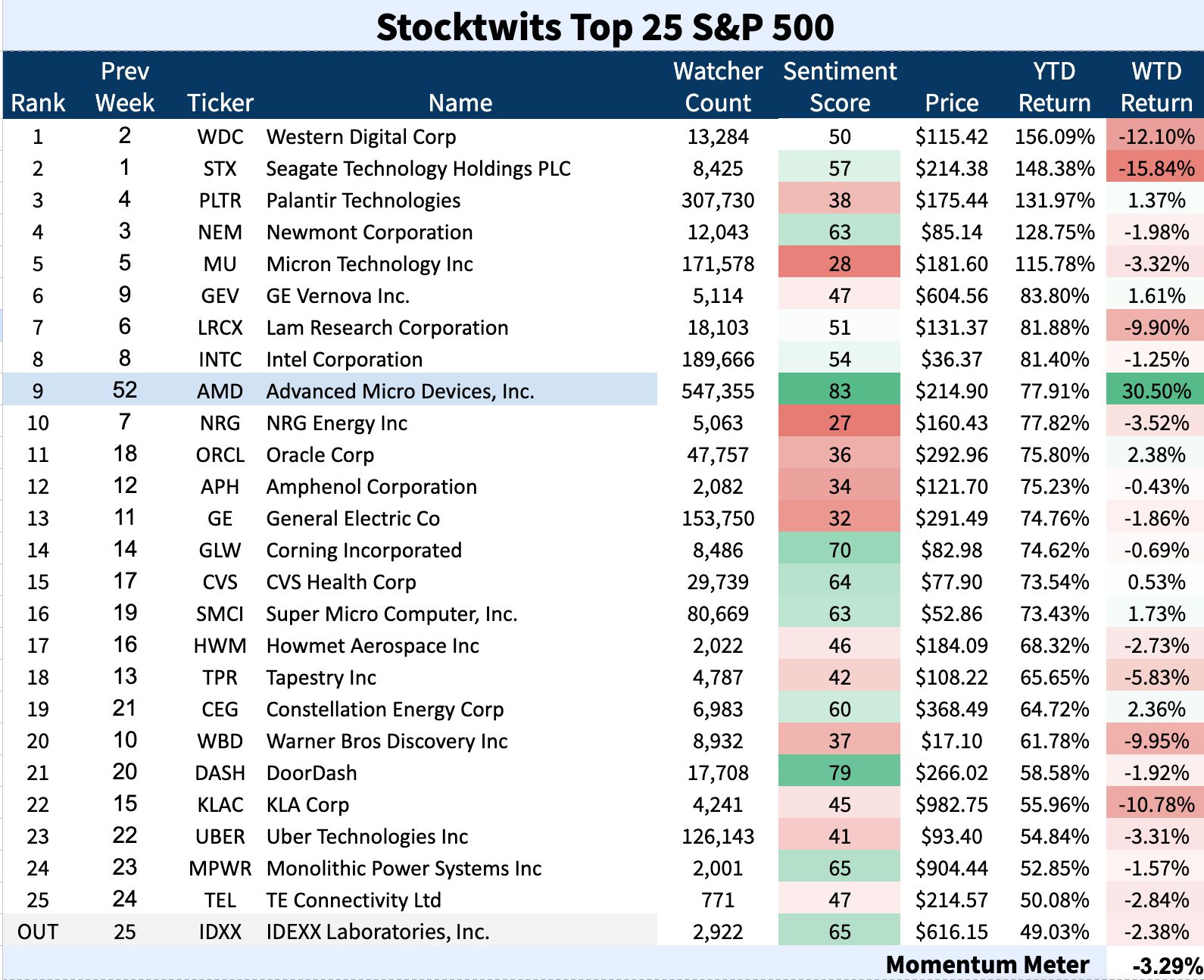

S&P 500

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list (-3.29%) underperformed the S&P 500 index (-2.43%).

There was one major change to the list this week.

