The Bull Market's Next Steps

Thinking In Bets

I want to start with a quote this week that sums up the way I think about the markets and investing from one of my favorite books.

“What makes a decision great is not that it has a great outcome. A great decision is the result of a good process, and that process must include an attempt to accurately represent our own state of knowledge. That state of knowledge, in turn, is some variation of ‘I’m not sure.’”

Annie Duke, Thinking in Bets

Investing isn’t about certainty. More often, it’s about being comfortable with uncertainty. While many people focus on calling tops, bottoms, or trying to sound smart after the fact, my work is centered on something far less exciting. A process-driven, repeatable set of steps done over and over again to understand the state of the market.

I’m never 100 percent right. That’s not the goal.

The goal is to consistently place probabilistically favorable bets when the weight of the evidence lines up.

Over time, that’s how you build abnormal returns using what looks, on the surface, like a very normal and even boring process.

Over the last few weeks, my “boring” process has highlighted a somewhat typical Bull Markets sequence unfold.

Strip away the headlines and focus on price and participation, and the message has been remarkably consistent.

Let’s get into it.

Twitter tweet

The Bull Market’s Next Steps

1. Shake and Bake, false breakdowns

Two weeks ago, we saw the part of Bull Markets that feels uncomfortable but is completely normal.

Breakdowns failing and weaker hands being shaken out.

The key was to see the market not losing longer-term trend structure.

Twitter tweet

In Bull Markets, failed breakdowns are often the first tell, the market is gearing up for a move.

2. Consolidation beneath the surface

Last week was the pause. Indexes ran into overhead supply. Breadth cooled.

Everyone waited on the media-driven event, of the FOMC meeting.

That was not a moment to press bets aggressively.

That was a moment to respect uncertainty and let the market resolve.

Consolidation above key uptrends was Not bearish, just not the bet to “cleanest” bet to place sitting right below overhead supply.

Twitter tweet

3. Continuation, expansion

This week delivered the next step. Expansion.

Twitter tweet

Breakouts started working. Participation improved. New highs expanded.

That combination matters because it is the phase where trend followers get paid for patience.