SPONSORED

GraniteShares Expands Leveraged Suite with ISUL and NBIL Single-Stock ETFs

GraniteShares 2x Long ISRG Daily ETF (ISUL) and GraniteShares 2x Long NBIS Daily ETF (NBIL) Launch Today.

GraniteShares, a provider of exchange traded funds (ETFs), today announced the launch of two new leveraged single-stock ETFs:

GraniteShares 2x Long ISRG Daily ETF (NASDAQ: ISUL), and

GraniteShares 2x Long NBIS Daily ETF (NASDAQ: NBIL)

An investment in these ETFs provides investors daily leveraged exposure to the two respective underlying stocks: Intuitive Surgical, Inc. (NASDAQ: ISRG) and Nebius Group NV (NASDAQ: NBIS).

GraniteShares’ leveraged ETFs seek daily investment results, before fees and expenses, that correspond to 2 times (200%) the daily percentage change of the respective common stocks. These funds are designed for investors looking to capitalize on short-term movements in the underlying stocks.

New GraniteShares 2x Leveraged Single-Stock ETFs

|

Ticker |

Fund Name |

Fund Page URL |

|

ISUL |

GraniteShares 2x Long ISRG Daily ETF |

|

|

NBIL |

GraniteShares 2x Long NBIS Daily ETF |

Underlying Companies

-

Intuitive Surgical, Inc., (NASDAQ: ISRG) founded in 1995 and based in Sunnyvale, California, develops and markets robotic-assisted technologies that advance minimally invasive care. Its flagship da Vinci Surgical System supports procedures across specialties such as general surgery, urology, gynecology, cardiothoracic, and head and neck, while the Ion endoluminal system enables minimally invasive lung biopsies and extends its reach into diagnostic procedures. The company also provides stapling, energy, and core instruments, training programs, technical support, system monitoring, and digital solutions that enhance hospital performance. Its products are sold worldwide through direct capital and clinical sales teams.

-

Nebius Group N.V., (NASDAQ: NBIS) headquartered in Amsterdam and rebranded from Yandex N.V. in 2024, is a Netherlands-based technology company building full-stack infrastructure for the global AI industry. Its offerings include GPU clusters, cloud platforms, and developer tools supporting AI workloads like generative AI and autonomous vehicles. The company also operates three brands: Toloka for AI data services, TripleTen for tech career reskilling, and Avride for autonomous driving and robotics, serving markets across Europe, North America, and Israel.

Designed for Tactical Traders

The new leveraged ETFs provide traders with a tool to gain leveraged exposure to these stocks, making them a potential consideration for those looking to execute short-term tactical trades.

“We continue to expand our suite of leveraged ETFs to meet the demand for high-conviction trading opportunities,” said Will Rhind, Founder of GraniteShares. “With the launch of ISUL, and NBIL, we are providing investors with targeted tools to access some of the most exciting companies in financial services, online brokerage and digital investing.”

For more information on the new GraniteShares leveraged ETFs, read the Prospectus.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

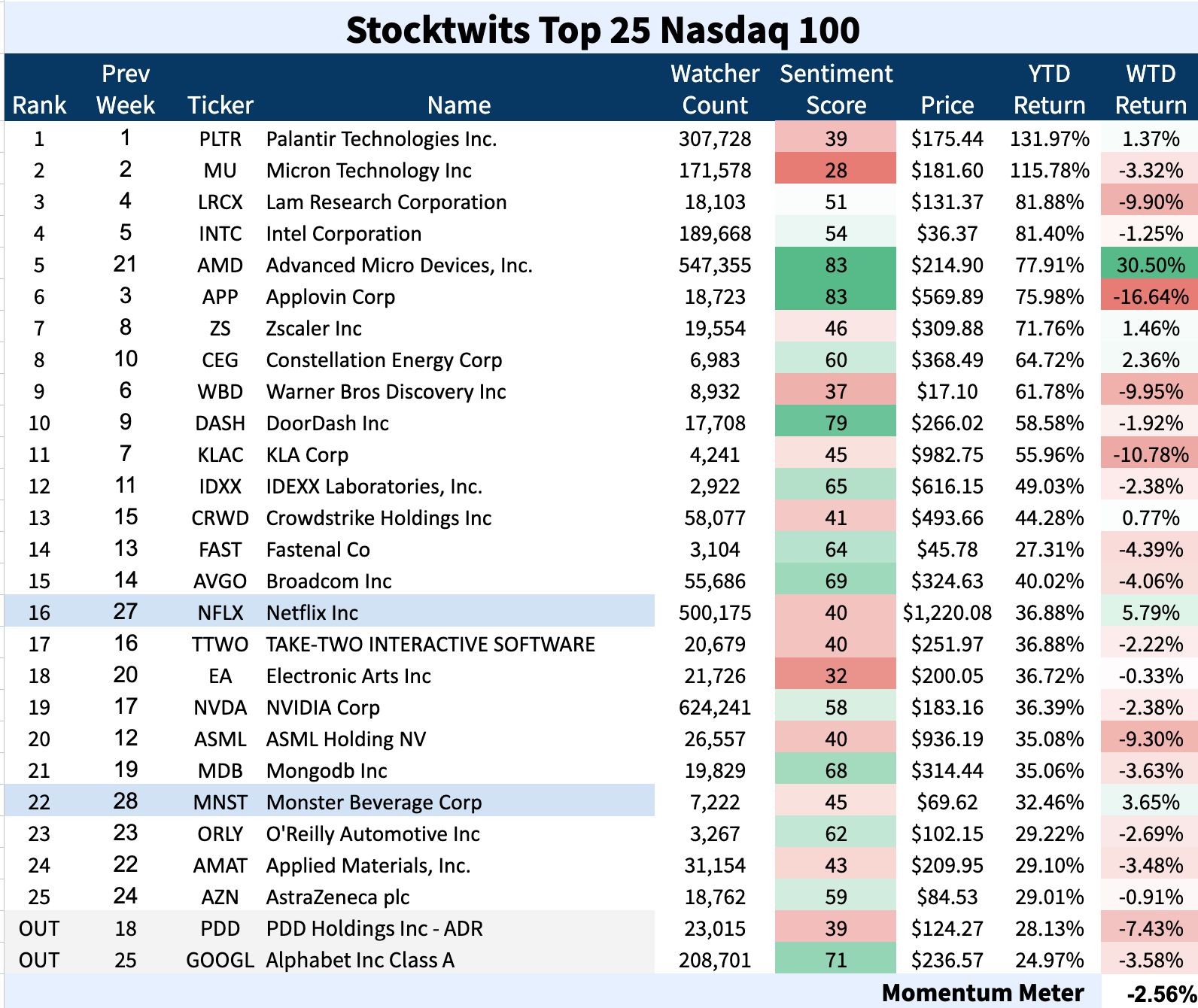

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list (-2.56% ) underperformed the Nasdaq 100 index (-2.27% ).

There were two major changes to the list this week.