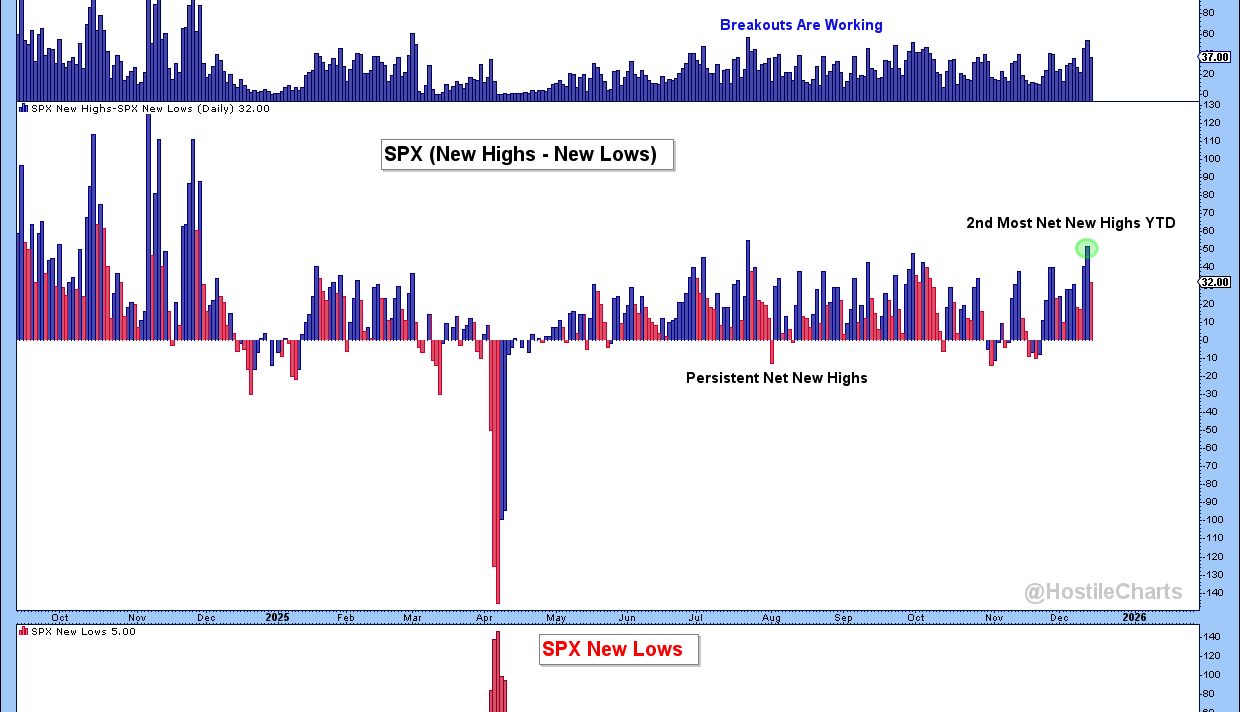

Step 3 – 52-Week Highs Are the Scoreboard

I love doing analysis on New Highs and New Lows it’s a great snapshot of of market breadrh and whether the market is rewarding strength or punishing it.

This week, new highs expanded meaningfully.

New Highs are Expanding….Step 3…..

That tells you breakouts are working and breakdowns are failing.

More importantly, when you zoom out, this does not look late. It looks early.

New High could JUST be getting started….

Strong breadth environments in Bull Markets do not end the moment new highs show up. They often persist.

That’s why I am far less interested in debating “how far” and far more interested in respecting what is happening.

Sector Confirmation, Leadership Is Broadening

If this is a real continuation phase in Bull Markets, leadership should expand.

That is exactly what we are seeing.

$XLF ( ▲ 0.15% ) Financials are acting like leadership. Breakouts are working, and relative strength is showing up even on days when the index is soft.

Financials breaking out….health sector expansion…..

American Express, Bank of America, JPMorgan, Citigroup, Wells Fargo, Goldman Sachs, and Capital One are all examples of constructive behavior.

Just one example of the Financials ripping….

If you prefer to avoid single-stock exposure, the sector and banking ETFs $KBWB ( ▼ 0.55% ) and $KRE ( ▼ 0.48% ) are confirming the same story.

$XLI ( ▼ 0.63% ) Industrials are doing the same thing. Clean breakouts, shallow pullbacks, and very well-defined risk.

Industrials breaking out…the list is growing….

These are the setups I want because I know where I am wrong.

If price falls back into the range, I step aside. If it holds, I stay involved.

$XLV ( ▲ 0.31% ) Healthcare is not breaking out to all-time highs yet, but it is regaining its footing after a pullback.

Healthcare setting up after a Healthy pullback..

In healthy Bull Markets, leadership rotates, everything doesn’t move at once.

$XLY ( ▲ 0.43% ) Consumer Discretionary is sitting near breakout territory. If this expansion phase continues, this is another area where new breakouts can start showing up.

May be the next place to fish for breakout….

Risk and Execution Lens

This is the part that actually matters.

During the shake, you protect yourself from false breakdowns, and play the “tradeable lows”.

Twitter tweet

During consolidation, you avoid forcing trades when the odds are unclear.

During expansion, you buy breakouts with defined risk.

That’s the entire process.

Above former highs and key support, the bet makes sense.

Back into the range, the bet comes off.

No drama. No predictions. Just execution.

Bull Markets move in phases.

We just lived through the shake, then the pause, and now we are seeing expansion.

When new highs expand and equal weight participation confirms, I want to respect what is working, not overthink it.

For me, that means buying breakouts, managing risk, and letting the market tell me when the phase changes.

Anyway, that’s my two cents.

My Weekly Show – Thompson’s Two Cents

🚀 Throw it on 1.5x speed and let it rip.

👍 Give it a like. It’s the easiest way to show me some love.

The Sunday Stalk List | Ep. 25

If you want clean charts, clear setups, and tactical insights — this one’s for you.

It hits inboxes every Sunday so you know exactly what to keep an eye on for the week ahead.

Cheers,

Larry Thompson, CMT CPA

Sign Up For Thompson’s Two Cents