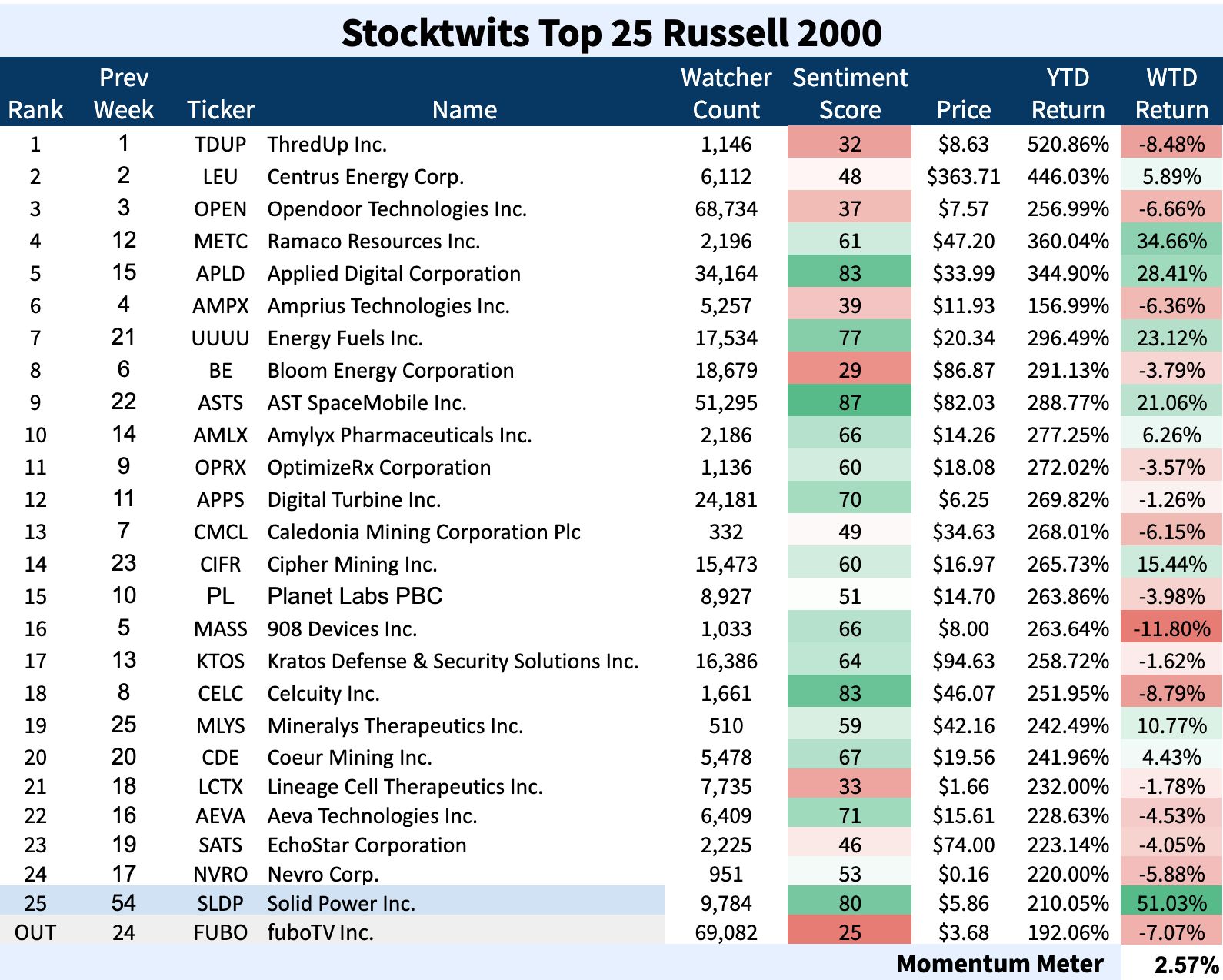

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list (2.57%) outperformed the Russell 2000 index (-3.29%).

There was one major change to the list this week.

IN PARTNERSHIP WITH MONEYSHOW

Join Stocktwits Editor-in-Chief Tom Bruni At The Orlando MoneyShow, October 16-18 🧑🏫

Hey all, Tom Bruni here! I’m joining our friends at the Orlando MoneyShow this October. I’ll cover how to use Stocktwits sentiment to navigate risks and find opportunities in the market. Plus, hear from dozens more experts during this three-day event. Register below and we’ll see you there! 🎫

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Top Dawg Of The Week 🐶

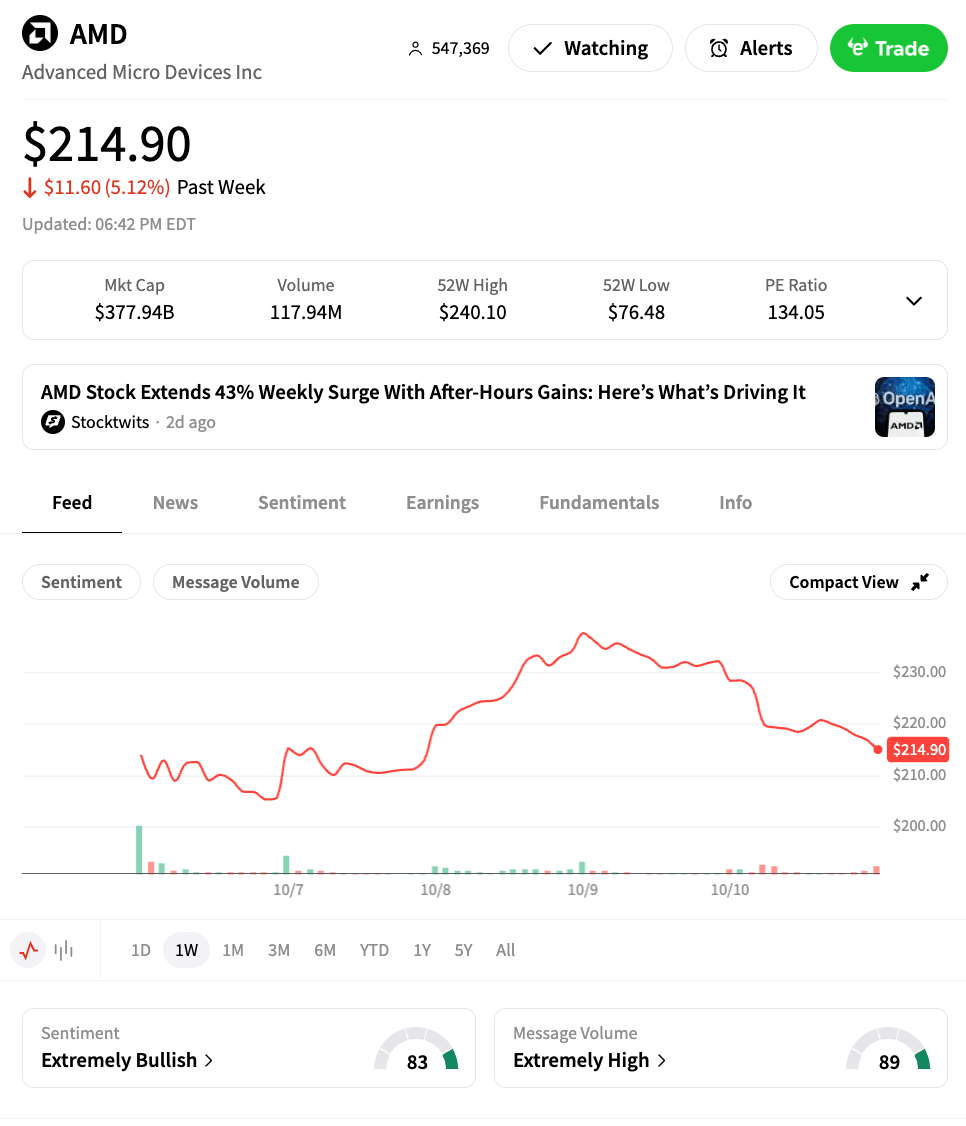

The Top Dawg worth mentioning is AMD, which rallied 30%. $AMD ( ▼ 7.73% ) is up 77% YTD.

Advanced Micro Devices’ stock has been on a strong three-session winning streak, thanks to a landmark deal the company inked with artificial intelligence startup OpenAI, and early signals point to further gains.

AMD climbed starting Monday after the news. Part of the deal gives OpenAI options for 160M shares in AMD common stock, in return for 6 gigawatts of processing power in an agreement cited at billions in value, though OpenAI would not state the exact dollar amount.

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